Core vaccine ingredients in market spotlight

Investors should focus on long-term basic research and avoid hype: experts

A student is vaccinated at a stadium in Wuxi, East China's Jiangsu Province on Tuesday. Photo: cnsphoto

China's capital markets should boost investment in core materials and technologies for making vaccines, including lipid nanoparticles (LNP) - which are scarce around the world right now - for making COVID-19 mRNA vaccines, according to the head of the Chinese Center for Disease Control and Prevention (CDC).Gao Fu, director of the Chinese CDC, said at a recent investment forum that there is "zero distance" between basic vaccine research and application, and the capital market should invest in core vaccine technologies and their adjuvant materials.

Several sectors in biomedical development have been receiving increased attention and investment from capital market, including the LNP, a key adjuvant for making mRNA vaccines, which should be an investment hotspot, Gao said.

"Ever since the outbreak of the COVID-19 pandemic, there has been rising attention in the biomedicine economy, including in clinical research organizations in animal-based research, and contract development and manufacturing organizations developing viral vectors," Zhu Jinqiao, chairman of EFUNG Investment Management Enterprise, a venture capital focuses on biomedicine, told the Global Times.

The approved vaccines in China so far are mainly inactivated vaccines which are built on established mature technology, and the country is also ramping up efforts in developing or importing mRNA vaccine as an alternative choice, according to National Health Commission official.

Promises of new vaccines

One of the core areas having a moment is mRNA or messenger RNA vaccines. People getting the jab from Pfizer-BioNTech or Moderna will get strands of genetic material that stimulate cells to make proteins of the COVID-19, helping the immune systems develop antibodies against future infections.

And for that process to happen, one key ingredient is the LNP, a carrier that acts as matrix for the strands of mRNA to reside in when the vaccines are injected into human body.

"The mRNA has many advantages. In theory, using mRNA to prompt the human body to make the protein is more efficient than directly injecting the protein, and they can trigger more intense reactions from the immune system," Tao Lina, a Shanghai-based expert in medicine and vaccines and a former employee of the Shanghai center for disease prevention and control, told the Global Times.

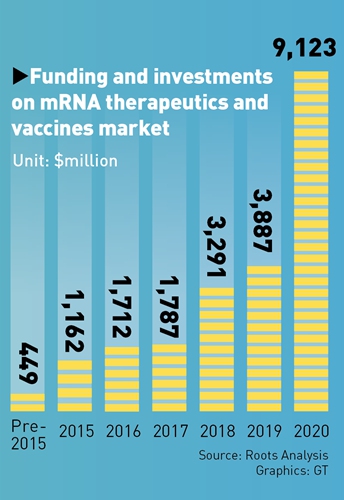

Globally, the new technology is winning the spotlight in the investment world. The share price of US-based mRNA company Moderna has increased by 700 percent since the beginning of this year, sending its market valuation to $62 billion. Together with CureVac AG and BioNTech, the three major mRNA companies now make up for a total of around $100 billion in market capitalization.

Stemirna Therapeutics, the first biotechnology company to bring mRNA therapeutics and high-end nanoparticle formulation platform to China, has received around 400 million yuan ($60.85 million) of investment.

Playing catch-up

However, compared to the frenzy capital market, the real world and basic research into the new vaccine technology is still making cautious steps forward.

Worldwide, there are currently only a few companies that supply LNP for vaccine makers, including Germany-based Evonik and Merck KGaA, and Canada-based Acuita, and many are running at their full capacity to churn out enough LNP to meet the soaring demand.

"The challenges for mass production of LNP is that it takes a long time to make," Tao said, "It has a very high technological threshold, because it is a new technology that was relatively niche and marginalized before the pandemic."

In China, the production chain of LNP is especially at an early stage, due to its late launch of research and development in the area, compared with countries such as the US and Canada, which hold most of the key LNP patents, according to Gao. Only a few Chinese companies, including Luye Pharma Group, Stemirna, Cansino and Walvax have also been developing LNP.

"The mainstream vaccines in China are inactivated vaccines, adenovirus vector vaccines and recombinant protein vaccines, none of which requires the LNP adjuvant," Tao said. "This is why in China, LNP companies are still small in number, and the development of LNP has been relatively late."

For investment companies, the relatively slow development means there is a lack of investment targets.

"Of course we would love to invest in good mRNA and LNP projects," Zhu said, adding that they don't think there is mature application of the basic research in the area in China, and that the LNP projects are overhyped by investors.

"There is one start-up making mRNA delivery system, and its valuation was pushed to more than 1 billion yuan, and it hasn't even been approved by the investigational new drug (IND) application," Zhu said.

According to Tao, the successful development and application of LNP will be a good addition to the existing vaccines in China, and might have great market potential, but for now China still lags behind the US and Canada in the research and production of LNP, and it would be "very hard" for China to catch up in a year or two, Tao added.

"The mRNA vaccines are still among the most effective types of vaccine currently available," Tao said, "but for them to realize their potential in China, capital investment will have to remain patient."