Workers operate industrial robotic arms in an auto parts factory in Taicang, East China's Jiangsu Province on January 7. Photo: IC

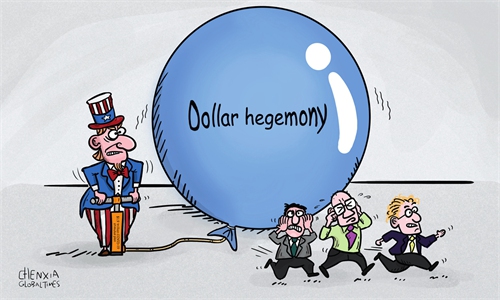

As the US economy is widely expected to post high growth this year boosted by massive fiscal stimulus, economists are raising concerns of potential negative impact on emerging economies, as capital and investment might flow to the US from these countries, economists warned.

Speaking at the Tsinghua PBCSF Global Finance Forum on Saturday, Chief Economist of JP Morgen China Zhu Haibin said that China, which was the only major economy to record economic growth in 2020, had been leading the global economic recovery in 2021, but the US could take China's place later this year.

According to Zhu, the US government's massive financial stimulus plan would lead to very fast growth. He expects that the US economy will grow 9 percent in the second quarter and 8 percent in the third quarter.

In its latest Global Economic Outlook released on April 6, the IMF estimated that China's economic growth in 2021 will be 8.4 percent, while the US' GDP growth will be 6.4 percent.

"Given such rare economic stimulus packages, especially as the US Federal Reserve is pursuing conservative policies due to concern about inflation, capital is likely to show a major shift to the US from emerging economies in the near future, resulting in the depreciation of local currencies," Tian Yun, vice director of the Beijing Economic Operation Association, told the Global Times on Sunday.

According to Tian, capital outflows from emerging economies will reduce local liquidity, leading to currency depreciations, as many emerging economies are still struggling with the pandemic.

However, with stable inflation enabled by a strong trade surplus, the successful handling of the pandemic that ensured the return of production, and adequate industry chains, it is unlikely to have a severe impact on China, Tian noted.

"To hedge the potential risks, these countries might have to increase interest rates. But it would be a tough challenge as higher rates would result in difficulties for enterprises to raise funds," Tian warned.

While capital outflows pose threats, the $2 trillion US infrastructure plan also offers opportunities for emerging economies as it requires the purchase of huge amounts of materials.

"As the manufacturing sector in the US only accounts for about 11 percent of the country's GDP, US domestic manufacturers cannot ensure sufficient supplies such as cement and rebar for the plan, and the US will need to increase imports from emerging countries," Tian said.

Even though there are uncertainties about China-US trade ties, it is undeniable that China remains the best choice to supply such materials as production capacity in the country is guaranteed while the costs are lower, Tian said.