Rail freight on track for record breaking year

Trade between China, Europe strong in face of ocean transport crunch

A China-Europe freight train leaves Southwest China's Chengdu International Railway Port in early July carrying a full load. Photos: cnsphoto

With ocean freight disrupted by a global container shortage, higher freight rate while air transport is too expensive, the cross-border cargo train service has held up 'half the sky' with its stable rate and delivery time, becoming a lifeline for transportation of much-needed goods ranging from personal protective equipment to electronics between China and Europe.

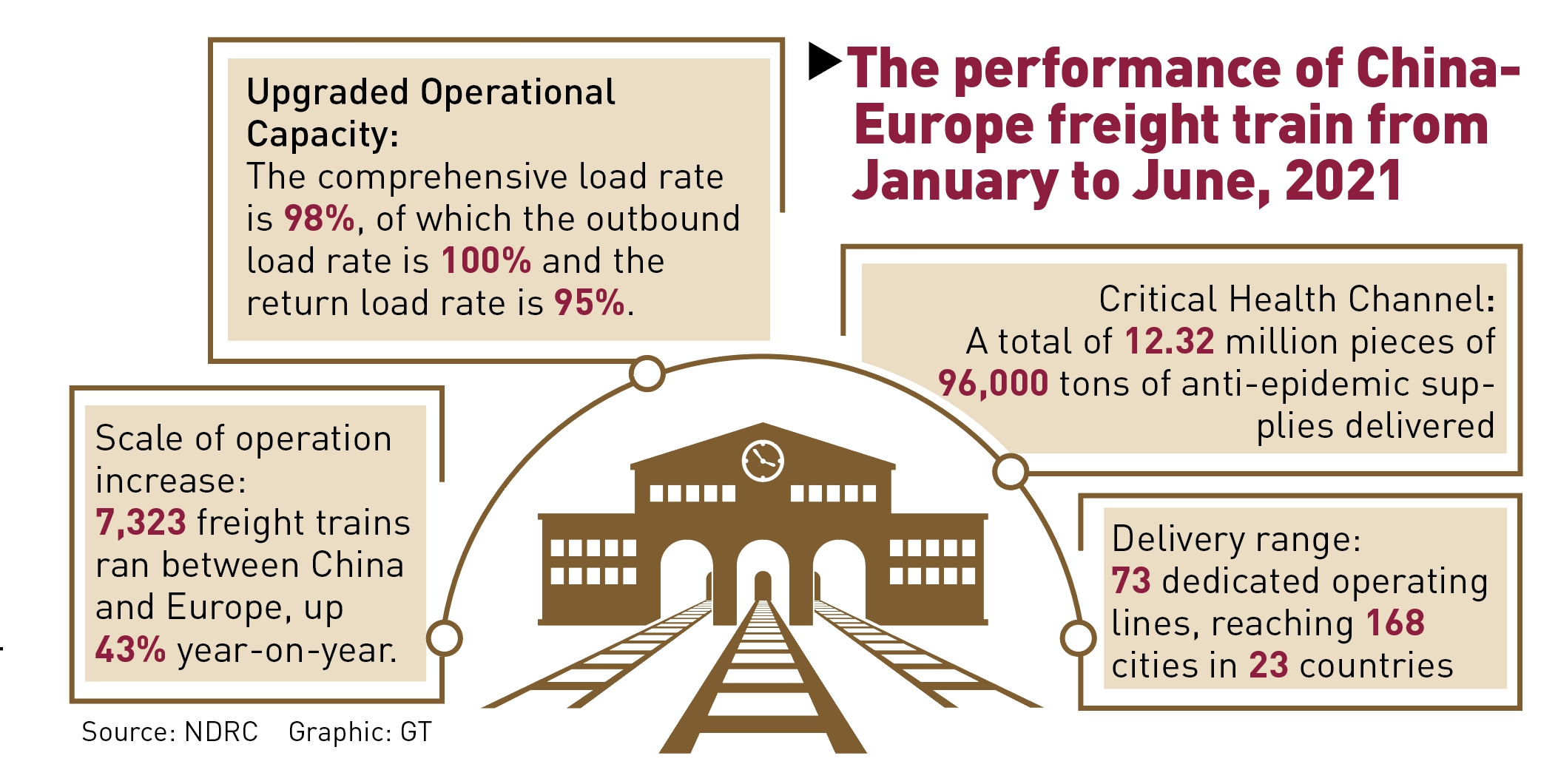

The cross-border train service outperformed expectations with record-breaking performances. From January to June, 7,323 freight trains ran between China and Europe, up 43 percent year-on-year. The number of single-month freight train runs exceeded 1,300 in both May and June - setting a streak of more than 1,000 freight train runs for the past 14 consecutive months, China's National Reform and Development Commission said on Monday.

The rail delivery range also continues to expand, and the effect of hub agglomeration begins to show. A total of 73 freight transport lines for China-Europe freight train service have been laid, reaching a total of 168 cities in 23 countries. The service has maintained safe and stable operations, especially after the Suez Canal jam which posed the unprecedented challenges to the global supply chain.

Tommy Tan, president of Shanghai EPU Supply Chain Management Co, who has been engaged in supply chain transportation for BMW since 2018, is a "loyal user" of rail freight.

Having been engaged in international trade businesses for many years, Tan remembered clearly when other transport methods were rendered ineffective by the outbreak, with rail freight becoming a core means of moving inventory.

"Due to the high stability of the train, even when the pandemic was at its peak, the supply of BMW spare parts from the Nuremberg factory to the vehicle assembly plant in Chengdu, Sichuan Province in Southwest China, remained undisrupted," Tan said.

The goods were delivered steadily every week, wining the broad recognition of customers.

"If it is transported by sea to a Chinese port city and then sent to Chengdu, the additional transportation cost will be excessive," said Tan, noting that without the China-Europe freight train service, difficulties in ensuring the stability of the supply chain would be unimaginable.

