Myanmar rare earths heading toward China encounter shipment obstacles amid upheaval

Orderly increase in domestic mining, technology crucial for secure supplies: experts

A rare-earth mining operation in Baotou, North China's Inner Mongolia Autonomous Region Photo: cnsphoto

Some Chinese rare-earth companies and their downstream firms are finding that their raw materials could not be shipped smoothly from Myanmar, a key supplier of medium and heavy rare earths for China, amid political upheaval in the Southeast Asian nation, although mining operations remain unaffected, several sources at those companies told the Global Times on Sunday.

Myanmar's rare-earth exports to China have dwindled to some extent, which has led to soaring rare-earth oxide prices in the market, a manager of a rare-earth enterprise in Ganzhou, East China's Jiangxi Province, told the Global Times on condition of anonymity.

He noted that the rare-earth mine in Myanmar from which the company gets its supplies has been operating as usual. But logistics issues have hindered exports since mid-March.

"When the political upheaval erupted in February, rare-earth exports to China remained unaffected, as most rare-earth mines are located in the northern part of the country where the situation had been stable, but things worsened in recent days," the manager said.

He said that Myanmar sits at the upstream of the global rare-earth industry chain, accounting for half of the global rare-earth ores. Its heavy rare-earth minerals are exported to China for extraction and processing, and then exported to the world.

Another manager of a private rare-earth magnet producer based in Ganzhou surnamed Zhang confirmed the existence of logistics barriers in speaking with the Global Times on Sunday.

"The biggest issue is that rare earths from Myanmar cannot be shipped to China, and it is not clear when this barrier will be removed, as it is highly dependent on Myanmar's political situation," Zhang said, predicting that the world may suffer from rare-earth shortages for some time.

The general manager surnamed Chen at a Dongguan-based company that makes magnetic material from rare earths told the Global Times on Sunday that its raw material costs have surged at least 30-40 percent since beginning of the year.

With the COVID-19 pandemic already brought under control in China, downstream firms in the fields of consumer electronics and new-energy vehicles have been buying more rare earths, which have driven prices higher.

Chen also confirmed to the Global Times that one of the firm's upstream suppliers of rare earths could not ship the metals from Myanmar at the moment.

Given the current situation, China's rare-earth imports from Myanmar might plunge in March, said an industry insider who asked to remain anonymous.

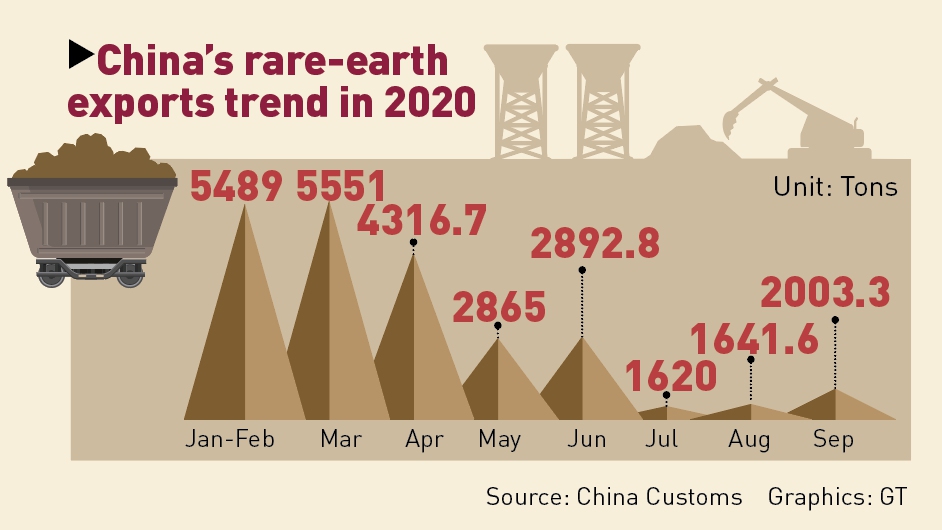

In the January-February period, rare-earth oxide imports went up 24.6 percent year-on-year to 3,546 tons, customs data showed.

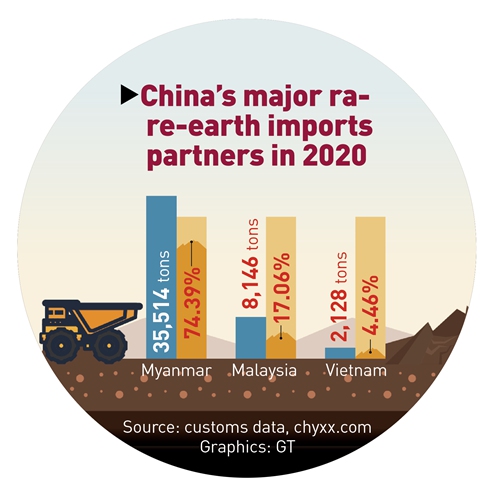

China's rare-earth imports from Myanmar rose by 23 percent from 2019 to around 35,500 tons last year, accounting for 74.39 percent of total imports, followed by Malaysia with 17.06 percent and Vietnam with 4.46 percent, according to customs data.

China has been heavily dependent on medium and heavy rare earths from Myanmar in recent years, which account for more than 60 percent of China's total ion-absorption rare-earth use, as the Chinese government has cracked down on illegal mining and strengthened measures in environmental protection.

Compared with light rare earths, heavy rare earths are less common and more valuable, and they are used in high-tech fields such as aerospace, military, national defense, and the synthesis of new materials.

A report by Soochow Securities pointed out that medium and heavy rare earths will potentially be affected the most during the unrest in Myanmar. If the unrest affects mines, which could lead to production declining or being halted altogether, or even export controls, it will have a greater impact on the supply of this category of rare earths.

The industry insider said that "China should diversify its import sources like from Vietnam, Laos and Cambodia, but we should also be clear that transferring the supply chain is not that easy to do in a short time, and there are a lot of uncertain and unstable factors surrounding new supplies from those potential sources."

He underscored the significance of guaranteeing resource supply security.

Looking internally, China's own reserves of heavy rare earths, mainly in southern China, can easily meet rising domestic demand.

"We should ramp up mining at a pace and in an orderly way under the condition that the activity meets environmental protection requirements," said the insider.

The Ministry of Industry and Information Technology and Ministry of Natural Resources hiked the first batch of quotas for rare-earth mining output this year, to be shared among six major producers, to 84,000 tons, a significant increase from the 66,000 tons in 2020.

Zhang Anwen, a vice secretary-general of the Chinese Society of Rare Earths, told the Global Times on Sunday that there are several approaches to deal with tightening heavy rare-earth supplies in China and high technologies turned out to be an effective way, by reducing the usage of dysprosium and terbium in making neodymium magnets, which are widely used in various products such as electric vehicles and hard disks.

"The technology has become more mature and is a direction that needs more efforts," said Zhang.