Will TSMC become a ‘US weapon’ to contain China’s semiconductor sector?

Chipmaker in Taiwan region under pressure amid US-China tech war

TSMC booth attracts visitors at the World Semiconductor Conference 2021 held in Nanjing, East China's Jiangsu Province from June 9 to 11. Photo: cnsphoto

As the global chip shortage drags on, the world's largest contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC) is reportedly raising prices by as much as 20 percent, a historical high.The reported price hikes came as TSMC accelerates its global expansion backed by vast capital expenditure. One of the chipmaker's high-profile projects is the $12 billion-plant in Phoenix, Arizona.

"The progress is on track with our plan. Construction on the fab has already begun," TSMC responded to the Global Times' inquiry on Tuesday, adding the volume production of the facility will begin in 2024 but refusing to specify which quarter.

Logistics media platform, The Loadstar, said TSMC is in discussion with liner operator Wan Hai to charter a containership with up to 5,000 containers to move components for creating a clean room at the Phoenix plant from Kaohsiung City in the island of Taiwan. TSMC refused to comment on market rumors.

Even if TSMC has plans to expand its plant in Nanjing, East China's Zhejiang Province this year, with the reportedly capacity elevated to 40,000 28-nm wafers per month, some industry observers said the plant in the Chinese mainland does not have advanced manufacturing capability due to political pressure from the island of Taiwan and the US.

Following a deal signed last week between an Arizona economic development group and an industrial cooperation promotion office in the island of Taiwan, the big chip plant project has raised questions amongst some industry observers in China: will TSMC become the next victim following Huawei amid the escalating US-China tech war?

Mixed motivation

The Chinese mainland imported $350.04 billion integrated circuits in 2020 amid the coronavirus pandemic - more than the combined value of crude oil and iron ore, according to customs data.

The island of Taiwan accounts for about one-third of these imports, with Japan, Malaysia, the Philippines, Vietnam and the US following behind.

In the face of the prolonged global chip supply crunch, all major economies are ramping up efforts to strengthen their own domestic chip design, R&D work and manufacturing as the situation has halted some auto makers' productions.

As a result, the US wooed TSMC to establish a facility in the country by providing favorable policies with an aim to bring more of Taiwan region's vast semiconductor industry to the Phoenix area which is already home to a major Intel chip factory. NXP Semiconductors and ON Semiconductor also have factories and offices there, CNBC reported.

However, the US' actual motivation may not be that simple.

