Update: China’s first securities class-action suit rules in favor of investors;lead fraudulent executive sentenced to 12 yrs and fined 1.2m yuan

Investors monitor stocks at a trading center in Chengdu, Southwest China's Sichuan Province. Photo: VCG

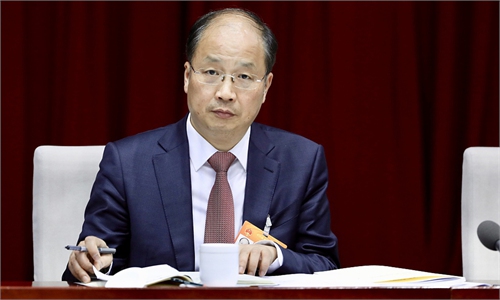

In a historic verdict, the Intermediate People's Court of Foshan, South China's Guangdong Province on Wednesday publicly released a ruling on a securities market manipulation case involving 12 individuals including Ma Xingtian, the former chairman and general manager of Kangmei Pharmaceutical, a drug maker that had massively inflated its financials, in what is being called one of the worst accounting scandals in A-share market history.

Ma was sentenced to 12 years in prison and fined 1.2 million yuan for the crime including manipulating the securities market, illegal disclosure or non-disclosure of important information, and bribery, according to the court, media reports.

The former vice president of the company Xu Dongjin and 10 responsible individuals were sentenced to fixed-term imprisonment and fined for participating in related securities crimes.

The case was the latest signal that Chinese authorities continue to crack down on illegal securities activities in accordance with the law and will resolutely safeguard deepening reform and the healthy development of the capital market, experts said.

In a separate trial on Friday in the Guangzhou Intermediate People's Court, Ma and five others, Guangzhou-based GP Certified Public Accountants, the auditor of Kangmei, and others were found jointly and severally liable, the court said in a statement on its website.

Investors lost a combined 2.46 billion yuan ($385.26 million), the court said, citing estimates from professional agencies. Shanghai-listed Kangmei was ordered to cover the investors' damages.

It was disclosed that the drug maker had inflated revenues, interest income, operating profits and cash in its financials, while the auditor had falsified records in its auditing report of the firm's fiscal reports, both constituting securities fraudulent statements, according to the decision.

The Guangzhou court held a public hearing of the securities fraud class-action lawsuit in July after the case, initially accepted by the court at the end of 2020 as 11 investors sued Kangmei over falsified disclosures, was considered as a special representative action in April following an application earlier the same month from the China Securities Investor Services Center to act as a representative on behalf of select retail investors.

"The first instance ruling came just slightly over half a year after an unprecedented class-action suit was considered applicable to the case, arguably indicating high efficiency and enabling average investors to reclaim [fraud-induced] losses in a convenient and practical manner," Hao Junbo, chief lawyer at the HAO Law Firm in Beijing, told the Global Times on Friday.

In a statement shortly after the decision was announced, the China Securities Regulatory Commission (CSRC) hailed the verdict of the case, the first special representative action in the country, as a vigorous measure to implement the country's revised securities law and a pioneering, iconic and milestone effort to safeguard investors' legitimate rights and interests.

Hefty civil compensation would have "chief wrongdoers" take responsibility, read the CSRC statement, citing the $385.26 million payment to toughen penalties over violators and wrongdoers and strengthen deterrence against them.

The securities regulator vowed to improve the class-action litigation mechanism and push for special representative action suits on a regular basis.

With class-action ligations minimizing the cost of rights protection, it's expected that smaller investors tend to readily resort to the regime if they suffer losses from fraudulent information disclosure, market manipulation, among other violations, according to Hao.