COMMENTS / EXPERT ASSESSMENT

Delta variant poses new threat to US’ frail economic recovery

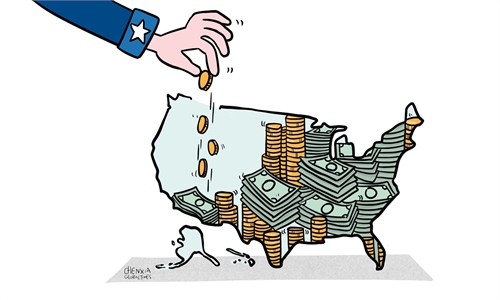

Illustration: Tang Tengfei/GT

As the fast-multiplying Delta variant of coronavirus stokes fresh concerns, the US economic recovery fueled by easy money and vaccines is facing new risks into the second half of the year.

Amid a COVID-19 Delta wave across the world, the US is seeing a surge in new cases of infection, hospitalizations and deaths in areas with low vaccination rates. The average number of new COVID-19 cases per day has tripled in the past 30 days in the country, according to an analysis of Reuters data. And the numbers are still growing.

Despite a 6.4-percent growth of the US economy in the first quarter, a band of savvy Wall Street investors have been acting as though the recovery remains far from secure. On Monday, fears of renewed COVID-19 shutdowns and a protracted economic recovery sparked a broad sell-off on Wall Street. The Dow Jones Industrial Average dropped 725.81 points, or 2.1 percent, its worst day since last October.

Indeed, the US economy rebound still faces risks on multiple fronts, and a new wave of infection could easily dampen the fragile rebound.

Firstly, chief among these risks is the Delta variant. Given the slow progress in promoting vaccination, it is virtually impossible for the country to realize herd immunity in the near term. The country fell short of the White House's goal to give at least a first dose to 70 percent of adults by July 4th; many parts remain far behind the goal. If the country fails to put the fast-spreading Delta wave under control, economic activities will be seriously impacted.

Second, the risks linked with Biden administration's rescue package supported by debt rally have already begun to emerge. Since taking office in January, the US President Joe Biden has rolled out $1.9 trillion worth of stimulus, and plans for additional spending to invest in infrastructure, job creation to boost the virus-hit economy are in the pipeline. As the economy rebounds from the contraction in last year, the prices have also been pushed high, dragging consumers' confidence to a five-month low in early July. Biden on Monday admitted that his administration understood that unchecked inflation over the longer term would pose a "real challenge" to the economy.

Third, the marginal effect of the earlier economic rebound has appeared, and the growth rate may have peaked. Economists estimated that the growth speed of the US economy is likely going to hit a high point in the second quarter and will slow as the boost from fiscal stimulus and reopening fade, according to a Wall Street Journal survey. During the economic recovery in the first half of the year, US' job gains have exceeded expectation, but such trend is not likely to continue as most people who were unemployed due to the pandemic last year have found jobs.

Fourth, the US stock market has seen a sustained rise, any bad news could stir up panic in the market. If the US stock market falls by more than 15 percent in coming months, it means that the US economy faced significant risk. The fall in the US stock market on Monday proved that the market is very vulnerable to news of the new wave of the pandemic.

In a recent speech about the US economy, Biden said the recovery hinges on getting the pandemic under control. If the pandemic continues to spiral out of control, US economic confidence will be hit hard, and it will have an impact on the already slowed recovery.

The author is a research fellow at Center for International Security and Strategy, Tsinghua University. bizopinion@globaltimes.com.cn