A mum selects infant formula for her child in a supermarket in China. File photo: VCG

Leading foreign private equity (PE) firms and Chinese home-grown infant formula brands are reportedly fighting for purchase of Reckitt Benckiser Group's infant-nutrition business in China, which reflects fierce competition in China's infant formula market and that local brands will likely usher in their golden era for growth.PEs including Bain Capital, Carlyle Group Inc, KKR & Co are among bidders for Reckitt Benckiser Group's infant-nutrition business in China that is priced as much as $2 billion, Bloomberg reported on Monday, citing people familiar with the matter.

Meanwhile, Inner Mongolia Yili Industrial Group Co, New Hope Dairy Co and Sequoia China, an investor in Hebei-based dairy product producer Junlebao Dairy Co also have submitted a bid, the report said.

The three Chinese companies have not commented on the report.

The business refers to the infant formula business of Mead Johnson Nutrition that Reckitt Benckiser bought in 2017 for $16.6 billion in its biggest-ever takeover to increase the group's presence in developing Asian markets, especially China when the country made a change to its one-child policy.

Song Liang, a Beijing-based expert on the dairy industry, told the Global Times on Wednesday that it's unwise for Reckitt Benckiser to give up the Chinese business now because China's market demand is still comparatively large despite a slowdown in the birth rate, and the rise of local brands as well as the impact of the pandemic.

He said domestic infant nutrition brands' bidding for the business showcases their ambition to compete with foreign brands for high-end markets, especially in the first- and second-tier cities like Beijing and Shanghai, he said.

Strategy adjustment in China

Faced with growing pressure in the Chinese market, New Zealand-based dairy company A2 Milk Co recently announced to cut its revenue and profit forecast for fiscal year 2021.

According to a stock-exchange filing on Monday, the company said that it now targets revenue of NZD$1.2 billion ($875.7 million) to NZD$1.25 billion, down from a February estimate of NZD$1.4 billion, in part due to the challenges in sales through daigou and cross-border commerce.

Daigou, also called overseas professional shopper, refers to individuals who buy products outside China for consumers to be shipped back. However, the business was severely impacted amid the pandemic when cross-border shipping was delayed or almost cut off.

A Netherland-based daigou surnamed Yu told the Global Times that she has stopped shipping baby formula back to China since March 2020 after the virus ravaged European countries and the number of flights to China plunged.

"The parcels were delayed by more than a month, while domestic consumers were afraid of virus transmitted by the parcels. Therefore, I was forced to stop the business," she said.

Despite current setbacks, A2 Milk stressed, "We recognize that the China market and channel structure are changing rapidly and are commencing a comprehensive review of our growth strategy and executional plans to respond to this new environment.

Unlike A2 Milk, another New Zealand dairy company Fonterra announced in March that it has decided to sell its joint venture farms in China and reduce its stake in its Chinese baby formula producer Beingmate in order to focus on its New Zealand milk business.

In the meantime, foreign infant formula brands are accelerating expansion in lower-tier cities in China. "Nestle stepped up entering in third- and fourth-tier cities in the second half of 2020, which, along with its brand substitution strategy, contributed to its sales recovery," Song said, noting that the company is expected to continue such effort this year.

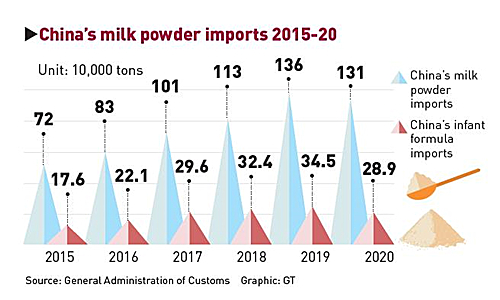

China's milk powder imports 2015-20 Graphic: GT

Rise of home-grown brands

As domestic consumers' recognition of home-grown brands gradually recovers years after the Sanlu infant milk scandal in 2008, growing demand for local infant formula products has been a new trend in China.

According to Euromonitor, the market scale of China's infant formula is nearly 200 billion yuan ($31.12 billion), accounting for about 50 percent of global market. In the Chinese market, local brands' share has increased to about 60 percent in recent years from 30 percent in 2013.

Data from the Ministry of Commerce showed on January 8 that the retail price of local infant formula was averaged at 209 yuan per kilogram, 22 percent lower than that of foreign brands, but the price gap has apparently narrowed compared with a 39 percent gap in 2011.

Song said the rapid rise of home-grown infant formula brands is a result of their presence in third- and fourth-tier cities in China where the birth rate remains comparatively high as well as market aggregation toward a few leading brands.

"Although domestic consumers' recognition of local infant formula brands is on the rise after the safety problem was solved, we should be clear that local brands still fall behind those foreign ones in sci-tech research and development (R&D)," Song said, urging home brands to make improvement in resource integration, formula innovation and R&D to compete with foreign brands.

He said that overseas infant formula brands have long enjoyed the advantage of online sales channels, and the e-commerce sector may witness the fiercest competition this year as leading local brands start to step up efforts in this regard.