HKEX launches first A-share derivatives product in fresh boost for city's financial market

Move further lifts city's status as global financial hub

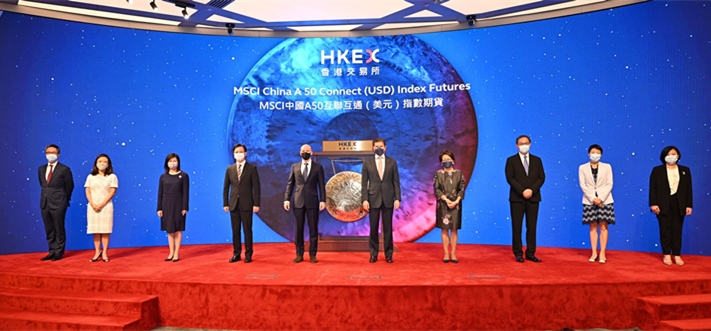

The launch ceremony of the first A-share derivatives product by HKEX based on MSCI China A 50 Connect Index on Monday Photo: Courtesy of HKEX

The Hong Kong Exchanges and Clearing (HKEX), the operator of Asia's third-largest stock exchange, on Monday launched its first A-share derivatives contract, offering global investors an appealing risk management tool that attests to China's economic rebalancing, as the Hong Kong Special Administrative Region (HKSAR) muscles in as an international financial hub that backstops the globalization of the country's capital markets.

With this addition to its derivatives product suite, HKEX is "now home to the world's most complete and competitive offshore A-share equity and derivatives trading venue, offering global investors and risk managers a convenient and cost-effective solution to trade and manage their China exposure," read a statement the bourse operator sent to the Global Times on Monday.

The new offering cements the HKSAR's role as the gateway to the Chinese mainland for global investors and "marks another great step forward in supporting the further internationalization of China's capital markets," HKEX Chief Executive Officer Nicolas Aguzin was quoted as saying in the statement.

The new futures contract, based on the MSCI China A 50 Connect Index, comprises a selection of 50 stocks from the largest shares traded in Shanghai and Shenzhen via the stock link-up between the Hong Kong and mainland stock exchanges.

Shenzhen-listed battery giant Contemporary Amperex Technology is the largest constituent of the new product with an index weighting of 8.37 percent, followed by the country's most valuable baijiu maker, Kweichow Moutai, with a 7.5 percent weighting, and giant solar manufacturer LONGi Green Energy Technology with a 5.57 percent coefficient, according to index information provided by HKEX.

Also among the top 10 constituents are China Merchants Bank, Wanhua Chemical Group, Apple supplier Luxshare Precision Industry, and electric vehicle maker BYD.

The new futures product is considered more balanced in weighting terms than the more established offering from the Singapore Exchange, providing investors with a risk management tool that truly represents the country's shift toward new-economy sectors.

Financials account for merely 18.36 percent of HKEX's A-share futures contract, while industrials make up 14.74 percent. In the case of the Singapore bourse's flagship FTSE China A50 futures product, financials represent a weighting of 37 percent, while industrials account for only 3.89 percent, according to media reports.

In a sign that the new product will provide the Hong Kong bourse with a tailwind to take on its Singapore counterpart, shares of Hong Kong-listed HKEX closed up 0.34 percent on Monday, slightly outperforming a 0.31 percent gain in the benchmark Hang Seng Index.

Singapore stocks lost 0.73 percent on Monday, bringing the exchange's losses over the past month to nearly 5 percent.

On the part of international investors, trades of the new derivative components have already been accessible via the stock connect tie-ups, whereas the new contract provides fund firms, among other global investors, with a new benchmark to gauge their performance, Raymond Deng, investment strategist CIO of consumer investment and insurance products at DBS Bank, told the Global Times on Monday.

Fund firms would hence re-anchor their investment strategies in line with the new contract if it becomes popular enough to overshadow the Singapore offering in the future, analysts said.

Trading volumes and derivative products matter more than IPO deals for HKEX's business revenues, Deng said, adding that the new derivative offering bodes well for the bourse's business prospects.

Moreover, the new product, essentially underpinned by the mainland-Hong Kong stock connectivity, is seen as reinforcing the success of the HKSAR in financial terms.

In the words of Aguzin, such connectivity is Hong Kong's unique advantage, setting the city apart from other international financial centers.

Trading volumes of the stock trading link-ups posted record half-yearly highs in 2021, with average daily turnover of the northbound leg up 54 percent year-on-year to 114 billion yuan ($17.73 billion), while the reading for the southbound leg soared 132 per cent to HK$48 billion ($6.17 billion), according to HKEX statistics.

The new A-share index futures contract has been certified by the US Commodity Futures Trading Commission to be offered in the US, where local investors can trade the new offering at launch, per HKEX, which also announced a trading fee holiday for the contract during the first half year.