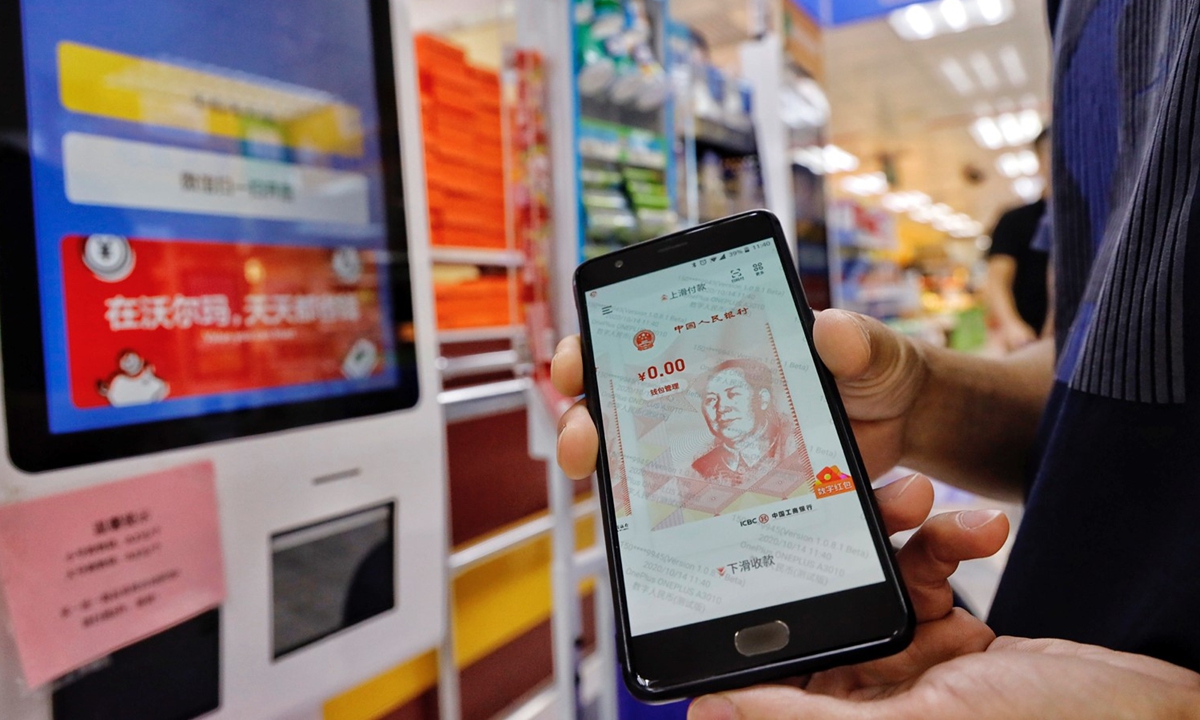

Residents who received "red packets" of digital RMB use the money in a store in Shenzhen, Guangdong Province, on October 14, 2020. The city launched a pilot program to distribute 10m yuan ($1.49m) in the form of digital currency to residents on October 12, 2020. Photo: Li Hao/GT

Digital yuan, the digital Chinese currency that has been under rapid development pushed by the People’s Bank of China (PBC), will support electronic payment services by widely used Chinese mobile payment tools Alipay and WeChat Pay, analyst told the Global Times on Thursday.

Mu Changchun, director of the Digital Currency Research Institute of the PBC, said on Thursday that retail-focused digital cash could provide a key backup for mobile payment methods such as Alipay and Tencent, Reuters reported.

“To provide a backup or redundancy for the retail payment system, the central bank has to step up and provide central bank digital currency (CBDC) services to the retail payment market,” Mu said.

“PBC’s illustrating the relations between digital yuan and the two payment tools is like releasing signal to the public that the digital yuan is not something administrative; rather, it is a market-oriented payment method,” Chen Bo, director of the Digital Finance Research Center at the Central University of Finance and Economics, told the Global Times on Thursday.

Payment giants like WeChat Pay and Alipay are financial platforms, playing the role of wallets, while digital yuan is the content of the wallet, Mu said last October during a conference.

As for how the two differently payment tools would coexist, Chen said it depends on the consumer’s payment habit, while acknowledging the cooperation and competition relations between them.

According to Mu, digital yuan and banknotes will coexist with hard currency for a long time and there will be no competitive relationship between it and the dual payments platforms.

China’s digital yuan, although in its pilot phase, will expand to more consumers in the rapidly developing digital era, making daily life easier and digital payments more secure.

The launch of the digital yuan is picking up speed since the start of this year. Six of China’s state-owned banks, which have taken part in the distribution of digital yuan, have begun accepting public applications to open trial digital yuan wallets, part of a move to pave the way for the digital currency’s nationwide rollout.

China has initiated large scale tests of its digital currency since October, with trials in cities including Beijing, Shanghai, Shenzhen, Suzhou and Chengdu.

The country will steadily continue the research and development of digital currencies, actively participate in the formulation of international rules and technical standards on data security, and fiscal control of digital currencies, according to the outline of China’s 14th Five-Year Plan for national economic and social development and the long-range objectives through the year 2035.

Global Times