Stocks connected to rapper Kris Wu drop after his detention in Beijing for suspected rape

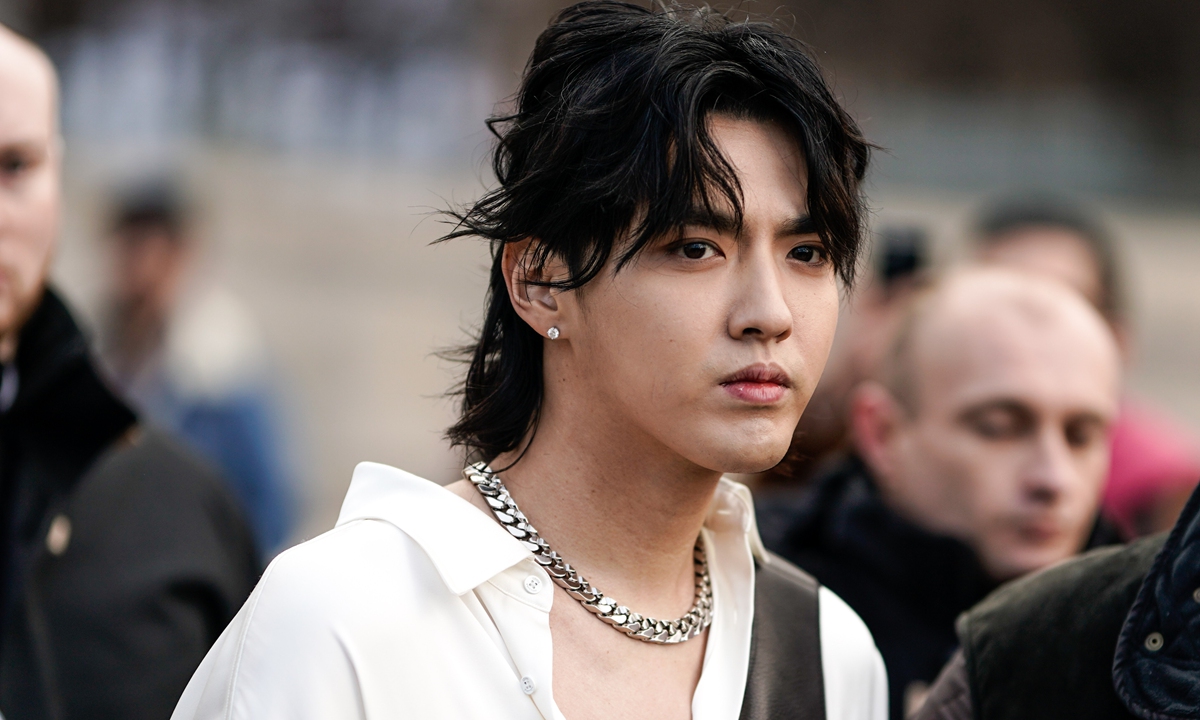

Kris Wu Photo: VCG

Stocks connected to Kris Wu dropped on Monday after the Chinese-Canadian pop idol was detained by Beijing police on Saturday evening following allegations of rape.

The stock prices of three major producers of Wu's first TV drama (The Golden Hairpin) - HKEX-listed Tencent Holdings, China Literature and Shanghai-listed Phoenix Publishing & Media Group - were down 0.84 percent, 1.11 percent, and 1.56 percent respectively when the market closed on Monday.

The declines clearly showed investors' distrust and pessimism toward the companies involved, as share prices are the most sensitive market indicators, Dong Dengxin, director of the Finance and Securities Institute of Wuhan University, told the Global Times on Monday.

The drama was produced by Tencent Video, New Classic Media, and Fonghong film, which correspond to the three listed companies, according to media reports.

However, Phoenix Publishing & Media Group said that Fonghong film does not have any direct relationship with the company. The comment was made in response to investors' questions on July 20, financial media Jwview.com reported on Sunday.

The impact on companies, especially those in the cultural sector, might last for a while amid great uncertainty. It will require time and money for the companies to cultivate alternatives to Wu, said Dong.

Shares of Cultural Investment Holdings, the parent company of Sparkle Roll Media - which is Wu's management company in the Chinese mainland - dropped 1.96 percent on Monday.

The official Sina Weibo account of the big-budget costume drama, which stars Wu, had deleted all posts featuring the actor as of Sunday, leaving only a poster featuring the show's supporting characters.

The direct impact on brands cooperating with Wu will likely not be overwhelming, as many brands have already terminated their contracts with Wu, according to Jwview.com, citing analysts.

Global Times