COMMENTS / EXPERT ASSESSMENT

Why have Nokia and Ericsson seen ‘different trends’ of development in China?

Ericsson. Photo: VCG

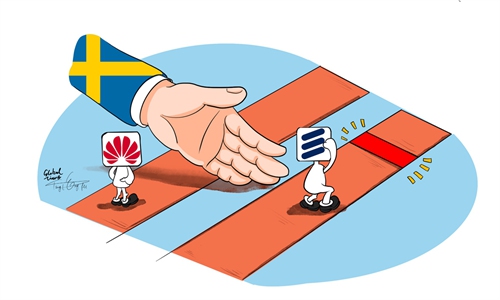

A recent released 5G contracts set of Chinese network operator China Mobile sparked wide discussion as some observers identified "different trends" of the development of Nokia and Ericsson in the colossal Chinese 5G market, stating that while Finland-based Nokia has won its first 5G contract in China, Sweden-based Ericsson was going backwards.

Among China Mobile's three new 5G contracts, Nokia, which didn't secure any 5G radio contract in China last year, held a 10 percent share in one contract this time, equaling about 4 percent of the total $6 billion tender. Meanwhile, Ericsson won about 2 percent of the overall tender value, compared to its 11 percent share last year, according to the Reuters.

As a leading 5G market, China has been offering an open market to global players. And so far, the Chinese 5G market may be the most competitive one in the world, with domestic players the frontrunners in the race. Nokia's increasing share and Ericsson's declining share have been driven by market forces, but the result also reflects the trend of popular sentiment toward the two brands.

It is reportedly the first 5G contract in China for Nokia. The "different trends" of Nokia and Ericsson came under the spotlight as Ericsson's home country Sweden since last year irrationally started to crack down on Chinese 5G developers and banned them from participating the country's 5G rollout under a groundless "security risk" accusation.

The so-called security risk has long been used as a guise of the US attempting to contain China's technological advancement. Without any evidence, Washington has been cajoling or threatening others to join the confrontation and defending the US' hegemony.

5G is one of the hottest battlefields given Chinese firms have managed to lead the development in almost every aspect of the new generation of network, from domestic suppliers, base station layout, to application rollout.

With the US leading the anti-China campaign, some countries chose to take sides even at the cost of its own interests. For instance, countries which decided to exclude Chinese firms not only faces imminent huge cost of replacing previous equipments, but also lost its chance to let as many suppliers as possible to compete and offer the best choice for the country.

In June when a Swedish court decided to uphold the Swedish telecom regulator's ban on Chinese 5G developers, an Ericsson spokesman, cited by Reuters, said the ban "may adversely impact the economic interests of Sweden and Swedish industry, including those of Ericsson."

Indeed, although China has been offering an open 5G market to the world, it doesn't mean that economic and trade exchange wouldn't be impacted by political tensions. From the public to domestic authorities, they won't allow others, using absurd excuses, to vilify or bully Chinese firms.

Taking the political tension provoked by Sweden toward China for instance, if any negative impact emerges, business partners related to Chinese market may choose to avoid risky cooperation with Swedish firms, and Chinese customers will lose preference for Swedish products and services. There's no need to explain the differences between the importance of the 1.4-billion-people Chinese market to Ericsson and the importance of the 10-million-people Swedish market to Huawei and ZTE.

Ericsson reported a plunge in sales during the second quarter in Chinese mainland market by as much as 60 percent year-on-year, and again warned that Swedish authority's ban hurts competition. True, Chinese 5G developers deserve fair treatment in overseas market. Offering a fair and open environment for global players benefits others' and one's own long-term interests.

As a major driver for recovery of the global economy during post-COVID era, Chinese market is offering crucial opportunities for foreign firms to survive and grow, but with a premise of mutual respect over each other's core interest. Both foreign firms and authorities need to be aware of that; otherwise, they may need to try to find other markets.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn