Chinese firm’s reported deal to acquire UK chip firm faces uncertainty amid US pressure

Chip Photo:VCG

Chinese semiconductor company Nexperia reportedly plans to acquire Newport Wafer Fab (NWF), the UK's largest chip producer, raising questions over whether a potential deal could win approval from the UK government amid mounting US pressure on allies to join its crackdown on China and a global chip shortage.

Nexperia, a subsidiary of Chinese technology firm Wingtech Technology, is said to be in talks to acquire NWF for 63 million pounds ($87 million), according to CNBC, which cited anonymous sources. The deal is set to be announced as soon as Monday or Tuesday, the sources said.

Wingtech Technology said on Saturday that it would not comment on the takeover. The company did not immediately respond to the Global Times' request for further comment on Sunday.

The deal could face great uncertainty in getting the UK government's approval as it comes during a global chip shortage and the US' crackdown on China's chip industry, which has made countries more prudent when it comes to semiconductor production, Chinese experts said.

Ma Jihua, a veteran industry analyst, told the Global Times on Sunday that it is expected that the deal will face some difficulties going through the UK government.

Ma added that the US' crackdown and blockade on China's chip industry has led many countries to see chip self-sufficiency as a matter of national security.

The prudent approach has been intensified amid a global chip shortage, and every country wants to retain its manufacturing ability, Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told Global Times on Sunday.

"The UK certainly wants to retain its remaining semiconductor production capabilities," Xiang said. "Therefore, in this situation, it is unlikely for the UK government to approve the takeover."

A UK government spokesperson told CNBC that the government will continue to monitor the situation closely and will not hesitate to use the powers it has under the Enterprise Act, should the situation change.

"We remain committed to the semiconductor sector, and the vital role it plays in the UK's economy," the person added.

While the UK government may call off the deal over political considerations, it is hard for the UK business sector to ignore the offer from a commercial point of view, experts said.

NWF makes silicon chips that are used in power supply applications for the automotive industry. The company is deep financial trouble.

According to CNBC, the company has outstanding debt, including 20 million pounds owed to HSBC and 18 million pounds to the Welsh government, which could be paid off following the sale.

"European chip plants have problems with high operating costs and low efficiency. They can make a lot of commercial profits by selling to Chinese companies at this time to cover their losses," Xiang said.

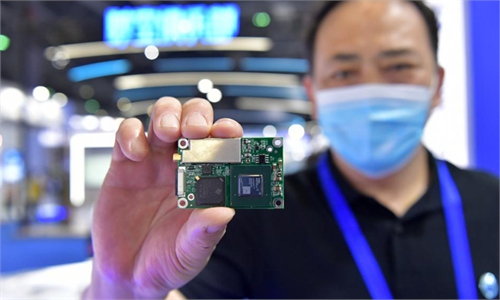

For the Chinese firm, the deal could help the company's development and production of semiconductors for the automotive industry amid a shortage of chip production capacity in the country, Zhang Xuefeng, an industry observer, told the Global Times on Sunday.

"In the long run, it may also play a positive role in improving China's chip manufacturing and design technology," Zhang said.

However, even without overseas acquisitions, domestic chip production is gearing up.

From January to May, China produced 140 billion chips, up 48.3 percent year-on-year, according to data released by the National Bureau of Statistics in June.

Experts predicted that the chip shortage, which has lasted for over seven months, could be eased as early as the first half of next year, and then prices may crash.

"Chip is a cyclical industry. If production capacity increases and enterprises no longer stock up, then the sector's total production capacity will be unleashed next year and chip prices will plummet," Ma said.