China’s national carbon trading begins, ramping up efforts to achieve decarbonization goal

Nationwide efforts to achieve decarbonization goal will pay off in economic shift: experts

Photo:VCG

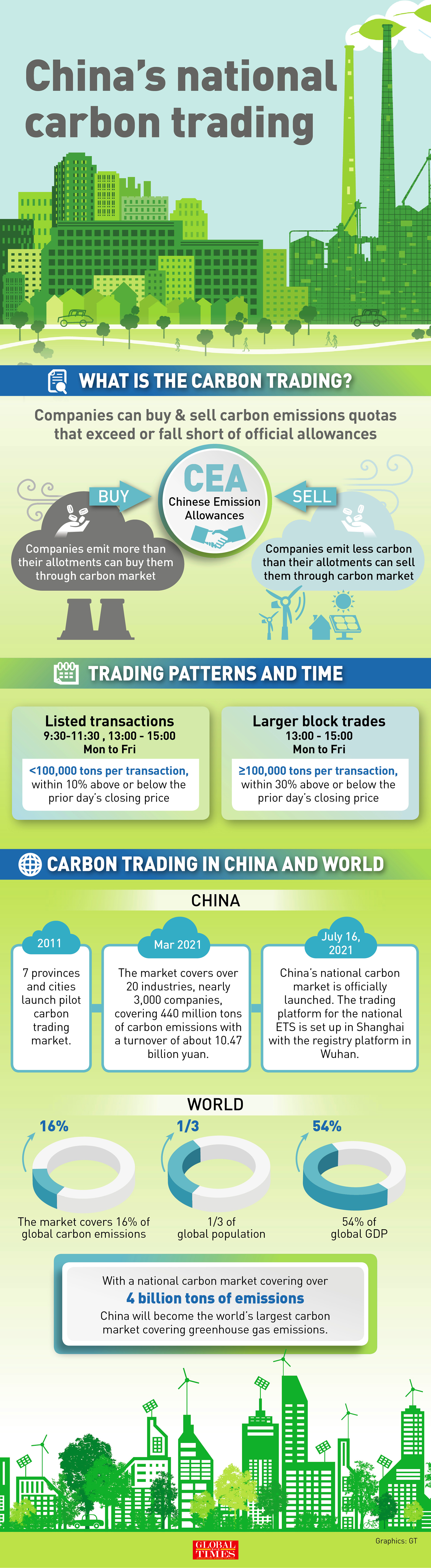

China's national carbon market, the largest emissions trading system (ETS) in the world, was officially launched on Friday, marking a milestone for the nation's institutional innovation in pushing ahead green development and a crucial step for the country to decarbonize its economy by 2060.

The move, despite being delayed from the scheduled June 30, not only demonstrated the country's resolve in dealing with climate change, but also will become a key accelerator in China's continuous pursuit of economic development of high quality and greenness.

The opening ceremony was held at the same time in Beijing, Shanghai and Wuhan, capital of Central China's Hubei Province. The trading platform for the national ETS is set up in Shanghai and the registry platform in Wuhan.

The power generation industry became the first industry to be included in the national scheme.

"In the first industrial cycle of the national carbon market, China's power generation industry has a total of 2,162 enterprises, covering approximately 4.5 billion tons of carbon dioxide emissions," said Minister of Ecology and Environment (MEE) Huang Runqiu at the launch ceremony.

"The national carbon market is a major institutional innovation that uses market mechanisms to control and reduce enterprises' emissions and promote green development," Huang said.

"The electricity industry alone makes China the largest carbon market in the world. If other sectors are included later, China's carbon market may exceed all other carbon markets, which will attract a huge amount of capital and technological investment," said Wang Jun, director of Carbon Asset Management of Sichuan Yongxiang Co.

More key polluters including cement and steel producers will gradually enter the ETS, according to the MEE, although no detailed timeline is currently available.

Opening at 48 yuan ($7.42) per ton at 9:30 am on Friday, the market quickly saw the first national carbon transaction matched, priced at 52.78 yuan per ton, generating a total of 160,000 tons of transactions and a transaction volume of 7.9 million yuan, according to a CCTV report.

The carbon price increase expanded 6.73 percent at 51.23 yuan at Friday's closing.

The trading scheme debut came after smaller pilots in a number of provinces were held in previous years, where carbon traded at around 40 yuan a ton.

Wang told the Global Times on Friday that the launch of the national ETS is a significant move in bringing more awareness for industry players, showing that CO2 can be priced and traded, offering a market-driven approach to stimulate green economic development.

