Semiconductors supply woes deepen, global cooperation urgently needed to expand production

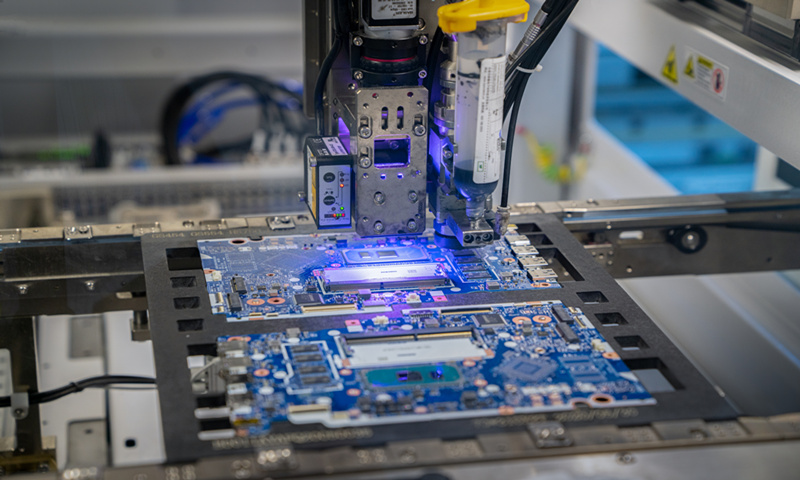

A chip manufacture machine Photo: VCG

Showing no sign of slackening, the global chip supply shortfall is pushing up the prices of chip wafers and semiconductor products by a steep 20 percent, media reports said.

And, industry analysts warned the chip supply woes won't ease until the end of 2020 or even 2021.

Multiple companies across the globe along the semiconductor industrial chain announced a rise in chip prices, including Chinese leading chipmakers Semiconductor Manufacturing International Corp (SMIC), Hangzhou Silan Microelectronics Co, China Resources Microelectronics, Japan-based Shin-Etsu Chemical Co and some US semiconductor makers, according to media reports.

Announcing the price increase to its customers via email, SMIC said its chip products now on assembly lines will keep their original prices, but future semiconductor products will be sold at a higher price, financial media 21jingji.com reported, adding the rise ranged between 15 to 30 percent.

Such a price hike has pushed up the stock prices of semiconductor-related companies on a whole. On Friday, the semiconductor plate on the Chinese market rose 5.31 percent, compared with the day before.

The rising demand for electronics amid the coronavirus pandemic, coupled with less optimistic expectations of economic recovery by the world's automakers, have caused the current global chip shortages, Zhang Xiaorong, director of the Cutting-Edge Technology Research Institute, told the Global Times on Friday.

And, the US government's relentless trade restrictions imposed on SMIC and other Chinese high-tech companies also contributed to the shortfall in chips on the market, forcing many manufacturers from electronics to automakers to stock up on wafers and semiconductor products, Zhang noted.

"The ban of the US government has restricted China's semiconductor production expansion and resulted in insufficient chip supply globally, seriously disturbing growth of the semiconductor industry," Zhang said.

Currently, at least nine automakers have been forced to suspend production, including Hyundai, Honda, Volvo, Ford, Nissan, Nio and other plants.

The chip crisis has now even spread to telecom equipment and consumer electronics. Apple, Samsung, Sony and Foxconn all issued warnings on a delay of chip shipments or shipment reductions, said 21jingji.com.

On Thursday, the world's largest contract chipmaker Taiwan Semiconductor Manufacturing Company (TSMC) said it plans to invest $100 billion over the next three years to increase capacity. The move came after Intel Corp's announcement to spend $20 billion on the expansion of advanced chip-making capacity.

To tackle the growing shortage of chips, US national security adviser Jake Sullivan and top White House economic aide Brian Deese will hold a meeting on April 12 with the chipmakers and automakers, Reuters reported, citing people familiar with the matter.

However, Liu Kun, a Beijing-based semiconductor industry analyst, told the Global Times on Friday that the weak supply capacity of chipmakers across the globe means the shortfall won't be resolved until the end of 2020 or early 2021.

Liu said there is a growing demand in enhancing international cooperation to tackle the chip crisis, but some foreign companies remain concerned with the risks of being sanctioned by the US government if they choose to cooperate with their Chinese counterparts to increase chips production ability.