Steel prices fall in China after govt efforts to curb months-long surge

Drop pressures some firms, but helps market stability: analysts

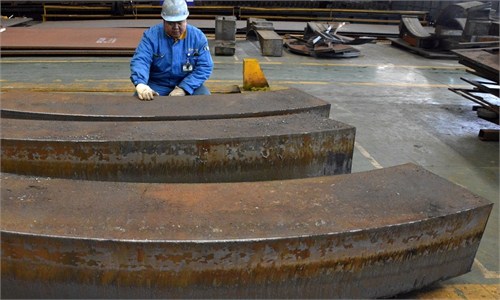

Industrial equipment operates at full capacity in a facility of MA Steel Hefei Iron & Steel Co in Heibei, capital of East China’s Anhui Province on Thursday. The company, which makes cold-rolled sheet steel coils for automobiles and home appliances, saw its output rise 16.4 percent in the first quarter of the year. Photo: cnsphoto

Steel prices in China have been pulling back significantly following months of soaring levels, a trend that is even creating pressure on certain companies, especially small and medium-sized players in the sector, industry representatives said.

The price drops came after Chinese authorities launched a new round of measures to curb soaring prices in a bid to ease the cost pressures on downstream industries like electronics producers. The measures, while affecting certain firms in the short term, will ensure long-term stability for the steel sector and related industries, analysts said.

The steel industry experienced a roller-coaster weekend with declines in certain segments. For example, rebar price fell 20-120 yuan ($3.1-18.6) per ton in several major domestic cities, after reaching a new high ignited by a global demand rebound and rising inflation posed by US monetary easing.

The sharp drops were the first in months as the government sought to discourage speculation, sending a strong message of how China was doing its part in stabilizing the market. Several Chinese steel industry insiders said that they expected more price declines.

A manager surnamed Zheng with Hexin Trading, a steel trading company based in Tangshan, North China's Hebei Province, told the Global Times on Sunday that steel prices dropped by 10 percent due to the government's efforts. Zheng temporarily slowed down his trading activities to avoid the risks of another decline.

"Without the continuous price gains, we may not be able to make money from it, since the raw material price and stock price are also rising in response to strong demand," said Zheng.

Zheng said that he bought steel at 6,200 yuan per ton and now the price has declined to 5,700 yuan.

These trends "may have less impact on big steel producers who stocked up on materials earlier at a relatively lower prices," he added.

A staff member at Tangshang Rui Peng Xiang Steel Sales surnamed Li told the Global Times on Sunday that average factory prices of different steel products had fallen about 500 yuan per ton recently, although she didn't say why.

However, she said the falling price has had little impact on her company's business. "Our prices move in response to factory prices," said Li.

The decline came as market regulators contacted several industry participants on Friday about the strengthening of price management in Tangshan, North China's Hebei Province, and Shanghai, the latest attempt to ease the cost pressure on downstream enterprises and safeguard market order.

This was part of a series of efforts to ease prices, after the exchanges - including the Shanghai Futures Exchange - adjusted margin requirements and transaction fees to curb speculation.

An executive meeting of the State Council, China's cabinet, on Wednesday also called for effective market adjustment in response to the excessive rise of commodity prices and its associated impact, the Xinhua News Agency reported.

The efforts have had an immediate effect, in stark contrast with some media reports claiming that China was passing the higher costs on to overseas customers, industry experts said.

Although the price curbs had an impact on certain steel industry players, industry representatives told the Global Times that it's necessary to stabilize the market.

Analysts said that there is also room for further price declines; however, despite great efforts by the Chinese side, cooling global steel prices requires a joint international effort.

The global market is expecting greater inflationary pressure driven by multiple factors, including US monetary easing and market speculation, Wang Guoqing, research director at the Beijing Lange Steel Information Research Center, told the Global Times on Sunday, noting that prices are rising faster in the West than in China.

The US steel price is as high as 10,000 yuan per ton, compared to around 6,000 yuan in China, because steel supply cannot keep up with the recovery of the US manufacturing industry, the expert said.

Other cause of the soaring steel price is the high price of imported iron ore, which is monopolized by some global suppliers including the Anglo-Australian mining company Rio Tinto Group. Chinese officials have also moved to curb surging iron ore prices, including diversifying supply sources.