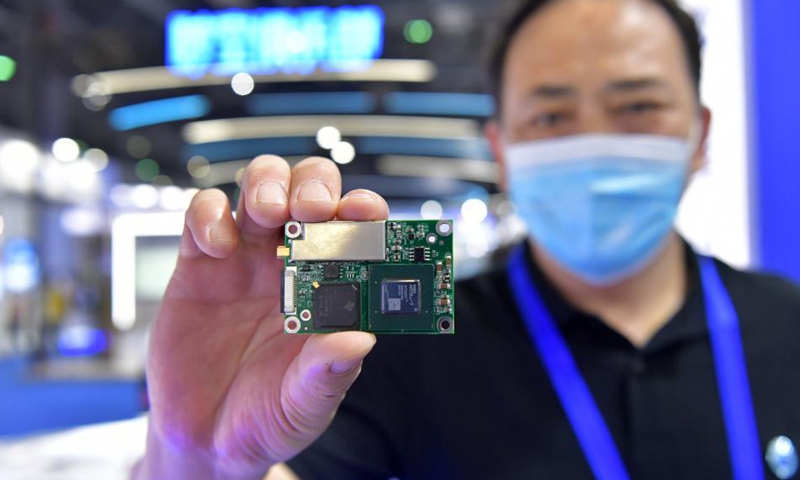

An exhibitor shows a module with an anti-jamming chip during the 12th China Satellite Navigation Expo (CSNE) in Nanchang, capital of east China's Jiangxi Province, May 27, 2021. Photo: Xinhua

Chinese semiconductor producers reported revenue growth of up to 35 times year-on-year in the first half amid robust sales to the computer and vehicle sectors, as well as more long-term demand in fast-growing industries like 5G and artificial intelligence.

Industry analysts said that huge market potential in the coming years will give domestic chipmakers an opportunity to gradually replace overseas chip foundries in supplying domestic terminal manufacturers like Huawei.

As of Monday, more than 60 semiconductor companies listed on the A-share market had disclosed their first-half results, and more than half said that net income doubled year-on-year.

Shanghai-based Bright Power Semiconductor, a leading maker of LED driver integrated circuits, reported revenue of 1.07 billion yuan ($165 million), up 177 percent year-on-year, with net income soaring by nearly 35 times to 336 million yuan.

More importantly, many companies made milestone breakthroughs in sectors including semiconductor equipment and materials, including photoresist - an important semiconductor material that is applied in wafer production.

Shanghai-based electronic materials manufacturer Red Avenue New Materials said in its interim earnings report that its new photoresist products won orders from leading chip companies like Wuhan-based Yangtze Memory Technologies Co. The photoresist business of its subsidiary surged 46.74 percent to 56.48 million yuan.

The sales boom mainly reflected disrupted chip supplies globally at a time when there is mounting demand for electronic devices and cars as people resume working in the wake of the COVID-19 outbreak, Fu Liang, a veteran industry analyst, told the Global Times on Monday.

Fu said that chip supplies are still tight, especially for high-end semiconductors, which need more time to expand production.

On Wednesday, Taiwan-based TSMC told clients that it intends to increase prices for advanced processes like 7-nanometer and 5-nm chips by around 7-9 percent, while raising them about 20 percent for its more mature processes, according to media reports. It's likely to be the steepest single price increase for TSMC.

Chip prices are likely to rise further in the third and fourth quarters, Zhao Haijun, co-chief executive of Semiconductor Manufacturing International Corp, said at a quarterly earnings meeting on August 6.

Supply shortages will continue until at least the first half of 2022, he said, pointing to the pandemic and international uncertainty.

Thanks to the transition from 4G to 5G, the popularity of fast-charging devices and electric vehicles, as well as smart home appliances, demand for semiconductors will boom in the long term, Fu said, noting that "this will be a good opportunity for local chipmakers to move from the edges of the sector to the center."