Investors monitor stocks at a trading center in Chengdu, Southwest China's Sichuan Province. Photo: VCG

An official from China's top securities regulator said on Thursday that the agency was working with its US counterpart on auditing and delisting problems involving US-listed Chinese companies.

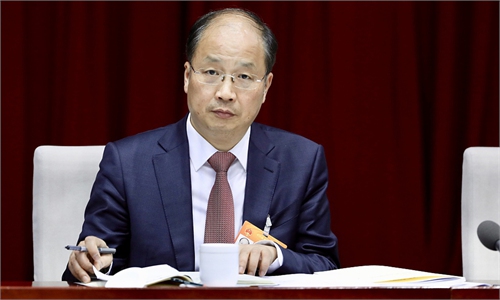

Discussions with the US side on the delisting of Chinese shares were smooth and candid, Shen Bing, director general of the department of international affairs of the China Securities Regulatory Commission (CSRC), said on Thursday at a conference in Hong Kong.

"There may be delisting risks for Chinese stocks, which the CSRC will do its best to avoid. We do not believe that the delisting of Chinese shares in the US is good, for the companies, global investors or China-US relations," said Shen.

The remarks show that China is making an effort to carry out normalized communication on regulatory cooperation with the US, which was disrupted under the extreme policies of the Trump administration, Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, told the Global Times on Thursday.

"The audit working papers that contain raw data and regard national security will still be the focus and challenge of the talks. The Chinese side will not give into the US' demand to hand over the auditing papers to the US," Dong said.

The US has kicked several Chinese companies off its stock markets citing "national security." US authorities also require foreign companies to meet US auditing standards and those that don't comply will be delisted from major US stock exchanges, which will affect many Chinese companies.

The US government is partly pushing for decoupling from China and is tightening its supervision of locally listed Chinese companies, which has led many Chinese companies to go for listings in Hong Kong, Ashley Ian Alder, CEO of the Hong Kong Securities and Futures Commission (SFC), said on Thursday.

Analysts said that this is not a simple financial problem, but one that should be discussed in the context of bilateral relations between China and the US, where the two sides will maintain a complex relationship of competition and cooperation over the long term.

The review of Chinese stocks is just another card the US has played against China, just like the "Taiwan card," Hu Qimu, chief research fellow at the Sinosteel Economic Research Institute, told the Global Times on Thursday.

"The bottom line is that China and the US will not go to war or have one final communication before using nuclear weapons. On this bottom line, the US would fully strive for its best interests," said Hu.

But such a US crackdown on the stock market would just promote Hong Kong's position as an international financial hub, analysts said.

"Many international investors and companies believe that Hong Kong is still an important channel to enter the Chinese mainland, and that Hong Kong can still help Chinese companies attract foreign and domestic capital in Hong Kong against the political backdrop of decoupling between China and the US," said Alder.