Beijing stock exchange ‘may start trade as early as year-end,’ to form ‘effective closed loop’ with onshore, offshore capital capacities

stocks Photo:CFP

The blockbuster announcement of the setup of a new stock exchange in China's capital city, being referred to as the "third child" to the A-share market that currently bases trades in Shanghai and Shenzhen, becomes the focus of attention during the ongoing China International Fair for Trade in Services (CIFTIS), in a move reputed to beef up the country's capital market capacity and set out a road map toward common prosperity for a multitude of innovation-oriented smaller businesses.

The new market may begin trading as early as the end of the year with an initial 66 firms, market insiders said, noting that such a vision will be of significance for China to increasingly take on the US in capital terms, supposedly a rising part of rivalry between the world's top two economies.

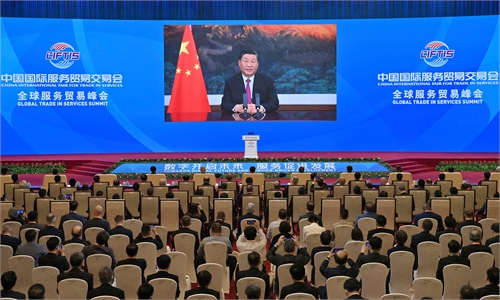

The establishment of the Beijing Stock Exchange and deepening the reform of the National Equities Exchange and Quotations (NEEQ), as known as the New Third Board, were announced at the Global Trade in Services Summit of CIFTIS late Thursday.

Buoyed by the new bourse announcement that instantly turned out to be a buzz phrase on Chinese social media, securities and venture capital shares, seen as benefiting mostly from the addition of the Beijing stock exchange, surged across the board at market opening on Friday.

The new bourse, built on the basis of a selection of most capable firms traded on the New Third Board, is intended to grow as a primary platform for technologically advanced small- and medium-sized enterprises (SMEs), funneling funds into a galaxy of firms to advance the economy's shift toward a focus on common prosperity-oriented growth, observers said.

The selection tier of the New Third Board, now home to 66 firms, is expected to translate into the first batch of companies to float on the new exchange, Wu Jinduo, head of fixed income at the research institute of Great Wall Securities in Shanghai, told the Global Times on Friday.

The average operating income for the 66 firms stood at 390 million yuan ($60.38 million), up 34.6 percent year-on-year, while their net profits rose 37.3 percent to average 45.26 million yuan, according to their first-half financial disclosure. Nearly half of the selection tier firms recorded an increase of over 30 percent in income terms.

The financial soundness of these firms renders them initial candidates for listings on the new stock exchange, according to Wu.

The Beijing bourse will be positioned differently from the existing bourses in Shanghai and Shenzhen and regional equities exchanges and eye its uniqueness to better serve the high-quality development of innovation-weighted SMEs, the China Securities Regulatory Commission (CSRC) said in a statement shortly after the new bourse was announced.

The securities regulator vowed to deepen NEEQ reforms and build the Beijing Stock Exchange based on the NEEQ's selection tier.

Stock market Photo:VCG

"The Beijing exchange is likely to shift the existing stocks on the selection layer of the New Third Board to the exchange once and for all, similar to what NASDAQ did by shifting the 1,500 stocks from the pink sheets when it was created in 1971," Dong Dengxin, director of the Finance and Securities Institute of Wuhan University, told the Global Times on Friday.

"The securities regulator has done a lot of preparation, mainly in rules and trades, so far this year," Wu stated, adding that the new bourse is basically ready for trading.

The launch of the bourse would still be contingent upon whether or not various domestic and external risks have been fully considered, she continued, citing the possible fallout on the domestic capital market of the US Federal Reserve's future moves to taper off its quantitative easing, the downward pressure on the domestic economy and geopolitical uncertainties.

The market is also awaiting detail rules to crystallize the discrepancies between the Beijing market and its Shanghai and Shenzhen counterparts, analysts said.

The arrival of the new bourse is unlikely to be far away, according to market followers.

