China will ensure supply of major commodities and curb unreasonable hikes on prices

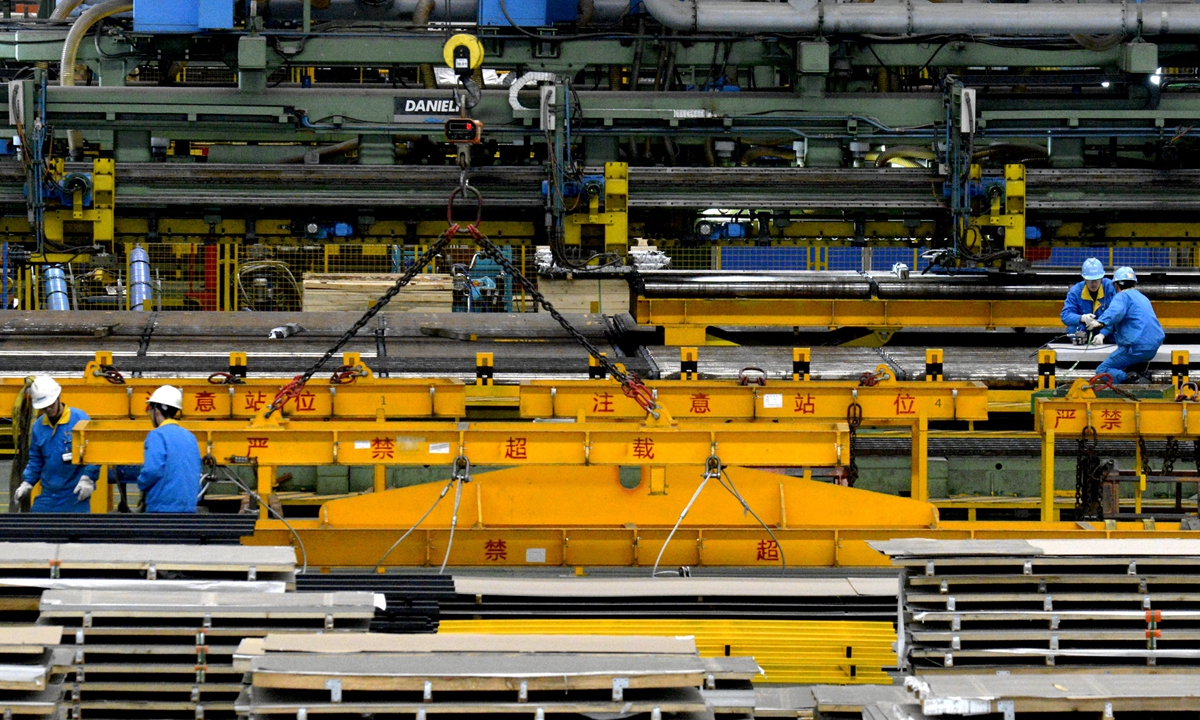

A steel manufacturing firm in Taizhou, East China's Jiangsu Province, is busy making supporting equipment for overseas mining. Photo: cnsphoto

China will crack down on monopolistic practices, the dissemination of fake news and price gouging as part of efforts to ensure supply of major commodities and curb unreasonable price hikes, according to a State Council executive meeting on Wednesday.

Prices of certain major commodities have continued an uptrend since this year, primarily as international price pressures feed into the domestic market, with some major commodity prices keeping hitting fresh highs, said a statement after an executive meeting, presided over by Premier Li Keqiang, which cautioned against the transmission of rising major commodity prices into consumer prices.

The meeting urged multifaceted measures to ensure supplies such as raising tariffs on certain steel products, temporarily cutting import duties on pig iron and scrap steel to zero and removing export rebates on certain steel goods.

In addition to efforts to curb energy-intensive projects, the country will urge major coal firms to increase supplies while having wind, solar, hydraulic and nuclear power playing a bigger part in securing supplies during the summer, read the statement, pledging to strengthen both imports and exports of major commodities.

On top of that, the country will toughen market regulation, strengthen industry self-discipline and the joint supervision of futures and spot markets, according to the statement, vowing targeted measures and efforts to troubleshoot abnormal trade and malicious speculative bets.

The Wednesday meeting, the latest official warning against runaway commodity prices, seems to have poured cold water on white-hot commodity trade, with the night session of the domestic futures market opening with deep losses.

Global Times