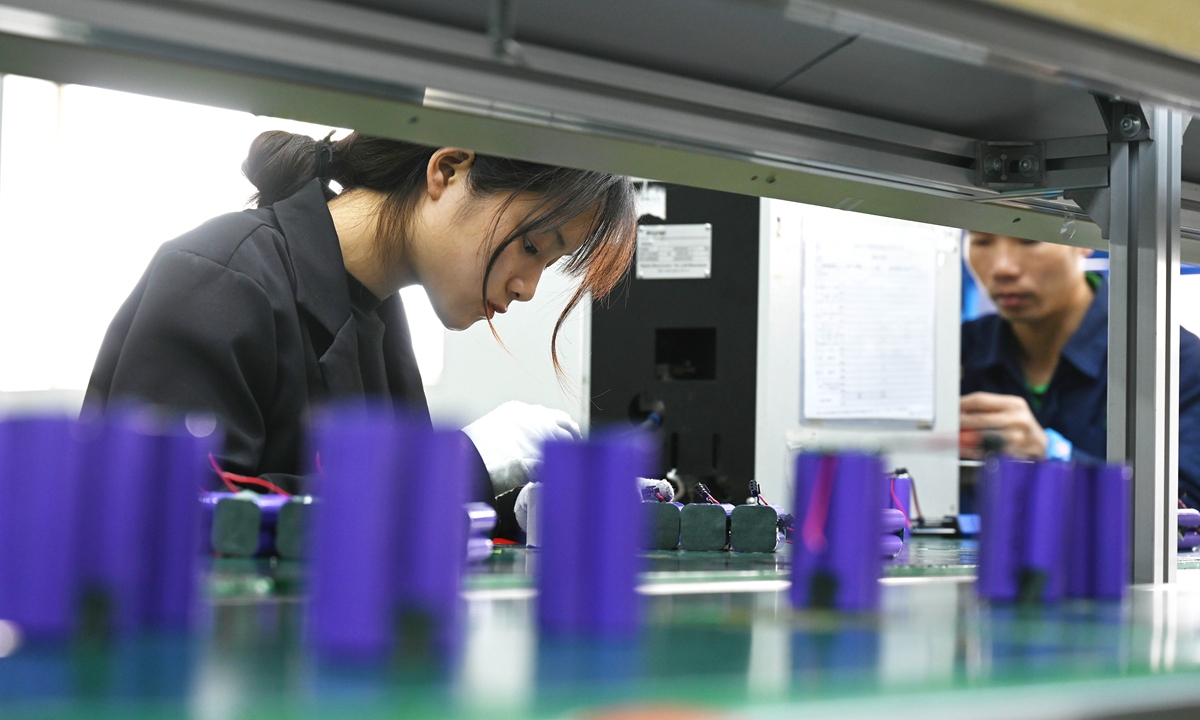

Workers are busy at Zhuoneng New Energy Co in Qinzhou, South China's Guangxi Zhuang Autonomous Region. The company is Guangxi's largest national high-tech enterprise specializing in research and development, production and sales of lithium batteries and new-energy power systems. Photo: cnsphoto

Affected by staggering coronavirus case spikes in Malaysia and the ensuing lockdowns, major world aluminum electrolytic capacitor makers have seen their production disrupted, which could further affect the supply chain of many crucial components.

Analysts said that this may accelerate the shift of the industry chain to the Chinese mainland, which will bring it closer to its sources of raw materials - and the huge market. The shift could also help the Chinese domestic sector, which is seeking to upgrade their production amid surging demand.

Following the Malaysian government's extended lockdown orders, production at Japan-based Nippon Chemi-con Corp and Nichicon Corp - the world's two largest electrolytic capacitor makers - has been suspended since July 3. Nippon Chemi-con has notified its agencies to halt production till Tuesday, according to media reports.

This situation will further disrupt the already tight supplies of aluminum electrolytic capacitors globally, with international manufacturers mulling a second round of price rises, according to market intelligence provider TrendForce.

Aluminum electrolytic capacitors are basic electronic components that charge and discharge in electronic circuits, and they are widely used in a range of products from home appliances to industrial equipment.

The new-energy sector, which includes such products as electric automobiles and solar power, as well as emerging sectors brought about by 5G such as the Internet of Things, further broadens their application scope.

Liang Zhenpeng, a senior industry analyst, told the Global Times on Sunday that China's ample aluminum stockpiles and growing demand for higher-end aluminum electrolytic capacitors may drive the pivot of the industry chain to China from the Southeast Asian country.

Sun Zhenxiang, head of Shenzhen Yudamei Electronic, a company that mostly provides chip products, told the Global Times on Sunday that domestic terminal manufacturers are speeding up localization of aluminum electrolytic capacitors since the US' crackdown on Huawei to avoid potential supply chain challenges.

However, domestically made aluminum electrolytic capacitors are at the low- to medium-end, and the major importer of the component risks losing the higher-end market to foreign enterprises, he said.

Fortunately, domestic leading aluminum electrolytic capacitor manufacturers like Nantong Jianghai Capacitor Co and Aihua Group are competing to develop medium- to high-end products, as local replacement demand intensifies.

For example, Nantong Jianghai completed the purchase of the capacitor business from Japan-based Hitachi Chemical Co in June, through which the company will own research and development and manufacturing capacity overseas for the first time.

"China's aluminum electrolytic capacitor makers have a long way to go in exploring new materials and new technologies," Liang said, noting that local companies need to identify their shortcomings by comparing themselves with global leading enterprises, so as to catch up and have some influence in the high-end sector.