An investor tracks A-share performance in Fuzhou, capital of East China's Fujian Province. Photos: cnsphoto

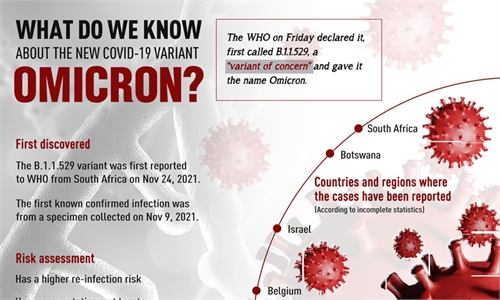

China's A-share market closed mixed after opening sharply lower on Monday due to concerns related to the newly discovered Omicron variant of the coronavirus, which drove Friday's massive sell-offs in the US and Europe as investors fretted about renewed uncertainty.

The benchmark Shanghai Composite Stock Index was down 0.04 percent to close at 3,562.70 on Monday, while the Shenzhen Component Index rose 0.22 percent and the NASDAQ-style ChiNext was up 1 percent.

"The performance of the A-share market proved that it has internal momentum, with little impact from overseas markets," Yang Delong, chief economist at Shenzhen-based First Seafront Fund Management Co, told the Global Times on Monday.

Lithium battery and the healthcare sectors led Monday's rise, while hotel and aviation stocks dived.

Despite a new potential chapter in the global pandemic, China's A-share market may be more resilient than overseas markets, and policy expectations of stable internal growth may be a more critical factor dominating market performance, a note from Chinese investment bank CICC said.

The domestic equity market may experience rising volatility over the short term, but there's no need to be pessimistic. The end of this year and the beginning of a new year may be an important window for strengthened policy moves, it noted.

Hu Yifan, chief China economist at UBS, said that the People's Bank of China, the central bank, will likely cut interest rates before the traditional Spring Festival holiday to ramp up market liquidity.

She told a press conference on Monday that international investors have growing interest and confidence in China's A-share market thanks to its stellar performance as the nation put the coronavirus under control despite intermittent small-scale flare-ups.

"China's definite advantage on the supply chain side has been given full play during the pandemic. China's planning mechanism in sectors like manufacturing and chipsets, especially after the sixth plenary session of the 19th Central Committee of the Communist Party of China (CPC), has become clearer, which strengthens investor confidence," Hu said.

Global holdings of Chinese stocks and bonds have jumped by $120 billion in 2021 as foreign investors chased returns in the country's markets, according to the Financial Times' calculations.

Yang estimated that the benchmark Shanghai Composite Stock Index could increase 5-10 percent by the Spring Festival from current levels.

The possibility of a sudden global shutdown due to the Omicron variant is small, and it will not cause a reversal in the global economy, but it will mean more risks and uncertainties for the US and European economies, industry watchers said.

US stock futures led a market rebound on Monday as investor sentiment steadied. Oil prices bounced more than $3 a barrel to recoup some of Friday's losses.

European stocks started the new trading week higher with the pan-European Stoxx 600 up 0.8 percent as of press time.

The US and European stock markets fell sharply on Black Friday. The Dow Jones Industrial Average dropped about 905 points, or 2.5 percent, marking its worst day of the year, while the S&P 500 and NASDAQ Composite slid 2.3 percent and 2.2 percent, respectively.

Global Times