Meituan posts 3rd quarterly loss in a row amid pending regulatory actions

Firm’s core business remains robust despite regulatory actions

Meituan Photo: CFP

Chinese food delivery giant Meituan on Monday posted its third quarterly loss in a row, though the company's core business remains robust, despite pending regulatory actions, including a potential huge fine after an antitrust probe and possible new regulatory scrutiny over its acquisition of bike-sharing firm Mobike.

The company said on Monday that the anti-monopoly investigation was still underway and that it was actively cooperating with regulators, but it could not predict the outcome of the probe.

Also, in a fresh sign of regulatory toughening, China's top market regulator said on Monday that it began an investigation into Meituan's failure to declare its acquisition of Mobike in accordance with laws and regulations.

While the company's prospects might by clouded by the pending results of the probe as part of the tough regulatory rhetoric, the life services-to-food delivery platform is expected to retain its strength over the longer term, analysts said.

Meituan reported a narrower net loss of 3.36 billion yuan ($431.5 million) for the second quarter, against 2.21 billion yuan in earnings over the same period last year, according to its financial disclosure on Monday.

The company booked about 4.8 billion yuan in net losses in the first quarter after swinging to a net loss for the fourth quarter of last year.

The mainstay of Meituan's business maintained impressive growth during the three months ended in June, with the food delivery segment logging an operating profit of 2.45 billion yuan, a surge of 95.2 percent year-on-year, and the in-store, hotel and travel segment recording a 93.7 percent jump in operating profit to 3.66 billion yuan.

But the operating loss for new initiatives and other items widened during the quarter.

Its shares in the Hong Kong market closed up 1.51 percent on Monday, outperforming a 0.52 percent gain in the benchmark Hang Seng Index.

As for progress in the antimonopoly investigation that the State Administration for Market Regulation (SAMR) launched in late April, the company said in a filing with the Hong Kong stock exchange that "the investigation is ongoing and the company is actively cooperating with the SAMR."

It added that "the company is not able to predict the status or the results of the investigation at this stage, and the company could be required to make changes to its business practices and/or be subject to a significant amount of fines."

The fine announcement could be on the horizon, according to industry insiders, basing such estimates on the time frame for a record $2.8 billion antitrust fine on Alibaba on April 10, nearly four months after the investigation was launched in late December.

"As the Chinese economy has continued to recover steadily, our various business segments maintained healthy growth in the second quarter of 2021. The recent new regulatory environment change reminds us of our role in society and compels us to innovate and better contribute to society at large," Meituan founder and CEO Wang Xing was quoted as saying in a statement that the company sent to the Global Times on Monday.

In late July, guidelines were unveiled urging online food platforms to provide social insurance coverage, among other welfare-related spending, for their delivery riders.

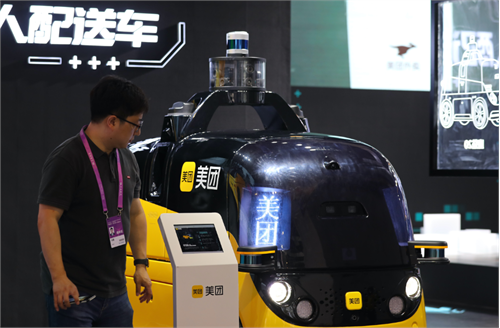

The company said on Monday that it has collected feedback through panel discussions with delivery riders to improve business operations as well as enhance the riders' welfare. Additionally, it plans to assimilate autonomous delivery vehicles and drones into its delivery network, as part of efforts to improve delivery efficiency.

The country's unswerving approach to reining in monopolistic practices and unfair competition would inevitably subject Meituan, among other platform giants, to higher costs of complying with regulations, Fang Xingdong, founder of Beijing-based technology think tank ChinaLabs, told the Global Times on Monday.

The regulatory toughening, aimed at directing the platform economy toward healthier growth, and the antitrust fine itself, won't derail Meituan from its food delivery-centric growth, Fang reckoned, noting that consumer demand for food delivery services will remain strong, underpinning Meituan's longer-term prospects.

Regulatory guidelines offer Meituan a clearer direction and policy path, which also gives recognition and support to and spurs on-demand delivery and a new business model, Wang told an earnings conference call on Monday.

Meituan will aim for the company and the food delivery sector to move toward healthier and more sustainable development, he stressed.

Also, as Fang pointed out, it could be an increasing trend for the likes of Meituan to diversify into areas such as chips to climb up the innovation ladder.

Meituan has started to meet its chipmaking commitments, with Chinese wafer foundry firm Rongxin semiconductor, which was only created in April, saying that it has received strategic investment from Meituan and other venture capital firms.

Meituan and its industry fund also lately made the list of investors in a Series A+ round of funding into Chinese artificial intelligence vision chipmaker Axera.

Other internet behemoths that have ventured into the chip arena include Baidu, Alibaba, Tencent and ByteDance.