Capital rushes into clothing industry in China on improved efficiency, technology

‘Old trees sprouting’ amid injection of new cash, technology

Two female workers are busy at a textile facility in Meishan, Southwest China's Sichuan Province on September 28, 2021. Photo: cnsphoto

As one of the "old" industries that empowered China's export economy dating back to the early age, the clothing industry becomes again appealing to capital, which is now eager to inject new vitality into the traditional industry. Improved supply-side efficiency including manufacturing and transportation has also become major supporting factors for the industry's new life.

Investors such as GL Ventures, IDG, Legend Capital, and Matrix Partners China are just some of the names investing in the garment industry and making "old trees sprout."

More investment

A senior investor surnamed Cheng based in Shanghai said that textile and clothing has always been one of his main investments on the stock market.

"Because of the industry's large scale and large demand in China, returns from the industry are very stable. Almost everyone is following the trend of investment in new energy and other industries. But in fact, there is also great space for development of traditional industries in the context of consumption upgrades. Therefore, it is a good time to invest," Cheng told the Global Times on Monday.

In September, Bosie, an emerging domestic clothing brand, completed hundreds of millions of yuan in the B+ round of financing, which will be used for product research and development and supply chain upgrade.

Separately, in September, Beaster, a new Chinese clothing brand, completed its first round of financing, securing more than 200 million yuan ($31.4 million) in funds.

Apart from garment brands, the supply chain of the clothing industry has ushered in intensive financing as part of an industry-wide upgrade.

In August, clothing supply chain SaaS provider Lingmao SCM announced the completion of nearly 100 million yuan in A round strategic financing. And before that, garment accessories one-stop supply chain B2B platform Fuliaoyi.com completed hundreds of millions of yuan financing. Apparel e-commerce platforms are also attracting attention from the capital market.

The size of China's clothing market is expected to reach 2 trillion yuan in 2021, according to industry forecast.

But institutional analysis pointed out that the industry was large while not strong enough.

The upgrading of clothing industry led by evolving demand of new generation and increased efficiency of suppliers is one of the fundamental reasons for the entrance of new capital into this sector, said analysts. The trend is set to further boost the globalization of Chinese brands.

