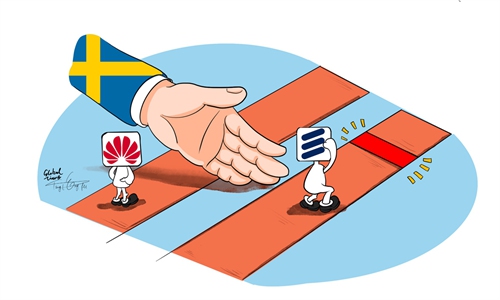

Ericsson wants to stay in China, but faces acute challenges over Sweden's ban on Huawei

Ericsson. Photo: VCG

While Ericsson's executive is publically determined to regain lost market share in China after Sweden arbitrarily excluded Chinese companies from its 5G build-out, the Swedish firm's revenue from one of the world's fastest-developing 5G markets will likely tumble to between 3-5 percent this year, due to political factors and fierce competition, an expert said on Sunday.

Ericsson Chief Executive Borje Ekholm vowed to ramp up efforts in the Chinese market despite setbacks in obtaining radio contracts. "We have been in China for 120 years and I don't intend to give up easily," Ekholm said in an interview with Reuters, adding that "We are going to show that we can add value to China."

However, despite Ekholm's pledge, the company faces acute challenges in the Chinese market, mainly because of the Swedish government's approach toward China, analysts said.

"There is little chance that Ericsson could regain its lost market share in China, as the company's setbacks are linked to the Swedish government's crackdown on Huawei and other Chinese firms, which has triggered public anger in China," Ma Jihua, a veteran industry analyst, told the Global Times on Sunday. "Domestic carriers can't ignore public sentiment when choosing suppliers."

Ericsson recently settled for a mere 2 percent of China Mobile's 5G contract, down sharply from 11 percent last year. In comparison, Huawei secured about 60 percent of the total tender, followed by ZTE with roughly 31 percent and Finish telecom giant Nokia of approximately 4 percent.

By making an effort, Ericsson may be able to retain a certain market share in China and avoid being squeezed out entirely, Ma said, noting that the company's revenue from the market may contract to between 3-5 percent in 2021.

Ericsson's financial results showed that its sales in the Chinese market plunged by 2.5 billion Swedish crowns ($290 million) in the second quarter, the first drop in three years.

Ericsson is itself to blame for its poor performance in China, Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times on Sunday. "Ericsson's 5G technologies and equipment, services and pricing have no edge over those of Huawei, ZTE and other international giants," he said.

Take technology, for example. When 5G base stations are initially rolled out, they consume around four times as much as electricity as 4G stations. Through technological breakthroughs, Huawei's 5G base stations' power consumption decreased to about 2.5 times, while that of Ericsson products fell to around 3.5 times, Xiang said, noting that Huawei's advantage in this regard is attractive enough to telecom carriers.

"Unlike some Western powers' wrongful move of containing China and Chinese companies like Huawei, China has been providing a fair environment for foreign players," Xiang said.

In addition to seeking technological breakthroughs, Ericsson should step up opposition to Swedish government's ban on Huawei and ZTE, which is the foundation for the company to enjoy equal treatment in foreign markets, Ma said.

Global Times