Climate-blind borrowing risks 'credit crunch' for future generations

Climate-blind loan risks ‘credit crunch’ for future generations

As countries step up borrowing to fund COVID-19 stimulus spending, few governments are paying attention to how climate change could limit their ability to repay the debts, researchers warned on Wednesday.

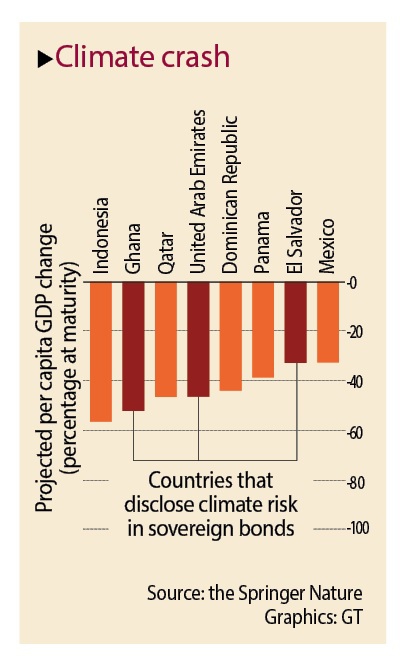

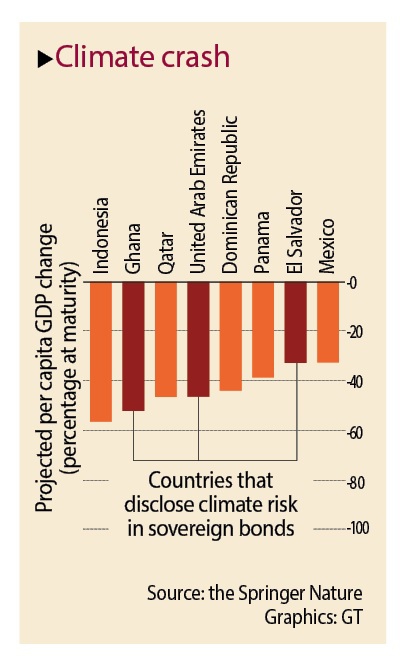

Increasingly severe climate shocks, such as hurricanes, and chronic pressures such as water shortages and drought are already hurting economies, and could worsen in the future, scientists say. But researchers at Oxford University, who estimated national governments issued 193 long-term bonds worth $783 billion in 2020, reviewed investor prospectuses for 50 and found about three-quarters did not disclose any climate-related risks.

The findings suggest "governments do not understand the economic impacts of climate risks or are unwilling to report them," they said in a commentary published in the journal Nature. "Without rigorous climate disclosures, investors and governments are flying blind," they added.

Of the 26 countries assessed, only three - Bermuda, the Dominican Republic and El Salvador - acknowledged that increasingly frequent weather disasters would create risks for their economies. Only two - Bulgaria and the United Arab Emirates - identified the financial risks of transitioning their economies to cut emissions, and only Ghana disclosed the impacts of both types of risk on its ability to repay, researchers said. They also warned that only 18 percent of total announced COVID-19 recovery spending had been directed to activities that would reduce global emissions, despite calls to "build back better."

India had earmarked nearly $7 billion for new coal infrastructure in India, and Germany had provided a $10 billion unconditional bailout for its major airline, Lufthansa, they noted.

Increasingly severe climate shocks, such as hurricanes, and chronic pressures such as water shortages and drought are already hurting economies, and could worsen in the future, scientists say. But researchers at Oxford University, who estimated national governments issued 193 long-term bonds worth $783 billion in 2020, reviewed investor prospectuses for 50 and found about three-quarters did not disclose any climate-related risks.

The findings suggest "governments do not understand the economic impacts of climate risks or are unwilling to report them," they said in a commentary published in the journal Nature. "Without rigorous climate disclosures, investors and governments are flying blind," they added.

Of the 26 countries assessed, only three - Bermuda, the Dominican Republic and El Salvador - acknowledged that increasingly frequent weather disasters would create risks for their economies. Only two - Bulgaria and the United Arab Emirates - identified the financial risks of transitioning their economies to cut emissions, and only Ghana disclosed the impacts of both types of risk on its ability to repay, researchers said. They also warned that only 18 percent of total announced COVID-19 recovery spending had been directed to activities that would reduce global emissions, despite calls to "build back better."

India had earmarked nearly $7 billion for new coal infrastructure in India, and Germany had provided a $10 billion unconditional bailout for its major airline, Lufthansa, they noted.