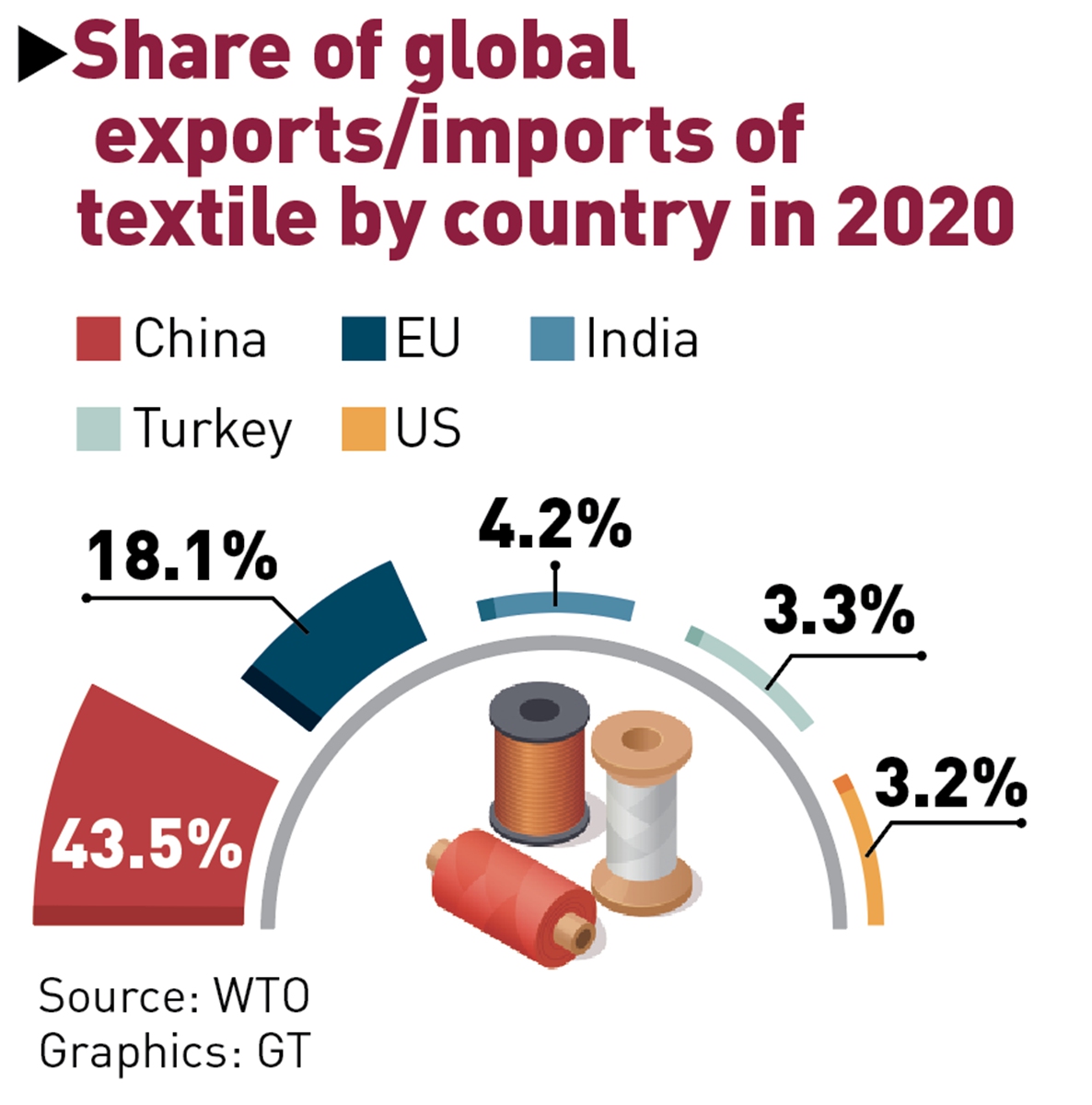

Graphics: GT

Upgrading on the way

Around 80 percent of China's garment enterprises remain labor-intensive operations, many of which are seeking to improve their proportion of production by using mechanization, and then achieve intelligent production, Zhang Yi, CEO of iiMedia Research Institute, told the Global Times on Monday.

"The process of upgrading from manual to mechanized and then to intelligent provides a huge space for capital investment. Enterprises need new production lines, assembly lines and other machines to make upgrading possible," said Zhang.

In addition, analysts noted that China's garment industry can grow beyond the establishment of global fast-moving consumer goods brands such as Uniqlo and Zara. China has all the ingredients to form a product system from sportswear like Adidas or Nike to other forms of clothing, such as down jackets, they said.

In fact, the performance of domestic clothing brands during this year's Double 11 online shopping festival offered positive proof that Chinese brands are growing in influence.

During the just-concluded shopping festival, most of domestic key companies, especially local sports brands, were among the hottest items for Chinese shoppers.

For instance, sportswear brand Li-Ning saw a year-on-year growth of 37.7 percent of sales during the shopping spree, and outdoor down jacket brand Bosideng gained 53 percent growth, data showed.

"The majority of our products sold out during Double 11 presales and our factory had to work in full swing to meet demand. Our sales went up nearly 25 percent from 2020 and the whole-year sales are expected to increase by 20 percent," a manager of a domestic clothing company based in Ningbo, East China's Zhejiang Province, told the Global Times on Tuesday.

It only began domestic sales in 2018, after fractured China-US trade relations "severely affected exports."

According to an analysis report by Guosen Securities, in the short term, the institute is optimistic about resilient brands. In the long term, it continues to be optimistic about high-quality enterprises with leading brand strength, product strength, operating efficiency and financial health.

"The building up of brands is actually a type of upgrading for the clothing industry. In terms of production scale, Chinese products are among the top in the world, but they are still inferior in the international market," a textile industry analyst surnamed Chen told the Global Times on Tuesday.

China remains the biggest textile exporter in the world, with net exports of textiles equaling $154.1 billion in 2020, up 28.9 percent on a yearly basis and accounted for 43.5 percent of world's total textile exports in terms of value. The figure stood at 10.3 percent in 2000, according to a report on world trade review by the WTO.

Products of the same grade with similar quality and specifications produced in China remain cheaper than those from other countries due to the lack of internationally well-known brands and enterprises, Chen said, noting that it is the direction that China's clothing industry should make advancement.