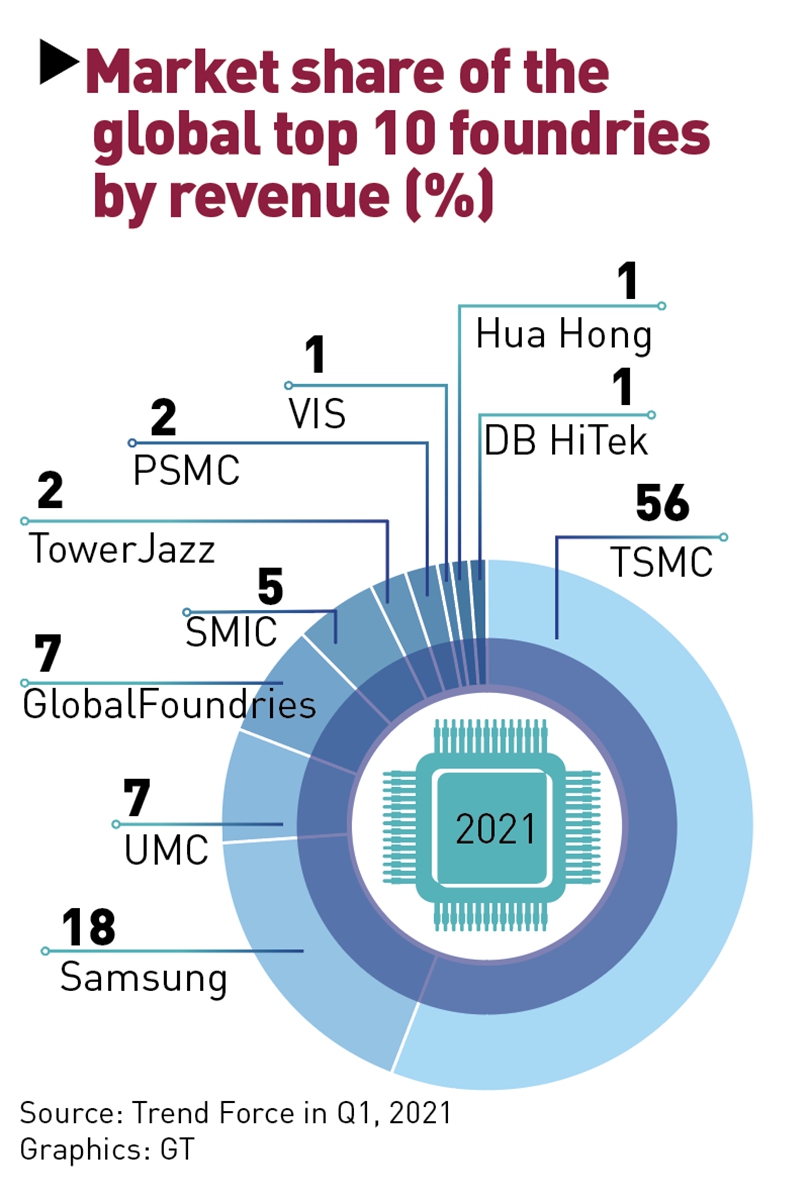

TSMC, which powers smartphone chips for Apple, MediaTek, Qualcomm and others, has grown its market share to 56 percent within the semiconductor contract manufacturer market, according to consulting firm Trend Force in the first quarter, far surpassing Samsung (18 percent), United Microelectronics Corporation (7 percent) and GlobalFoundries (7 percent).

Even though the US boasts strong chip design capability, the US Semiconductor Industry Association said the country only accounts for 15 percent of the global outsourced assembly and test market in 2020.

This statistics is now in the crosshairs of some US politicians.

By 2022, the Office of Commercial and Economic Analysis of the US Air Force estimates, 90 percent of leading-edge chip production will be based in Taiwan region, South Korea, and the Chinese mainland, with US-based global share of fab capacity dropping to 8 percent, Foreign Policy reported.

"This concentration of production and trend of American firms to increasingly rely on Asia for the manufacturing of semiconductor technologies poses risks to American economic competitiveness and national security should supply chains get further disrupted or US firms become unable to operate or transport goods in the region," the reported noted.

Only by binding the US with TSMC, could the superpower shore up its downstream manufacturing sector at the same time creating a large number of new high-quality jobs, experts pointed out.

As a further step, the US hopes to regain its dominance in the semiconductor industry by attracting the chipmaker to set up facility in the country although TSMC has been experiencing a trying time, an industry analyst, told the Global Times.

"When the TSMC Phoenix factory finishes construction, the company will likely lose its bargaining chips," industry observer Ma Jihua noted, adding the chipmaker is facing massive pressure to avoid possible US crackdown.

However, if the US intensified its crackdown on China's semiconductor sector by disrupting TSMC's supplies on the Chinese mainland, following its all-round hit on Huawei, the chipmaker would not be likely to follow, Ma said.

"It's equal to cutting off TSMC's future to enter the lucrative mainland market, considering the massive orders from the mainland and its strong downstream manufacturing capability," he added. "Losing the Chinese mainland market, it's pretty hard for TSMC to find the next heavy buyer."

With the Chinese mainland doubling down on establishing a self-dependent semiconductor industry, from removing tariffs on raw materials needed by next-generation monitor manufacturers to attracting semiconductor talent, it would be a big loss for TSMC to let go of such a thriving market, Ma continued.