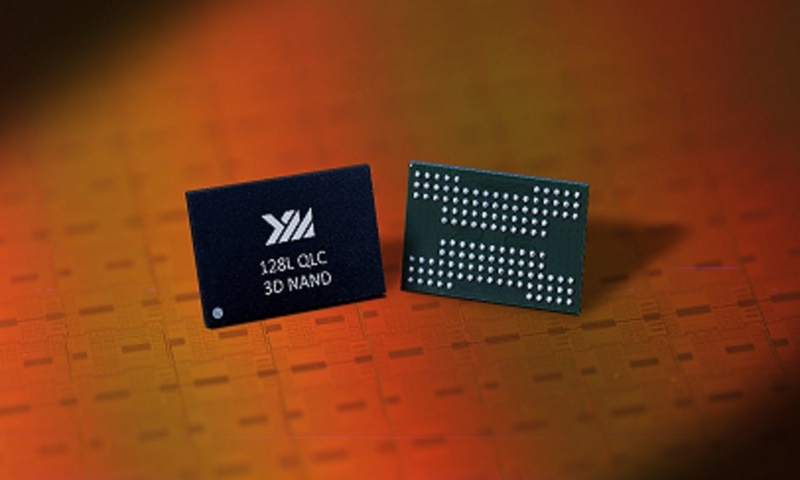

Photo: ymtc.com

Wuhan-based Yangtze Memory Technologies Co (YMTC) has put into mass production a 128-layer memory chip, a feat of domestic chipmaking in terms of stacking density, addressing China's missing link in high-end solid state drives (SSDs), according to media reports.

Powev Electronic Technology Co, a Shenzhen-based storage and memory manufacturer, recently took the wraps off its newest upscale SSD under its subsidiary brand, Asgard, based on YMTC's 128-layer 3D three-level cell (TLC) NAND flash memory. According to industry insiders, the announcement suggests YMTC's 128-layer technology has officially been massed produced, Chinese news site guancha.cn reported on Thursday.

The Wuhan-based 3D NAND flash memory maker was only established in July 2016. In April 2020 it announced that its 128-layer technology had passed sample verification on the SSD platform, less than a year after its 64-layer TLC 3D NAND flash memory was produced in volume.

Higher density will allow greater storage capacity. With the 129-layer lineup, YMTC is closing the gap with South Korean memory giants SK Hynix and Samsung, among other established chipmakers.

SK Hynix announced in June 2019 that it began mass-producing the world's first 128-layer 4D NAND.

In a radical breakthrough, Micron, a smaller rival to the two South Korean conglomerates, revealed in November 2020 that it has commenced volume shipments of the world's first-ever 176-layer 3D NAND flash memory, boasting industry-pioneering density.

However, YMTC's notable progress over the past five years remained insufficient to give it a boost in the global memory rankings, industry data showed.

In the first quarter of the year, Samsung took the top spot in revenue in the NAND flash market across the world with a 33.5 percent share of the global market, according to market intelligence provider TrendForce.

Japanese memory manufacturer Kioxia ranked No.2 with 18.7 percent of the market, followed by US-based Western Digital with 14.7 percent, SK Hynix with 12.3 percent, Micron with 11.1 percent, and Intel with 7.5 percent, according to TrendForce data.

This means the six major memory firms held nearly 98 percent of the entire global market of NAND flash memories.

Global Times