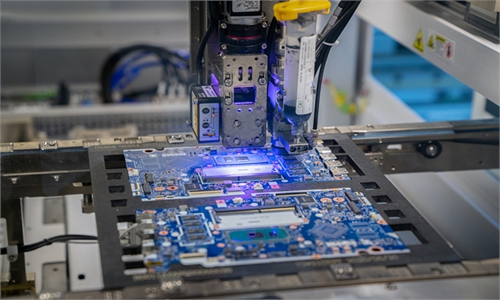

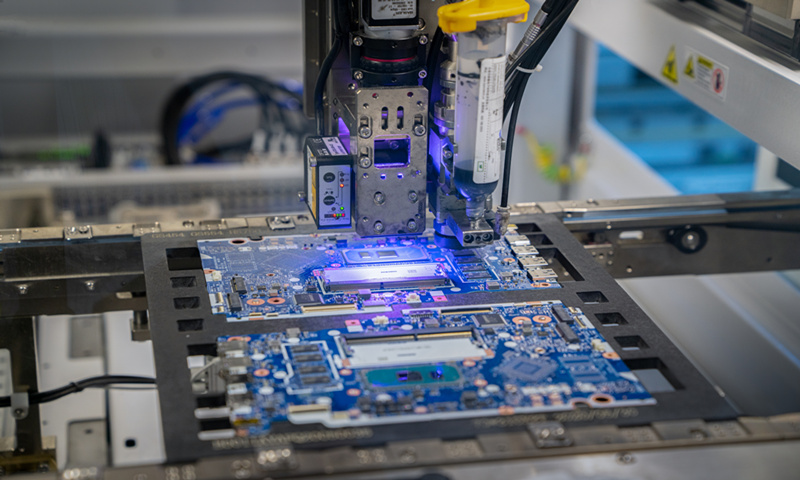

A chip manufacture machine Photo: VCG

Shares of Taiwan-based chip designer Alchip Technologies have fallen by nearly half in the past few days since a major client, a supercomputer firm in the Chinese mainland, was put on the US Entity List over allegations that next-generation technology could serve military purposes.

The US' crackdown on China's rising high-tech sector by cutting off chip technology has severely disrupted the semiconductor industry and supply chains, which in turn hurt businesses around the world, including those in the island of Taiwan, where the semiconductor sector acts as a pillar, expert noted.

The Taiwan-listed firm closed down by the 10-percent daily limit for five consecutive days ending on Thursday, losing about $460 million in terms of market capitalization.

The US Department of Commerce on April 8 blacklisted seven mainland entities involved in supercomputer programs, alleging that the firms' activities are contrary to US national security or foreign policy interests.

The move barred US-based companies from exporting technology to the seven groups without proper approval.

Among the targeted firms, Tianjin Phytium Information Technology was the largest client for AIchip last year, contributing 39 percent of the latter's related revenues.

If business with Phytium grinds to a halt, it will have a 25-percent impact on the chip designer's revenues in 2021, Alchip's legal representative said on Tuesday, according to media reports.

Alchip said it had stopped production of all products related to Phytium, adding that it was collecting "detailed documents for our US counsel to determine if the products are subject to EAR (Export Administration Regulations)".

But another chip firm from the island - Taiwan Semiconductor Manufacturing Co (TSMC), the world's largest contract chip manufacturer - has not suffered the same problems in the capital market as AIchip has, due to the former's large scale of production for different clients.

TSMC's shares have risen from NT$610 on April 7 to NT$619 as of Thursday's close.

The South China Morning Post reported that TSMC has suspended new orders from Phytium. However, TSMC said that it could not confirm the report, and declined further comment.

Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times on Thursday that the US' increasing pressure on rising high-tech firms based in the Chinese mainland, most of which source chips from firms on the island, will hit the long-term development of the latter where the semiconductor industry plays a pillar role.

"Chinese firms have been revving up research and development in the semiconductor industry over recent years, striving for an independent path amid the US' blockade, although there is still a technological lag in the cutting-edge segment," said Xiang.

In 2020, China's chip manufacturing capacity accounted for 15 percent of the world's total, steadily improving its strength, according to a report by US' Semiconductor Industry Association.

Chinese officials have repeatedly criticized the US government for abusing the concept of national security and state power to suppress Chinese high tech companies to maintain its monopoly and hegemony in science and technology.

Global Times