Shipping disruptions, material price spike squeeze profits of China’s textile makers

A worker at a spinning workshop of a textile company in North China's Shanxi Province on July 23. Producing hemp textiles, the company exports its products to the US, Japan and South Korea. Photo: cnspho

After reaping the benefits from the large amount of personal protective equipment (PPE) exports in 2020, textile mills in China now face an export dip as disruptions in global shipping industry are causing prices to spike, squeezing the profits of the low-margin clothing and textile sector.

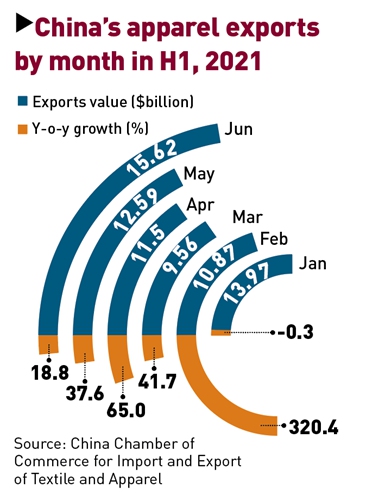

In July, China's textile products exports dropped 26.78 percent to $11.7 billion, official customs data revealed. From January to July, China's textile industry exported $80.25 billion worth of textile products, down 10.8 percent compared with the corresponding period of 2020 when medical supplies were in short supply due to the raging coronavirus then.

Overseas orders placed in July were down from March and April levels, Shaoxing-based Yao Xiang Textile Factory told the Global Times on Monday. The firm mainly sells textile products to Japan and the US.

The factory was the beneficiary of unique market dynamics. The more infectious Delta variant has wreaked havoc across countries in South and Southeast Asia earlier this year, forcing some textile orders to shift to China which had all but contained the virus, resilient supply chains and stable manufacturing capacity.

However, the skyrocketing shipping prices and rising raw material costs squeezed profits amongst Chinese textile firms. Some are even unwilling to receive new orders and ship goods.

Profits bite

As a world-class textile industry hub, Keqiao district in Shaoxing city, East China's Zhejiang Province, functions as a window to global industry dynamics.

Often referred to as China's Textile City, Keqiao has the largest professional textile market in Asia, where around 25 percent of the world's global shell fabric is traded annually.

Tan Ke, head of Keqiao District Commerce Bureau, told the Global Times on Monday that containers held up at ports overseas had led to the latest decline in textile exports. In tandem with a flare-up of the coronavirus within China, the partial shutdown of the world's third-busiest container port - Ningbo-Zhoushan port - further hit already fragile supply chains.

An employee at an export-oriented clothing company in South China's Guangdong Province told the Global Times that the shipping prices for large containers jumped four to eight times from last year, leaving vendors to consider air freight as an alternative.

"What concerns the industry is the unprecedented disruption to the global shipping sector. It only takes one second to shift the clothing orders from India to China, but it requires months to ship a container to a port in China," Chen Jing, vice president of the Technology and Strategy Research Institute, told the Global Times on Monday. "I have never seen such a phenomenon in the shipping industry."

For the low-margin textile industry, when transport spending accounts for one-fourth of the total costs, the economics stop making sense for many textile firms, said Chen.

Surging raw material costs worsened the situation. "The increasing prices of shell fabric failed to catch up with the growing pace of the prices of raw materials. For textile plants, if they don't spin the machines, they would break the contracts; but if they do, they accept a bad deal," Tan said.

However, the exports drop didn't mean textile mills in China have been idle. When the garment manufacturing factories in emerging economies in Southeast Asia and South Asia ground to a halt due to the Delta variant, orders again shifted to China, expanding the businesses of Chinese mills from producing upstream textile materials to garment processing, according to Tan.

With the coronavirus halting personnel exchanges and leading to cancelled industry expos, small companies found it hard to get to know new customers while big companies were increasing their businesses with old clients, the official explained that this secured the district's position in global textile industry.

As of Monday, pilot checkpoints in Keqiao reported 11,044 pieces of custom clearances, sending the district's exports value to $47.16 billion in the first half of 2021.

"It proved that Keqiao's textile industry remains complete and its supply chains are indeed resilient," Tan said.

Job opportunities

Textile remains one of the pillar industries in China which has generated significant employment opportunities. China's textile products and clothing exports value accounted for more than one-third of the world's total, Chinese financial media outlet 21jingji.com said.

With multiple constraints China's economy - ranging from the sudden Delta variant outbreak and regional flooding, to a spike in bulk commodity prices and flattening overseas demand as shown in July's slower economic growth, observers in textile industry remain optimistic as a key shopping season in September and October draws closer.

"It is notable that 2020 was so distinctive when a large number of Chinese companies churned out masks and protective suits to support the global war against the coronavirus. It makes sense to see exports drop in textile," Chen said.

US, EU, Japan and ASEAN nations account for 55 percent of China's exports in textile and clothing, according to China Chamber of Commerce for Import and Export of Textiles. Keeping a steady export growth to US and ASEAN in the first half of the year, China has witnessed slower growths to markets of Europe and Japan.

Softening demand for PPE reduced the exports. In the second quarter, China's exports of medical masks and protective suits to EU fell 94 percent year-on-year, according to the chamber.

With the global demand returning to traditional needs of clothes, socks and shoes, the industry should accept these changes, Chen noted.

"The world's demand for textile products remains rigid. China has an advantage on the production side compared with South Asia and Southeast Asian countries so we should not give up this advantage. It requires time for the shipping industry to improve so the textile industry must consolidate its strengths in stable production and wait for opportunities to thrive," he said.

Global Times intern Zhang Xi contributed to the story