Aviation industry facing headwinds

Coronavirus pandemic extends airline uncertainty

Travelers wait in queue to get on board a China Southern Airlines flight. Photo: VCG

Global aviation market has displayed more signs of a roaring recovery, supported by government policy support and airlines' booming confidence.

On Wednesday, Airbus delivered the first A350 from its wide-body completion and delivery center located in North China's Tianjin city.

Bloomberg reported on Tuesday that Qatar Airways Chief Executive Officer Akbar Al Baker said he is ready to order wide-body freighter planes from Airbus or Boeing within a month or two if a new model is available soon.

Earlier, United Airlines announced a deal for its largest airplane order amid a continuing rebound in global air travel: 270 new aircraft, including 200 Boeing 737 Max jets and 70 A321neos built by Airbus, The Washington Post reported.

Such purchases could hardly be seen for the aviation industry while the pandemic is ravaging the world, and the situation this year has just begun to improve.

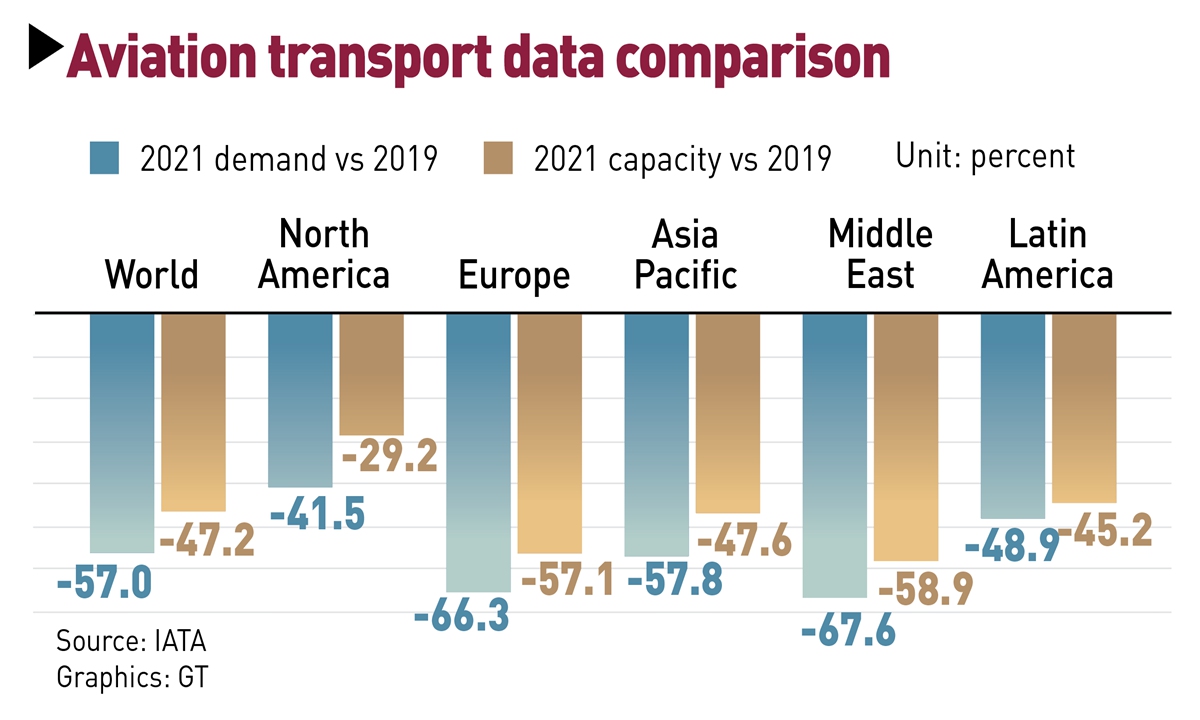

The International Air Transport Association (IATA) said that last year was severely battered by the coronavirus, and the global aviation industry's RPK in 2020 shrank by 66 percent year-on-year. Although the total market value of large global airlines has generally recovered, the gross economic loss suffered by the airlines this year may still mount to as high as $48 billion in 2021, following a huge loss of $126.4 billion in 2020.

Graphics: GT

Although it has been predicted that the global aviation industry is expected to see a full recovery by around 2024-2025, fleet expansion and rising confidence is being seen across the industry, which could be the ray of hope for the civil aviation industry, especially for China and the US.

When it comes to gauging market scale, China and the US can be described as super large civil aviation markets, based on the high numbers of aviation trips and the non-restricted domestic air travel, and the two countries' aviation industries are believed to survive the pandemic better and could be the first batch to return to profitability.

Economists said in an article on July 10 that in America, internal flights make up 60 percent of air travel, compared with 10 percent in Europe, the Middle East and Africa, citing data from Oliver Wyman, a consultancy.

American air carriers, for example, earn 70 percent of revenue from domestic passengers, whereas full-service carriers elsewhere might rely on the big seats at the front of intercontinental flights for half their revenues. This ratio is similar to the situation in China.

After two decades of continuous corporate bankruptcy and reorganization, the US aviation industry is now dominated by four industry giants: American Airlines, United Airlines, Delta Air Lines and Southwest, which carry about 80 percent of domestic passengers.

Scott Kirby, boss of United Airlines Holdings, has warned that the American carrier needs about 65 percent of pre-pandemic demand for business and international long-haul trips to break even.

Stable aviation comeback

China's aviation industry is seeing a stable recovery, and transport on domestic routes has returned to its pre-virus level, the Civil Aviation Administration of China said, and CAAC said the operation of the civil aviation industry in the first half of the year improved steadily, and the overall recovery was in line with market expectations.

The world's civilian aviation shifted from the US in the 1960s to other markets, including the Middle East and gradually moving to China, Willie Walsh, IATA's director general, said earlier.

Official data showed that in the first half of the year, the total transportation turnover of state-owned aviation companies was 29.31 billion ton-kilometers, a year-on-year increase of 38.8 percent and the total monthly transportation turnover has maintained positive growth for five consecutive months.

However, despite the pandemic, there has been no so-called mass bankruptcy event, and one of the big reasons is the government support, for many countries and local governments will support key airlines by meting out policy support and financial aid.

In addition, according to the calculations of the IATA, since the outbreak of the pandemic, global government support for the aviation industry has reached a huge amount of $225 billion. This explains why the pandemic has hit the industry hard, but the number of bankrupt airlines is very limited.

The government support can help reduce labor cost, too. But some low-cost airlines were having some trouble to stay above water amid the pandemic in the past two years, such as JetBlue intends to use a low-cost way to open international routes to replace the expensive wide-body aircraft, and Avelo relying on transporting passengers between destinations with insufficient air service coverage.