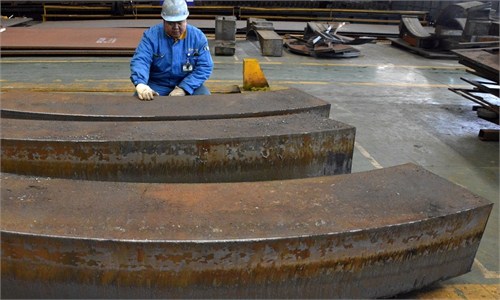

Workers at a steel processing enterprise lift processed steel coils at the Jingjiang Industrial Park in Taizhou, East China's Jiangsu Province on Wednesday. Due to strong demand at home and abroad, the production site is busy, and the company is sprinting to achieve its February operations target. Photo: cnsphoto

Chinese companies that manufacture components and mechanical goods are bearing the brunt of high bulk commodity prices, which are being pushed up by market speculation and US' extremely loose monetary policy.

But experts said that a stronger yuan and a rebound in domestic demand will offset some of the pressure by boosting imports and purchasing power, as domestic demand plays a rising role in economic growth.

Cost-driven inflation has become a risk for the global economic recovery, and whether yuan appreciation is needed to reduce import prices must be considered by monetary policy-makers, experts said.

The profits of Chinese industrial enterprises above a designated size grew 57 percent in April year-on-year, sending the profits in the first four months of 2021 up 1.06 times compared with 2020, the National Bureau of Statistics (NBS) said on Thursday.

Growth in the first four months was positive and steady, but the resurgence of coronavirus abroad and external conditions are adding uncertainty, Zhu Hong, a senior statistician at NBS said in a statement on Thursday.

Bulk commodity prices keep rising, adding pressure on companies in the middle and lower parts of the industry chain, Zhu pointed out.

In this context, growth in the profits of industrial enterprises above a designated size in April fell 35.3 percentage points compared with March.

The rising prices of raw materials are putting heavy pressure on mid-range parts, machinery and equipment makers, as well as auto components and electronic producers. Some downstream industry participants saw profits drop by 10-15 percent, the Global Times learned.

However, experts said that China, as an important global consumer of bulk commodities, is inevitably affected by imported prices, but the impact can be offset by a stronger yuan.

A stronger yuan will boost the purchasing power of domestic companies, especially the large electronic companies that rely on overseas sources for parts, Zhang Jianping, director of the Center for regional Economy, Chinese Academy of International Trade and Economic Cooperation, told the Global Times on Thursday.

Lv Jinzhong, director of the investigation and research department of the Shanghai headquarters of the People's Bank of China, the central bank, suggested in a recent statement that in order to offset the import effect, China should follow a prudent monetary policy, pay attention to the balance of trade, and enhance its exchange rate flexibility, including the appropriate appreciation of the yuan.

Driven by the US Fed's monetary easing, the central parity rate of the yuan reached 6.37 against the US dollar on Thursday, a nearly 3-percent rise compared with early April.

But a stronger yuan could also put pressure on exports, a mainstay of the Chinese manufacturing sector, along with higher commodity prices, Liu Xuezhi, a senior macroeconomic analyst at Bank of Communications, told the Global Times on Thursday. A stronger yuan could also raise the risk of speculation and asset price bubbles.

The steady recovery of domestic demand can also help ease the impact of high commodity prices.

From January to April, the profits of consumer goods makers rose 45.3 percent year-on-year. In this sector, the profits of agricultural and food-processing firms, and producers of wine, beverages, tea and other industries grew by double digits on average in the past two years, NBS data showed.

"In general, the global economy and China's economy are on track to recover... thanks to the financial support for the development of the real economy, together with the government's tax and fee cuts," said Zhang, and the profits of industrial enterprises in May are likely to improve.