Alibaba Photo:VCG

Alibaba reported stronger-than-expected earnings for the April-June quarter, its latest financial disclosure showed on Tuesday, an indication of the Chinese e-commerce giant's endeavor to align its businesses with a national antitrust push that intends to put the importance of profits and social wellbeing on an equal footing.

For the quarter ended June 30, Alibaba reported 43.44 billion yuan ($6.72 billion) in net profit calculated under non-generally accepted accounting principles (non-GAAP), an increase of 10 percent from the previous year, the company announced.

During the June quarter, global annual active consumers across the Alibaba ecosystem reached 1.18 billion, up 45 million from the March quarter, including 912 million consumers in China, Alibaba Chairman and CEO Daniel Zhang revealed in a statement on Tuesday.

The e-commerce giant recorded 205.74 billion yuan in business revenue, a jump of 34 percent year-on-year.

The results were broadly in line with previous market estimates. China International Capital Corp (CICC), one of the country's largest investment banks, put Alibaba's revenues at 207.1 billion yuan during the past quarter, an increase of 35 percent year-on-year.

The company's non-GAAP net profits for the June quarter were expected to remain flat at 39 billion yuan, per the CICC forecast in July.

With the country pushing ahead with a broad-based fight against monopolies and unfair competition, among other practices exemplifying the unchecked expansion of capital, giant internet platforms such as Alibaba would inevitably face slower revenue growth. But such travails will set the stage for more reasonable earnings growth over the longer term, Fang Xingdong, founder of Beijing-based technology think tank ChinaLabs, told the Global Times on Tuesday.

Overall sluggishness also dented e-commerce growth.

Staff at an industry zone in Lianyungang, East China's Jiangsu Province sort packages on Friday, the day China's major e-commerce platforms including JD and Alibaba's Tmall celebrate this year 618 mid-year shopping festival. Photo: VCG

China's retail sales grew 12.1 percent in June from the year before, official data showed, pointing to a continued downward spiral in retail sales growth since March. The May reading was 12.4 percent, easing from a 17.7 percent rise in April.The latest quarterly disclosure indicated an improvement from the previous quarter when the e-commerce leviathan was slapped with a record $2.8 billion anti-monopoly fine for its abuse of market dominance.

Alibaba posted a net loss of 7.65 billion yuan in the January-to-March quarter, its first quarterly net loss since its IPO, primarily owing to the hefty antitrust penalty by the government.

"As we said in last quarter's results announcement, we are investing our excess profits and additional capital to support our merchants and invest in strategic areas to better serve customers and penetrate into new addressable markets," read the Tuesday statement, citing Alibaba Chief Financial Officer Maggie Wu.

The e-commerce behemoth also said on Tuesday it would upsize its share repurchase program from to $15 billion from $10 billion, the largest-ever share repurchase for Alibaba, a move seen as a sign of the company's confidence in its long-term growth prospects.

Looking ahead, as Fang suggested, the company that has built a broad-ranging juggernaut based on its e-commerce prowess ought to devote more resources to innovations.

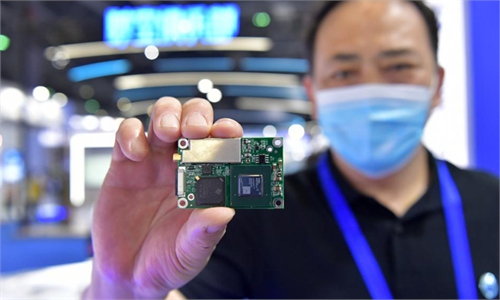

In a sign of such efforts, Alibaba's semiconductor unit disclosed in June that its self-developed Xuantie embedded central processing unit has achieved technological breakthroughs and delivered a world-class performance.