"Many shares have been operating at the New Third Board and the readiness of the first batch of stocks will put the development and operation of the Beijing Stock Exchange on a fast track. It is expected that the exchange will open bell in near future," said Yang Delong, chief economist at Shenzhen-based First Seafront Fund Management Co.

It is anticipated that the exchange will be operational by the end of the year at earliest or by next spring the latest, Dong said.

The expectation injected a shot in the arm of the firms listed on the selection tier, with 50 out of the 66 companies soaring over 9 percent at Friday's opening, with Hunan Wuxin Tunnel Intelligent Equipment Co leading the rally with a 30 percent gain.

The New Third Board, officially up and running in 2013, is now composed of three tiers - basic, innovation and selection. The selection tier was introduced to the New Third Board in October 2019 as part of efforts to refashion the over-the-counter market where thin trading volume and poor market liquidity appeared to have damped the appeal of the market. The firms having traded on the innovation tier for a year can be upgraded to the selection tier.

Compared with the A-share market where individuals' investment threshold is capped at 500,000 yuan for trades on the sci-tech-centric STAR Market in Shanghai, thresholds for individual investors of the New Third Board remain much higher even after a move in late 2019 to lower the numbers to 1 million yuan for trades on the selection tier, 1.5 million yuan on the innovation tier and 2 million yuan on the basic tier, from the previous 5 million threshold for NEEQ trading.

Firms that have traded on the innovation tier of the New Third Board for 12 months will be eligible for new listings on the Beijing Stock Exchange and a registration-based IPO system will be trialed on the new market, Zhou Guihua, an official with CSRC, said on Friday, offering a more detailed account of the forthcoming market.

A flexible and diversified financing mechanism will be adopted, with the availability of ordinary shares, preferred stock and convertible bonds, among other financing vehicles, according to Zhou, the new bourse will be structured as a company with the establishment of a shareholders' meeting and a supervisory board.

The Shanghai and Shenzhen bourses also unveiled rules and requirements for the firms traded on the selection tier to shift toward listings on the two markets earlier this year.

The forthcoming new exchange is considered to provide a most ideal destination for these promising yet less-established firms.

As of Thursday, a total of 7,304 firms with market capitalization hitting 2 trillion yuan were listed on the New Third Board, with 5,988 traded on the basic tier and 1,250 on the innovation tier.

By comparison, more than 4,000 firms were traded on the A-share market with total market value of 86.2 trillion yuan as of the first half of the year.

Looking ahead, the size of the new bourse is set to keep growing, as the Beijing market would serve to shore up a weak link in northern China that is barely on par with southern China where the Shanghai, Shenzhen markets, the Hong Kong bourse and the creation of a local stock market in Macao underpin its capital sophistication and savviness.

The balancing move is cited by some as an effort to put a greater number of capital-thirsty yet innovation-centered smaller businesses on track for brisker growth, thereby getting the economy well-prepared for its grand vision of common prosperity.

SMEs are able to "achieve big things" as they play a significant part in driving economic growth, fostering sci-tech innovation and creating jobs, the securities regulator said late Thursday.

The three-children A-share family, together with the Hong Kong market and the future exchange in Macao would put in place "an effective close loop" with both onshore and offshore capital capacities for there to be a complete trading scenario enabling the "circulation of capital elements, price discovery and risk management," Wu commented.

That suggests a rising profile of China's stock market as a whole on the global stage, better readying the country for a financial decoupling with the US which has been ramping up its regulatory toughening on US-listed Chinese firms.

With the establishment of the Beijing Stock Exchange, Chinese new economy stocks, in particular, will have more listing options to choose, Dong said.

"It is expected that there won't be many Chinese companies opting for a US listing in the future," he reckoned.

Despite this, it would take time for China to sufficiently rival the US in the capital market as the A-share market, only in its early 30s, remains fairly young compared with the US as measured by the market size, trading activities and sophistication, insiders stressed, expecting a more gradual path toward reduced gap between the two countries when it comes to the capital market.