COMMENTS / EXPERT ASSESSMENT

Overspending, trade war by White House causing runaway inflation

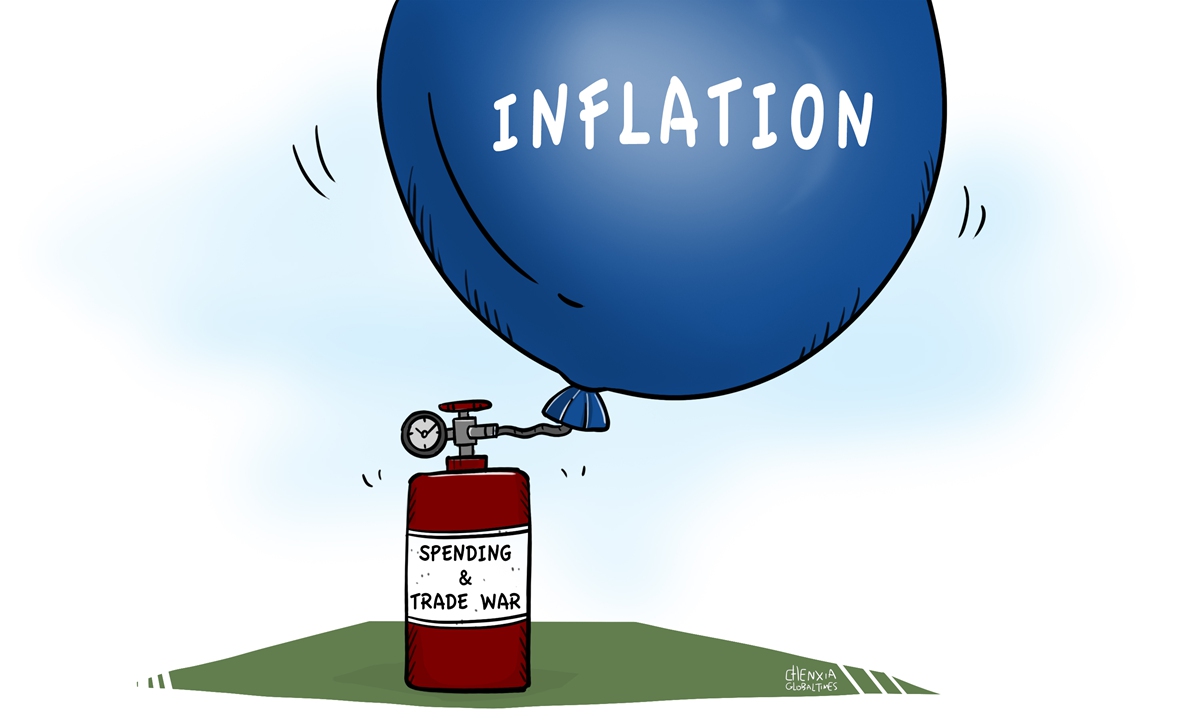

Illustration: Chen Xia/Global Times

Consumer prices rocketed by 6.2 percent in October in the US, the fastest pace since 1990 and far above the Federal Reserve's inflation target of two percent. The elevated prices are leading to rising concerns about diminished buying power among ordinary Americans, who are likely to hold President Joe Biden and his fellow Democrats accountable for their series of overspending programs.What is ominous for Biden's economic team is that inflation has become persistent and, by some measures, looks set to get worse. Over the past five consecutive months, price growth was hovering at more than 5 percent. The White House has claimed that current inflation rates are only "transitory", which has become a running joke among Americans, who now mock President Biden as "the captain of team transitory".

Overspending by the US government combined with the Federal Reserve's extraordinarily loose monetary policy in the past two years has caused the present mess. In March this year, the White House and Congress flooded the US economy with $1.9 trillion in new spending, after splurging about $4 trillion in Covid-19 pandemic relief by Donald Trump's administration in 2020. It is this extravagance that led to a steep rise in inflation in America that is making Americans' livelihood harder.

Now, the US government wants to spend more. President Biden is set to sign a $1 trillion infrastructure bill on Monday, and, the Democrats are pushing to pass another giant social-spending and climate plan which carries a price tag of $1.85 trillion. Biden's spending agenda is being vehemently opposed by the Republicans and is also causing a revolt within the Democratic Party.

Biden's claims that passing another big spending bill will help tame inflation, is beyond most economists' understanding of how the economy works. Actually, it is a common sense that it's a bad idea to pour gasoline on a raging fire. With American domestic inflation now running at 6.2 percent, a responsible and competent government would refrain from greater levels of spending.

If Biden's new social-spending bill is approved by Congress and signed into law, the consumer price index in the country is most likely to shoot up to 10 percent or even higher - effectively erasing the savings of middle-class families and making life harder for the working poor and the tens of thousands of the disadvantaged.

However, the Federal Reserve is not ready to pivot towards controlling inflation. Chairman Jerome Power has made the case for keeping interest rates low, while moving steadily on tapering asset purchases so as not to unsettle sky-rocketing American capital markets. The US central bank is still due to buy about $420 billion in bonds between November and June 2022, which sounds abnormal.

To make things worse, the Biden administration has stumbled on preventing and controlling the spread of the more contagious Delta variant of coronavirus, which has contributed to a shortage of truckers and severe logjams at major ports in the US. Supply chain disruptions are expected to persist well into 2022, further pushing up production costs and commodity prices.

Now, prices for goods spike across the board, from daily staples like groceries, cars, gasoline, home rental costs, to big-items such as flat televisions, furniture and prices at restaurants, hairdressers, cinemas, and health care centers. Some items of food have witnessed 20-50 percent surge in prices.

And, economists warn that Americans are expecting higher inflationary level in the coming months. If people think prices are going even more elevated in the coming months, the situation could quickly spiral out of control, as they demand higher wages that in turn lead to more price rises.

Even President Biden has admitted that inflation is unlikely to ease on its own and that the American people will have to endure it for a time. To help curb precipitous prices at the pump, Biden has begged the OPEC countries to increase oil production, ignoring his mantra to restrict carbon dioxide emissions and fight climate change.

Biden's Republican opponents are looking to seize on inflation and a suddenly slowdown of economic growth - double whammy for Biden - to hit Democrats and take back majorities in both the Senate and the House of Representatives, at next year's midterm elections. The US' economic growth lost momentum in the third quarter this year, with the quarterly GDP rising merely 2 percent. Supply chain bottlenecks and the US' protracted trade war with China have both contributed to insipid growth, and it is urgent and imperative for Biden to resolve these issues.

US Treasury Secretary Janet Yellen has advocated the world's two largest economies return to the negotiating table, and start reciprocally scrapping the punitive tariffs that have been levied since early 2018 amid Donald Trump's reckless and relentless trade war. High tariffs on Chinese imports have contributed significantly to elevating prices on the store shelves. Yellen's suggestion is sensible, and if it is adopted and implemented, the US inflation will be significantly eased.

Some Republicans are laughing at Biden's Build Back Better agenda, deriding the legislative program as "Build Back Worse". Now it is time for the White House to take real steps to curb inflation, and stop gambling with the livelihoods of ordinary people, as well as his own political future.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn