H&M, Nike, Adidas could lose out by politicizing cotton-picking: expert

Do not discriminate against Xinjiang

A worker picks cotton at a farmland in Awati County, Aksu Prefecture in Northwest China's Xinjiang Uygur Autonomous Region on October 10, 2018. The county is praised as "the home of long-staple cotton" in China. Photo: cnsphoto

Some foreign brands may see their enterprise values, when considering their growth prospects, reduced by about 50 percent in five years, due to their groundless attack on the cotton produced in Northwest China's Xinjiang Uygur Autonomous Region, Chinese experts said.

Based on fabrications of "forced labor" in Xinjiang, dozens of foreign brands which heavily depend on the Chinese market, including H&M, Adidas and Nike, unwisely chose to stand against 1.4 billion Chinese consumers by banning Xinjiang cotton in their production.

"The immediate share plunge of these related firms is only the tip of the iceberg for their future losses," said Zhang Yi, CEO of Shenzhen-based iiMedia Research.

The more crucial issue for the multinationals is their market prospects in the rapidly expanding Chinese market amidst a gloomy global economy.

"And the ultimate brand value of these Western companies, measured in terms of their growth potential, could be cut in half over the next five years if they refuse to rectify their discriminations against China," Zhang told the Global Times on Saturday.

On Thursday, the day after Swedish clothing company H&M triggered a thundering condemnation by Chinese netizens over its ill-intended ban on Xinjiang cotton, the firm, as well as dozens of foreign brands adopting similar stances to H&M, saw share prices drop significantly.

Germany-based Adidas, one of the most popular foreign clothing brands among Chinese consumers, saw its share price drop by more than 6 percent on Thursday. According to media reports, Adidas, together with US-based Nike, saw their market value drop by more than 70 billion yuan ($10.7 billion) on that day. The market value of H&M also slumped by about 4.8 billion yuan.

Reputation crisis

More than 40 Chinese entertainment-cycle celebrities have rescinded endorsement contracts with these brands, and the opinion storm has sent the related foreign brands into a big reputation crisis in the country.

"Converse and Adidas are among my favorites, now they have left me no choice but to abandon them, because there's no room for compromise when it comes to national dignity," Terry Xu, a 28-year-old Shanghai-based IT engineer, told the Global Times on Saturday.

"I feel offended and it's incomprehensible that these firms operating and thriving in China for decades chose to crack down on materials produced in China with simply cooked-up lies," Xu said, stressing that if these foreign brands still think they can have their way in China, they are in serious trouble.

Firms can never succeed if they have no respect for local markets and local consumers, Zhang said. For a long time, these Western corporate brands have expanded fast in the Chinese market, which correspondingly has offered rewards to the brands.

However, the market is also evolving swiftly in various areas. For instance, Chinese domestic brands have been growing rapidly within the world's strongest manufacturing power. The brand values of Li Ning, Anta and many other Chinese sportswear brands have been soaring in recent years.

At the same time, Chinese consumers are also changing significantly. With the size of the middle-income population on the rise, a historical win of completely alleviating poverty in the country, and the younger generation born after 1995 becoming a major consumption force in China, their shopping preferences have diversified.

And the younger generation's preference for domestic fashion brands which contain unique Chinese culture is high, Zhang said.

Aerial photo taken on Oct. 24, 2019 shows a harvesting machine picking cotton in a field in Awati County, Northwest China's Xinjiang Uygur Autonomous Region. (Xinhua/Sadat)

Lost prosperity

As the only major economy to report a GDP growth in 2020, China has been something of a life saver for many multinationals against the backdrop of the sudden onslaught of the COVID-19 pandemic.

As for Nike, the Chinese market is where the company recorded its only growth in the 2020 fiscal year, with sales in the region reaching $6.68 billion, according to the company's financial report.

Many foreign brands have offered rosy forecasts of their revenue growth in China for 2021, as the country continues to boost global economic recovery during the post-COVID era. For instance, Adidas was expecting 20-30 percent growth in the region in 2021, according to the company's financial report.

However, not only will the growth prospects be dented by the companies' unwise moves to discriminate Xinjiang cotton, they could face an irreversible decline in the world's largest market.

The Chinese market is now a competitive one, and once a multinational company loses its slice of the market share, another one will swiftly slip in, not to mention these brands are facing a generation, as mentioned earlier, which possesses a high preference for domestic fashion brands, Zhang said.

Under such circumstances, the reduced value in capital markets is only one part of their losses. What's more important is that they may never win back their reputation in the Chinese market while growth prospects are vital for any company.

The promising Chinese market will continue to offer plentiful opportunities for both domestic and foreign businesses, but Chinese people will never accept those brands trying to collect money from the market while assaulting China.