China's carbon market will maintain modest prices for a period ahead so that participating companies can get used to trading, Wang said, while prices could surge starting next year and double every one or two years.

Wang estimated that the carbon prices could reach around 300 yuan per ton by 2030.

China aims to have CO2 emissions peak before 2030 and achieve carbon neutrality before 2060, Chinese President Xi Jinping announced in September 2020 at the general debate of the 75th session of the United Nations General Assembly via video.

"As the Chinese national carbon trading starts today, this can be called a big milestone for China and the beginning of a new era. It shows to the world that China is working seriously toward carbon neutrality. Hopefully, other countries which do not yet have any carbon trading will be inspired to study and follow the Chinese example," Steivan Defilla, President Assistant at APEC Sustainable Energy Center, told the Global Times on Friday.

Catching up

Compared with early and mature global ETS operators like the EU and US, there is a lot for latecomers like China to learn from or avoid in operating the trading scheme, experts said.

The EU carbon market, which covers emissions from power plants, industry and European flights, started back in 2005, and it has been deemed as a cornerstone of the EU's strategy for reducing greenhouse gas emissions.

Emissions from installations covered by the EU ETS decreased 9.1 percent in 2019 compared with 2018, equivalent to 152 million tons of CO2, according to an annual report from the European Commission.

The two sides might look to jointly enhance their efforts to promote green and sustainable development in the future. Working together to tackle climate change might become a highlight for China-EU cooperation, said Cui Hongjian, director of the Department of European Studies at China Institute of International Studies.

The building of the EU ETS has gone through many twists and turns, and the EU has accumulated a wealth of experience as well as profound lessons.

"Given the difference of purchasing power parity between the euro and the yuan, it is a promising start for the carbon market to open at around 48 yuan per ton this morning," said Defilla.

"The EU's carbon market started to deliver only this year as the price for carbon was too low before. The reason for this has been that too many free emissions quotas had been allocated in previous years, so the supply of certificates was high compared to the demand. This has changed only recently," he explained.

The price of benchmark EU carbon permits climbed above 50 euros a ton for the first time in May, the highest level since 2005.

The size of China's carbon market will expand more than 30-fold over the next decade as it covers more industries and polluting becomes more expensive, according to Citigroup.

Qi Haishen, president of THE-Solar Tech Co, told the Global Times that both the EU and US have specific rules on emissions cutting, quota allocation and pricing, while still pushing actively for relevant legislation.

"Both have a common advantage in implementing the ETS: they try to protect local industries from the negative impact of carbon neutrality in international competition in the process of pursuing carbon emission reduction targets," Qi noted, adding that China could intentionally take note of such experience.

Besides promoting the scheme, experts suggested strengthening the regulation on emissions data and imposing heavy fines on any data fraud by participating enterprises.

"Data authenticity and reliability should be the red line for enterprises and the costs of illegality should be largely increased," said Wang.

China's national carbon trading

Promoting better growth

China's economic rise over the past decades has largely been powered by coal. The country, now among the world's biggest investors in green energy, is increasing its pace to shift to other renewables including wind and solar.

Zou Ji, president of the Energy Foundation China, told the Global Times Friday that the national policy boost to bring carbon emissions to the market will further press industries, especially heavy polluters, to make a shift and upgrade, in the process of which, an array of clean energy technology or equipment providers could see new growth opportunities.

"The structure of our economy is changing, with the share of the services sector and of new low-carbon manufacturing industries on the rise, and that of traditional polluting and energy-hungry industries falling," said Zou.

Amid the low-carbon transition, concerns have arisen as to whether it will put the brakes on the fast GDP growth of the world's second largest economy.

The overall GDP growth will not only maintain steady but also stay on a healthier and sustainable track for years to come amid the nation's push to change economic structure, Zou noted.

"For traditional polluting and energy-hungry industries, you wouldn't say their additional economic output will definitely fall amid the carbon market because some firms would handle the challenge and make a quick shift, but those incapable will be knocked out," he added.

The consumption of coal has been on a decline since reaching a peak in 2013. There was a slight upturn in 2018 and 2019, but consumption remained below 2013 levels.

Although total carbon emissions increased during the 13th Five-Year Plan period (2016-20), coal has lost its momentum with growth slowing down.

The country succeeded in lowering carbon intensity by 18.8 percent in the five years through 2020, showing the economy's reduced reliance on fossil fuels, data from a MEE report showed in March.