The freight train service is mostly punctual even in the hardest time of the virus outbreak. A freight agent in Yiwu, a small commodities' hub in East China's Zhejiang Province, surnamed Bao, an international trader for years, understands the importance of delivering on time.

As a trader delivering much-needed goods including face masks and other PPEs from China to Europe, Bao said that rail freight has become his first choice to move freight.

From Yiwu to Hamburg, Germany, the China-Europe freight train takes just 18 days, but it takes 35 days or more by sea, whilst the freight rates for both delivery methods are almost the same, Bao said.

"We will definitely give priority to the China-Europe freight train service, especially for the goods with high added-value and tight delivery time," said Bao.

The numbers are particularly highlighted for the world's supermarket Yiwu, which produced up to 80 percent of the world's Christmas merchandise and many other important items needed by the Western markets.

Correspondingly, Yixinou, which runs the longest line of the China-Europe international freight trains, with an important focus of the Belt and Road, has seen a significant growth in customer demand.

As of July 4, Zhejiang Province has run 1,100 freight trains and shipped 90,200 twenty-foot equivalent unit, a year-on-year increase of 2.7 times, accounting for more than 10 percent of the national share, accounting for more than 60 percent of the whole Yangtze River Delta region, latest data from Yixinou shows.

As the trade network along the Belt and Road between European cities and Chinese manufacturing hubs continues to expand, the return freight train from Europe has changed from a single import and export trade only between producing country and consuming country to an intermediary trade with many more countries involved.

A commerce official from Zhejiang Province surnamed Zhang told the Global Times on Monday that they have strengthened the guidance and assessment of return freight trains in terms of policy orientation.

"At the operational level, the service's overseas layout is constantly being improved in an orderly way, which promotes the operation of return freight trains," said Zhang.

In 2020, only 46 percent of containers were loaded on return trips from Europe to China due to the unbalance of trade after production halt in many parts of Europe, adding up the cost of each route and reduces the cost advantage of rail transport.

Nowadays, the outbound train load is as high as 100 percent of the capacity, while the return load has also reached 95 percent of capacity, especially after the Suez Canal jam and a serious shortage of containers led to an across-the-board sea freight rate hike.

Graphic: GT