On Saturday, the China Cotton Industry Alliance (CCIA) vowed to cultivate a high-quality cotton industrial chain, promoting the green and sustainable development of the cotton industry in Xinjiang, and to elevate the global influence of China's home-grown cotton brands.

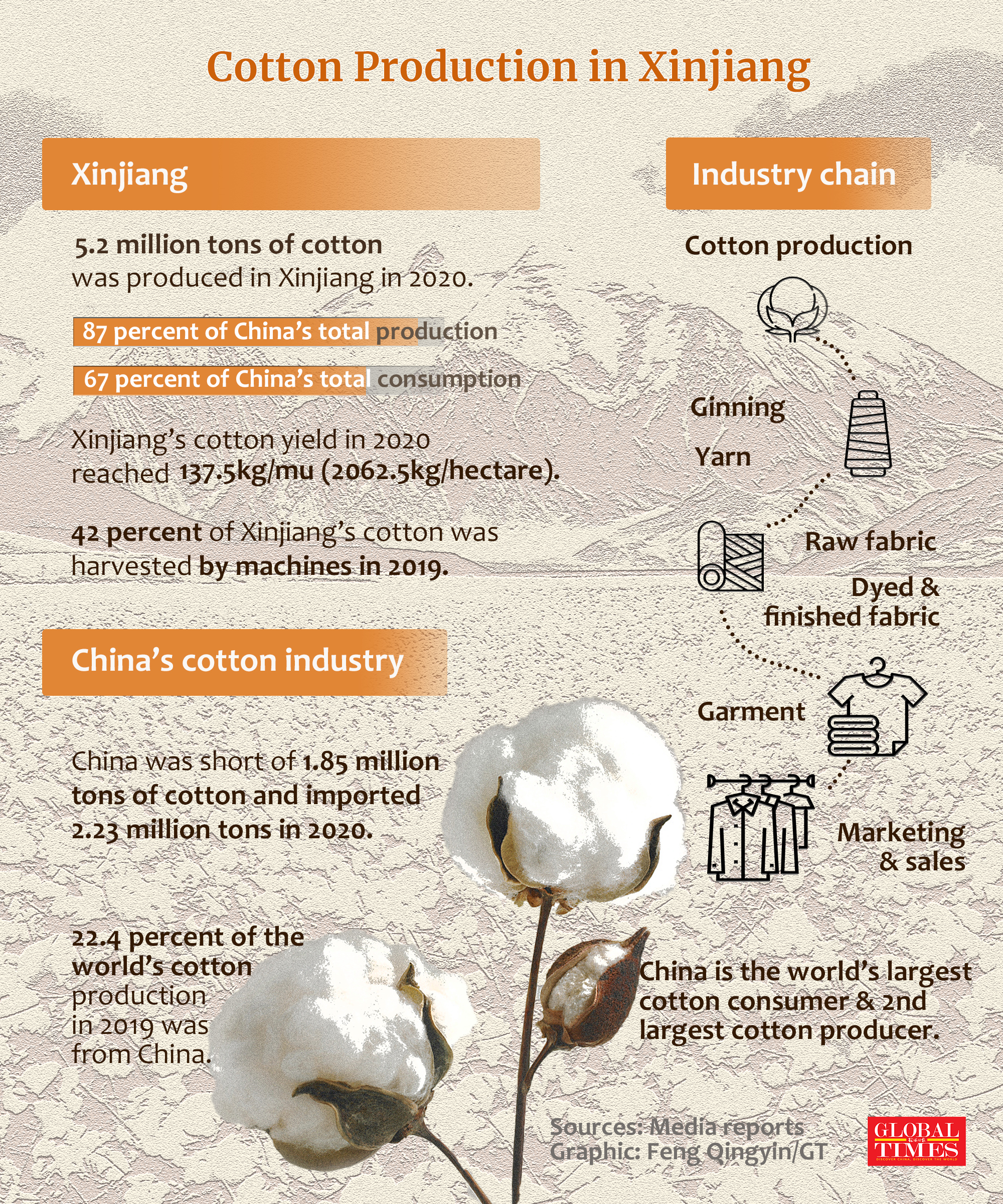

The CCIA condemned the fabricated rumors, clarifying that there has never been any so-called forced labor in Xinjiang. As the largest producer and consumer of cotton, China produced 5.91 million tons of cotton in 2020, 2 million tons short of the country's demand, according to a statement sent to the Global Times from the CCIA on Saturday.

Xinjiang produces about 5.16 million tons of cotton, accounting for over 87.3 percent of the nation's total annual output.

The CCIA said over 90 percent of cotton fields in northern Xinjiang are now mechanized, and the mechanization of cotton harvesting in southern Xinjiang is also increasing year by year.