Banks race to push digital yuan

More retail services expected to integrate into the program

A staffer displays the digital yuan application scenarios to visitors in the World Intelligence Congress in Tianjin in May. Photo: cnsphoto

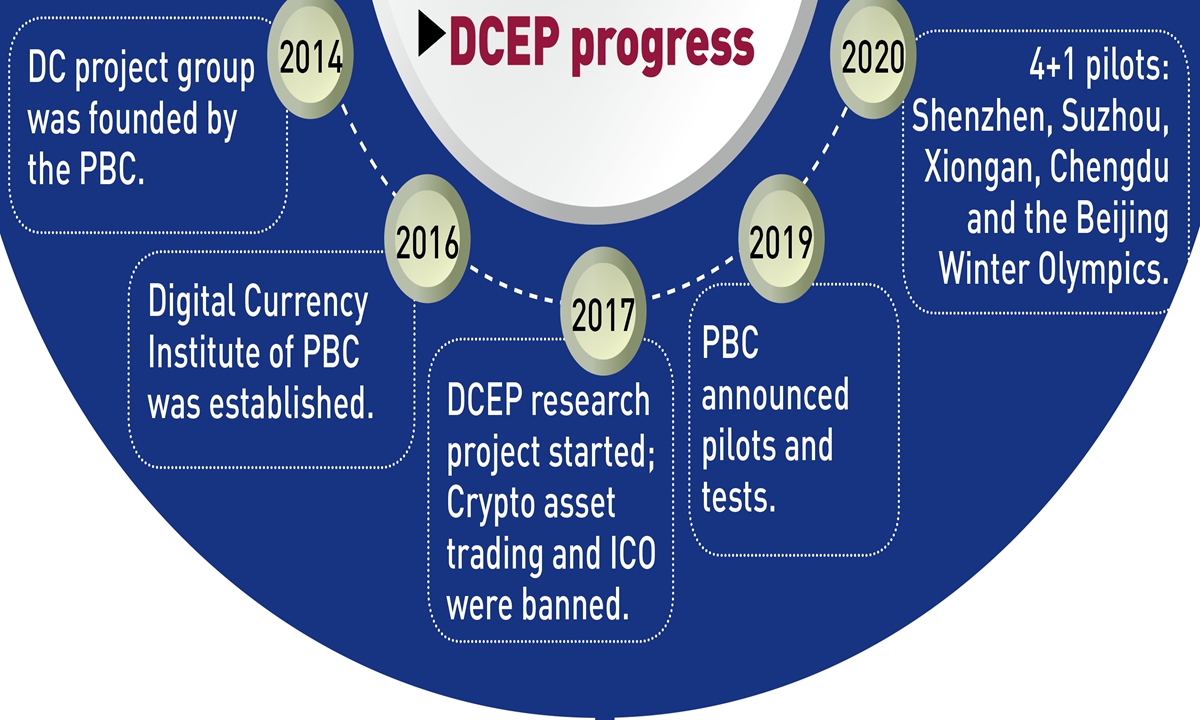

Source: GT

Riding on the wave of digital yuan's push across the country, Chinese commercial banks are racing to map out in the newly-emerging sector by attracting individual consumers as well as business clients, a move that analysts said they should regard as a strategy to maintain their commanding heights in future competition instead of only opening a new business line.

At present, the operating agencies responsible for the exchange of digital yuan are the six state-owned banks, and most of them have accepted users' independent applications to open a digital wallet.

The Global Times learnt that there are two types of channels to access digital yuan in the trial cities: one is rolled out by the People's Bank of China (PBC), the country's central bank, where aggregates each bank's digital yuan wallet for users to pick up while the other one is each bank's own digital yuan wallet via its own smartphone-based e-bank.

The PBC version is still under internal test, not yet officially online for the public.

Industrial and Commercial Bank of China (ICBC) and the Bank of Communications took the lead in offering more convenient services in opening the digital yuan wallet just by scanning a QR code. The Global Times also found that on the automatic teller machine of ICBC, customers can charge their digital yuan wallet via the machine.

Both banks also used small gifts including laundry detergent, data cables, card holders to attract users to open the wallet.

Apart from offline introduction and promotion in some pilot cities, staff of these banks also tried online methods like posting the QR code in their WeChat Moments.

An employee of a state-owned bank told the Global Times on Wednesday that they have the mission to deliver the new business to as many customers as possible like the way they market the credit card business.

"But the promotion scale has dwindled recently due to some unsatisfying feedback from customers - they thought the consumption scenario of the digital yuan is not various enough due to limited number of merchants connected."

"Compared with expanding promotion scale in a quick speed, we attach more importance to customers' feedback because the digital yuan is a new thing, if you cannot get a good review at the very beginning, it will be hard to win strong ratings down the track," said the employee, believing that the digital cash will be embedded into a greater number of application scenarios in the future.

The current tests covered daily scenarios including retailing in brick-and-mortar stores and transportation fares, as well as online shopping on platforms such as JD.com, Meituan and Didi Chuxing.

Though there is not a detailed timetable to introduce the digital currency officially to the public, the development of digital yuan remains very pragmatic with ongoing long-term research work and is now rolling out tests. The central bank so far conducted pilot programs in such cities as Beijing, Shenzhen, South China's Guangdong Province, Suzhou, East China's Jiangsu Province, Xiongan New Area, North China's Hebei Province.

Passengers in Beijing are now allowed to use digital yuan to pay for their subway commute from the beginning of July, one day after a subway line in Suzhou began accepting digital yuan, which are the latest trials rolled out by the Chinese government to apply digital yuan to real-life scenarios.

Beijing's financial authority announced in June that 40 million yuan ($6.27 million) in digital yuan will be given away to local residents in a regular test. It went separately into 200,000 red packets each containing 200 yuan.

Since trials of digital yuan were usually conducted in other cities before coming to the capital city, recent large-scale moves in Beijing could "add political weight on the digital yuan," according to Chen Bo, director of the Digital Finance Research Center at the Central University of Finance and Economics.

As a next step, Beijing will ramp up promotion of the digital yuan and focus its efforts on the 2022 Beijing Winter Olympics.

Strategic move

An industry insider in the bank system, who asked to remain anonymous, told the Global Times on Wednesday that for the commercial banks, business customers are more important compared with individual ones.

"They have set goals on attracting business customers to open the digital yuan wallet," the insider said. "It's not an easy thing for commercial banks to push ahead the digital yuan but it is also something they could not lag behind. It's not only a new business, but also a strategy to seek commanding height in future competition."

For individual customers, commercial banks have directly become the main point of contact. They can take advantage of the opportunity brought by digital yuan and adopt the strategy of "small high-frequency carrying high-end low-frequency scenarios" to build an ecosystem based on financial services, activate traffic and grasp data, said Wang Jun, chief economist of Zhongyuan Bank.

China has taken the global lead in advancing the digital currency thanks to an early start and abundant application scenarios aided by wide broadband coverage. It will probably become the first major economy to officially launch a sovereign digital currency, which has long drawn attention around the world.

The digital yuan, or the Digital Currency Electronic Payment (DCEP) as it is officially called, is primarily built on modernizing the domestic payment system and playing catch-up in the era of digital economy, envisions raising efficiency and reducing costs and serving the retail payment system in particular, said Zhou Xiaochuan, the former head of the PBC.

DCEP is a dynamic two-tier and multi-scheme program. PBC makes up the first tier and is in charge of building stable financial infrastructure and supervision of the whole program, while the second tier includes commercial banks, telecom operators and third-party payment platforms.