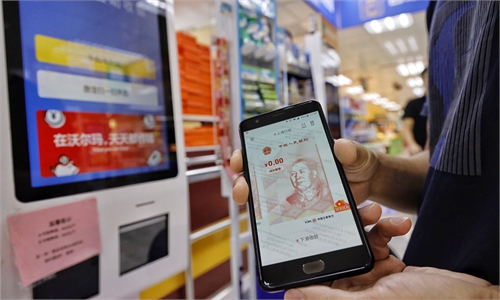

A staffer displays the digital yuan application scenarios to visitors in the World Intelligence Congress in Tianjin in May. Photo: cnsphoto

The nation's first digital yuan insurance policies have been issued in Shenzhen, South China's Guangdong Province, in what analysts describe as another major step forward in the broader deployment of the China's digital currency.

The Shenzhen subsidiary of Pingan Property Insurance, working with the Bank of China branch in Shenzhen, issued the first batch of digital yuan insurance policies, the Shenzhen Special Zone Daily reported on Tuesday.

The move aims to conduct a simulation exercise for the use of the digital yuan in more application scenarios and information systems, Wang Peng, an assistant professor at the Gaoling School of Artificial Intelligence at the Renmin University of China, told the Global Times on Tuesday.

It also aims to cultivate user habits for a broader range of application scenarios, as the previous trials mostly targeted e-commerce and online payments, according to Wang.

"As more users get used to making payments with the digital yuan and the market matures, the application scenarios will be able to expand from the insurance industry to more scenarios such as financial services, life services, and even the purchase of funds and trading in securities," Wang said.

The emergence of such insurance policies represents the insurance sector's pilot application of the digital yuan to online premium payments, which takes the digital yuan into people's daily lives, according to Shenzhen Special Zone Daily.

The new insurance policy targets medical workers in Shenzhen's Nanshan district, and it provides 300,000 yuan ($46,221) in coverage for death from COVID-19. It pays 50,000 yuan if a medical worker is diagnosed with COVID-19, and 50,000 yuan for an accidental death, per media reports.

Applicants are eligible for exclusive preferential allowance if they use the digital yuan wallet to make payments, reports said.

Pingan Property Insurance will further explore the application of the digital yuan in insurance claims, payments, and other aspects, and continue to expand the use of the digital yuan in the insurance industry to more scenarios, the Shenzhen Special Zone Daily reported, citing an official at Pingan's Shenzhen subsidiary.

In mid-October 2020, when China commenced public testing of the digital yuan in Shenzhen, the local government and China's central bank jointly gave away 50,000 digital red packets with each containing 200 yuan. It was the first time that the digital currency was tested in a public setting.

Since then, China has been continuously promoting the application of the digital yuan, with bidding projects for the field increasing significantly that targeted several cities in China, according to media reports on Tuesday.

China Mobile on Friday revealed a patent for technology designed to improve the security of users' digital currency assets.