China’s industrial profit growth maintains pace in H1, imbalances persist as SMEs recover slowly: NBS

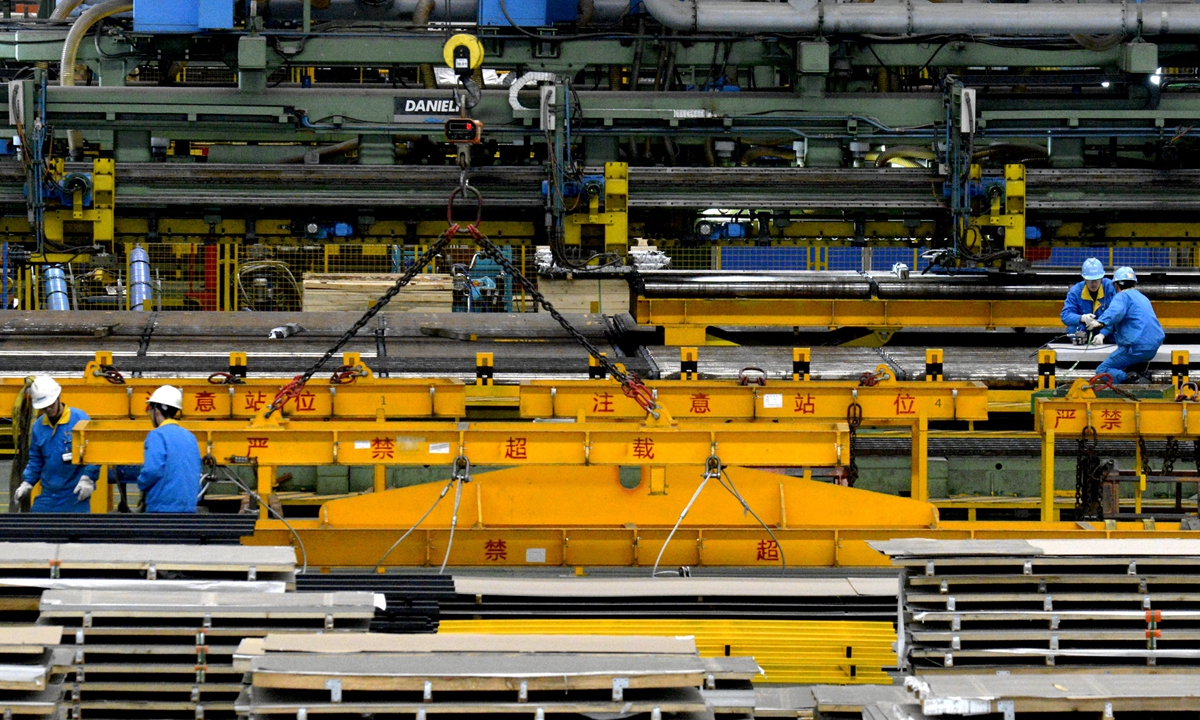

A steel manufacturing firm in Taizhou, East China's Jiangsu Province, is busy making supporting equipment for overseas mining on Thursday. Domestic and international demand continues to pick up, and opportunities brought by carbon neutrality and new infrastructure have led to a rapid rise in industrial investment. Photo: cnsphoto

Major Chinese industrial firms posted a whopping 66.9 percent gain in first-half earnings, official data showed on Tuesday, fending off woes over surges in raw material costs as the economy that has led the world in emerging from the COVID-19 pandemic proved its resilience, with factories humming and orders piling up.

China's industrial production recovered steadily in the first half of the year, with corporate operations recording continuous improvement and growing profits, data from the National Bureau of Statistics (NBS) showed on Tuesday.

Industrial enterprises above designated size recorded a combined total profit of 4.22 trillion yuan ($650 billion), up 66.9 percent year-on-year and an average annual growth of 20.6 percent over the past two years, according to the NBS.

Over 70 percent of major industries reported profit levels higher than the pre-COVID-19 period. Mining and raw material manufacturing industries reported remarkable profit growth, surging 133 percent and 183 percent year-on-year, respectively, the NBS data showed.

The profit of advanced manufacturing companies rose 62 percent, while for consumer goods manufacturers the growth rate was 38.6 percent.

Other than businesses engaged in raw materials manufacturing and processing, which benefited substantially from rising bulk prices, high-tech firms and equipment manufacturers booked a rapid rise in earnings, and new-energy vehicles were seen piquing the interest of many more consumers amid the virus, observers said.

Improved demand in the manufacturing sector that has resulted in a flood of orders also bodes well -- particularly for China -- as the country, having quickly resumed work and production not long after the virus hit, came across as the only viable economy with its supply chains in full swing while the rest of the world was still struggling to battle the disease. Hence, a multitude of Chinese exporters found themselves inundated with orders from across the world.

"In general, the total profit of industrial enterprises recovered steadily in the first half and their operations continue to improve. However, imbalances across manufacturing firms' profits remain, with private and smaller companies posting a comparatively slower recovery," Zhu Hong, a senior statistician at the NBS, said on Tuesday.

Surging bulk commodity prices put rising cost pressure on downstream firms, and there were weaknesses in the industry and supply chains, Zhu said.

In June alone, industrial enterprises above designated size achieved total profit of 791.8 billion yuan, up 20 percent year-on-year -- but the rate was slower by 16.4 percentage points, compared with the previous month.

A weaker-than-expected domestic consumption recovery also contributed to slower growth in industrial profit, Tian Yun, former vice director of the Beijing Economic Operation Association, told the Global Times on Tuesday. He said that the two-year average growth of the country's consumption was below 5 percent in the first half, failing to meet expectations of 6-percent growth.

Total profit of China's industrial enterprises will maintain double-digit growth, given the nation's relatively relaxed monetary and fiscal policies and buoyant export markets, according to Tian.

China's central bank announced a reserve requirement ratio cut of 50 basis points for eligible financial institutions from mid-July to support the real economy, through which 1 trillion yuan in long-term funds will be released.