Illustration: Chen Xia/GT

As the Biden administration intensifies its crackdown on Chinese companies by cutting their crucial supplies or forcing them to delist from the US stock market, it's understandable and justified for Chinese authorities to tighten regulatory oversight on Chinese companies opting for going public in New York.China's central government issued a new policy guideline last week that it will whip up regulations for the Chinese companies listed overseas or seeking to sell shares abroad. The State Council stated it would rack up supervision of companies listed overseas, particularly with regard to their use and storage of customer data.

And on Saturday, the Cyberspace Administration of China revealed that it mulls a rule to require internet companies collecting 1 million or more Chinese users' data must report to the cyber security review office before listing overseas.

Since 2010, China's technology giants have grown into some of the world's most valuable companies mainly because they were largely untethered and unchecked by government regulation. Many went to New York for stock listing, enabling a good number of overseas investors to profit from these companies' explosive growth.

Now, it is high time for China's financial regulators to strengthen audit of Chinese companies which are already listed or aspire to list on foreign stock exchanges. The regulators are poised to mete out new laws and regulations to guide cross-border data flow and management of important or confidential data that is pertaining to China's national security. The regulators will also strengthen corporate antitrust supervision to protect fair and free market competition.

The previous Trump administration took a radically confrontational approach that destroyed the basis of collaboration with Beijing for the purpose of stifling China's economic rise. As a result, Beijing was forced to respond.

In 2020, the US Congress approved a bill signed into law by Trump, which requires the audit papers of US-listed Chinese companies be open for US regulatory inspection. Failing to comply for three consecutive years will result in a delisting.

In January 2021, the NYSE delisted China's three largest telecommunications companies - China Mobile, China Telecom and China Unicom -- under an executive order signed by Trump before he left the White House. This highly unfriendly move, plus Trump's high-profile assault on Huawei, ZTE and approximately three dozens of Chinese high-tech companies, seriously damaged bilateral ties. Unfortunately, the Biden administration has largely inherited Trump's hardline anti-China policy.

Naturally, to counteract the US' antagonistic posturing, China responded by hardening its regulations. The country's top legislature, the National People's Congress Standing Committee, passed the Data Security Law that stipulates all Chinese companies and entities need government authorization before providing any China-based data to foreign judicial or law enforcement agencies. Another piece of legislation called the Personal Information Protection Law (PIPL) is also being worked on. The PIPL will regulate how data is collected, stored, used and shared in China.

The legislations are expected to help plug a long-running regulatory loophole that has allowed a number of Chinese technology companies to raise funds in foreign stock markets without adequate scrutiny at home.

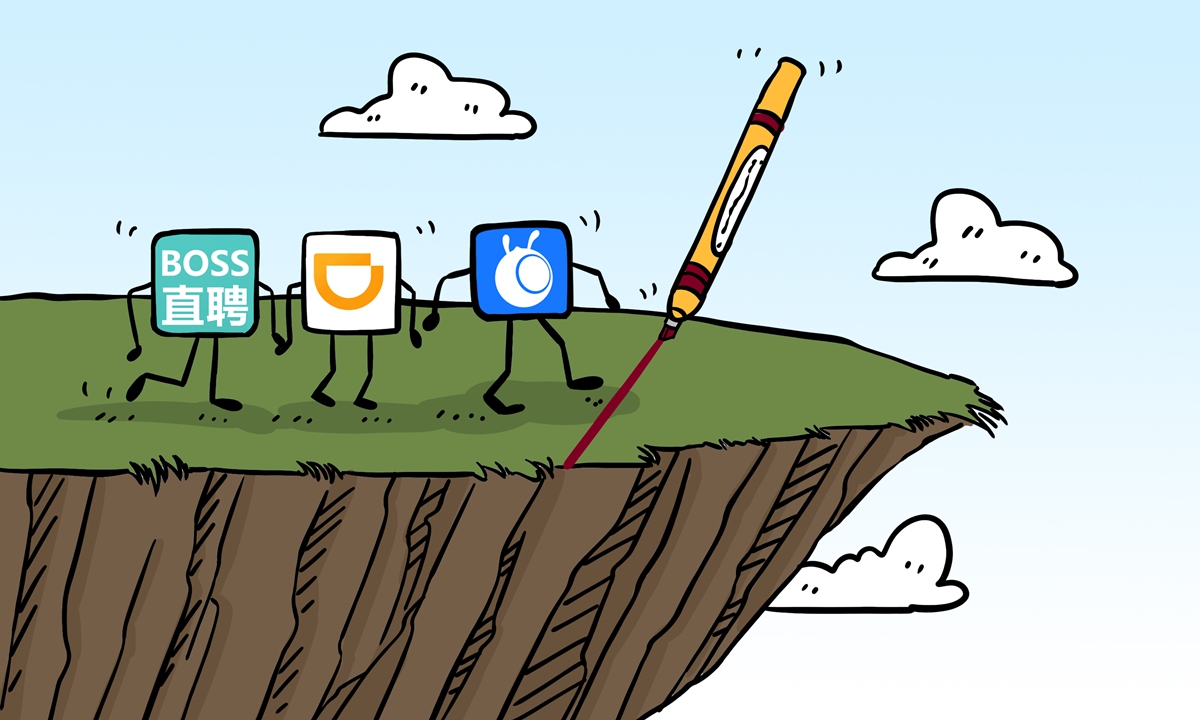

Accompanying China's latest acceleration of internet-based industry oversight, newly US-listed Didi Chuxing -- the largest ride-hailing business in the world -- and two other Chinese platform companies, Full Truck Alliance and Boss Zhipin, listed in the US earlier, were put under a data cyber-security review last week.

In a stern government move, Didi was banned by Chinese regulators from opening new user accounts as its domestic app download is now outlawed, which is a heavy blow to Didi's business expansion. The regulators found Didi to have "illegally collected and used users' personal information in a grave violation of (Chinese) law and regulation." On Friday, the regulators ordered 35 other apps, all related to Didi, to be removed from app stores in China.

With more than 377 million car-riders and 13 million drivers in Chinese mainland, Didi Chuxing has accumulated troves of Chinese middle-class' commuting and financial data - a de facto gold mine for any business or government. The stake is high for China's government to protect this data.

Major share-holders and institutional investors of Didi were alarmed at Beijing's sudden policy tightening which caused a precipitous decline of its stock price. But it is Didi's board of directors to blame. According to media reports, the Cyberspace Administration of China (CAC) told Didi to delay its US listing until the regulator had completed a data security review. Nevertheless, Didi decided to neglect CAC's regulatory directive and even rushed an IPO roadshow and got listed at the NYSE in late June.

Didi said that it had no prior knowledge that Chinese regulators would intervene. But the company should have realized the huge risks for not heeding the regulator's suggestion. The company's two largest shareholders - Japan's Softbank and the US' Uber Technologies -- and the leading investment banks on Wall Street, which underwrote Didi's US listing, were perfectly aware of the consequences if they moved forward with the IPO.

Didi Chuxing is likely to face more regulatory screening at home in the coming weeks. Like other Chinese platform giants including Alibaba, Tencent, Baidu and Ant Group, the State Administration for Market Regulation (SAMR) will scrutinize Didi's business operations. The review will go back several years to determine whether the company had leveraged its extraordinary overseas financing ability to subsidize car-riders and drivers in order to oust market rivals, build up a behemoth and dominate China's market. Not long ago, Alibaba was fined $2.8 billion by SAMR for forcing merchants to abandon rival e-commerce platforms.

China's economy is expected to grow by at least 8 percent in 2021. Businesses operating in this huge market are poised to be successful. But companies like Didi, Ant, Boss or others whose board of directors and management think they can outwit China's law will pay the price.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn