Staff working a luxury brand booth at the 4th China International Import Expo on November 7,2021 Photo: Li Hao/GT

At French luxury tycoon Kering's booth at the 4th China International Import Expo (CIIE), a dark-red satin shirt dress was displayed on a rotating pedestal, drawing attention from media and visitors.

During a media tour on Friday, an employee of Saint Laurent, an Haute Couture brand under Kering, told the visitors that the dress was designed by the brand's creative director Anthony Vaccarello for the 4th CIIE. She stressed that the dress had been inspired by Chinese red paint.

A few meters away, another knitted red dress was also a focus of limelight during the current CIIE. The 2.5-meter-tall dress was displayed by Japanese clothes brand Uniqlo to illustrate its 3D seamless knitting technologies, and was described by some Chinese media as the world's largest 3D knitted dress.

The two red dresses, which stand out among the thousands of products displayed at the 4th CIIE's consumption exhibition area, are reflections of how foreign companies are endeavoring to attract eyeballs at China's largest imports expo. There were also signs of success by a number of companies for having survived and succeeded in China's lucrative yet volatile consumption market in the past years.

Uniqlo displays a 2.5-meter-tall dress to illustrate its 3D seamless knitting technologies at the 4th CIIE. Photo: Xie Jun/GT

Making money

The CIIE has always been a highly sought-after stage for global fashion firms, whether they are luxury tycoons, fast fashion companies or sportswear firms. The 4th CIIE is no exception.

The world's three leading luxury groups Kering, LVMH and Richemont all attended the event. In addition, all major fast fashion and sportswear brands like Uniqlo, H&M, Nike all displayed products at the expo.

The Global Times reporter visited one of the CIIE consumption venues on Saturday, and saw that the venue was much more crowded than some other venues.

Luxury brands have designed their booths in an elaborate, art-like fashion: LVMH's booth design had taken inspiration from the brand's landmark architecture, while Kering's booth looks like a glimmering galaxy. Many sportswear firms also design interactive games, like football video games, to interact with visitors.

Their active participation in the CIIE also mirrors the companies' eagerness to boost exposure of their products at China's public events, as some of them have seen flourishing business growth in China over the past two years, while global consumption took a dive amid the pandemic.

"In the past one or two years, our brands' performance has largely surpassed pre-pandemic levels in the Chinese market. In the past three years, our Chinese employees have doubled…while our online revenues saw three-digit growth after the coronavirus was controlled," said Cai Jinqing, president of Kering Greater China.

For fast fashion brands, the buying powers of Chinese consumers helped them to balance off the coronavirus crisis. Uniqlo, for example, had reportedly closed 26 stores in South Korea in 2020, but opened 66 new stores in China last year.

"We have kept a steady pace of opening 80-100 new stores in China annually on average, and we plan to keep that pace in the coming years," Uniqlo China's public relations director Dong Chunfang told the Global Times.

Both Dong and Cai said that the coronavirus had been a boost instead of a drag on their companies' business in China. According to Dong, she sensed that Chinese consumers paid more attention to family and health after the coronavirus, which helped boost their companies' sportswear sales.

"We have confidence in all aspects of Chinese markets, whether in terms of demands or business environment. Now about 70 percent of our supply chains are located in China...the Chinese market is very important to us," Dong said.

Cai also told the Global Times that Chinese consumers increasingly favor products with Chinese cultural elements after emerging from the pandemic, which benefited the company's Chinese culture-rich brand Qeelin.

Sportswear brand Fila said they are optimistic about their development potential, after their revenues grew 51.4 percent in China in the first half of this year, Fila told the Global Times in a written response.

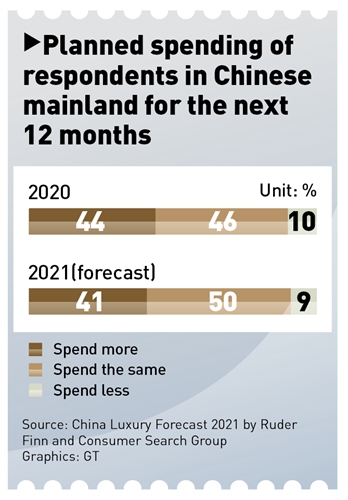

China's retail sales surged 16.4 percent year-on-year in the first nine months this year, up by 8 percent compared with the first nine months in 2019, official data showed. In particular, China's luxury consumption surged by 48 percent in 2020, a Bain & Co report showed.

Volatile and uncertain

However, this is not to say that every overseas fashion company can strike gold in the Chinese market. In fact, many overseas companies are facing challenges ranging from disrupted supply chains, rising material costs to changing customer taste. Some brands are withdrawing.

This is partly due to the fast changes in China's consumption market in recent years and particularly after the COVID19, as Chinese consumers no longer have a blind worship for overseas clothing brands.

Even for companies that seemingly have made success in China, they are cautious and even a bit nervous about post-coronavirus changes, as they try to upgrade their products so as not to be sifted out from the Chinese market.

"The Chinese market is very important to not only Kering but also the world's (luxury) market. Our global team is willing to learn from Chinese practices and coordinate with our Chinese team's fast response to market changes," Cai said.

The French company has already made some changes in China that it never considered throughout its 58-year history, such as launching online stores and partnering with internet celebrities. It is also pushing use of green and non-hazardous materials to meeting stricter environmental standards.