COMMENTS / EXPERT ASSESSMENT

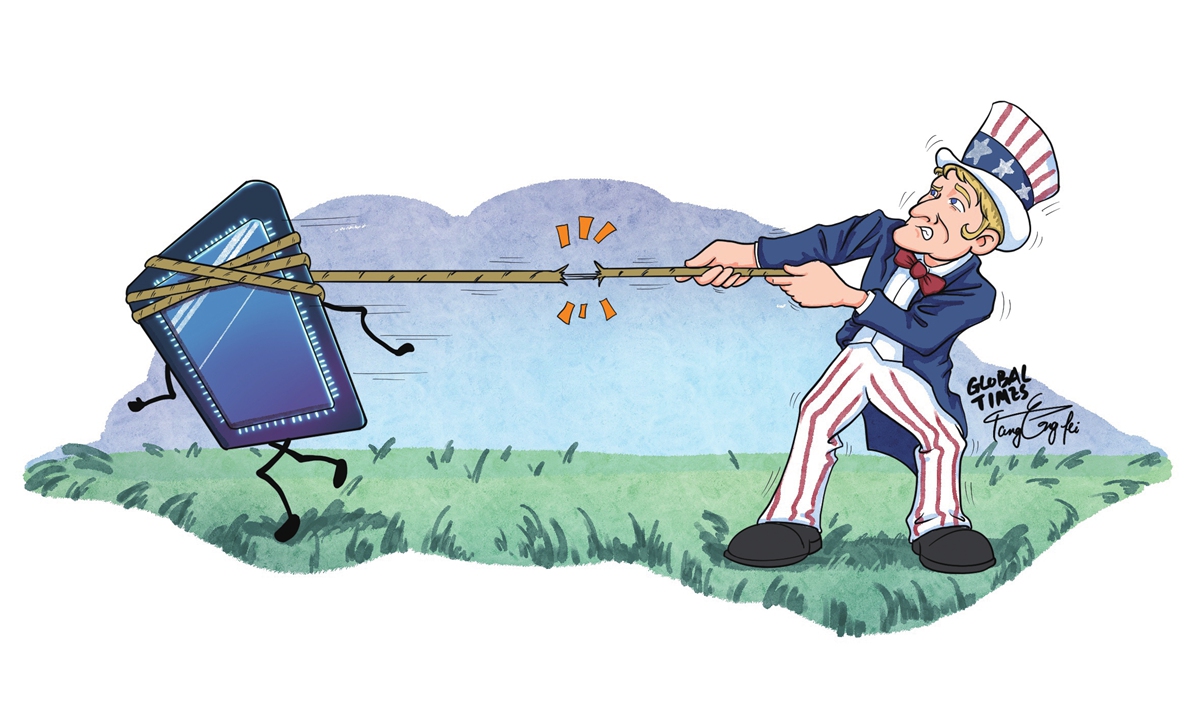

US’ political coercion in chip industry poses a global threat

US' political coercion in chip industry poses a global threat. Illustration: Tang Tengfei/GT

US Commerce Secretary Gina Raimondo on Monday urged the House of Representatives to immediately pass the Creating Helpful Incentives to Produce Semiconductors for America Act, or CHIPS Act. Speaking in the US Motor City Detroit, which has borne the brunt of the global chip shortage, Raimondo said the bill is critical to lowering US' dependence on parts from China.

The CHIPS Act, a $52 billion government subsidy program to support US production of semiconductor chips, is part of the broader US Innovation and Competition Act, or USICA, which was passed by the US Senate in June but has stalled in the House of Representatives. A couple of weeks ago, US lawmakers also cited the so-called China threat to press for the passage of the bill to subsidize building more chip factories in the US.

Increasing investment to boost the US' domestic chip production to cope with the shortage of chip supply is understandable, but some US politicians are targeting China in almost every move connected to their chip push. Their goal is obviously not only to revitalize the US chip industry, but also to stifle the development of China's chip sector at the same time, which fully exposes their hegemony mindset.

While playing up the "China threat" to push the passage of CHIPS Act, Raimondo said that the US Department of Commerce (DOC) is reviewing the chip data submitted by more than 150 semiconductor companies from across the world. In September, the DOC essentially coerced some of the world's largest chipmakers, including Taiwan Semiconductor Manufacturing Company (TSMC), to submit confidential business data, a move widely viewed as another instance of US hegemony and a new maneuver to target China.

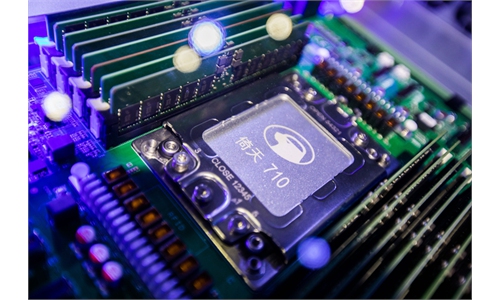

There is no shortage of instances that the US government is trying to strangle China's chip industry. The world's largest chipmaker Intel's plan to build a plant to manufacture silicon wafers in Chengdu, Southwest China's Sichuan Province, was also blocked by the Biden administration over "security concerns," Bloomberg reported in November. South Korea's SK Hynix's chip factory renovation plans in Wuxi, East China's Jiangsu Province may be cancelled because US officials do not want advanced equipment used in the process to enter into China, according to the Reuters.

At present, manufacturers from auto production to consumer electronics across the world are suffering from a global shortage in chip supplies. Industry analysts have pointed out that the political coercion and interference of the US government to split the global semiconductor sector is a major factor in the current chip shortage and global industrial chain disruption.

With the purpose of suppressing the development of China's science and technology, the previous Trump administration arbitrarily suppressed Chinese companies such as Huawei Technologies and Semiconductor Manufacturing International Corp (SMIC). This restricts the development of these companies to a certain extent, and worse disrupts the global chip industry chain, indirectly contributed to the shortage of global chip supply. However, facts have proved that Trump's political repression, which goes against the laws of the market, has not force companies to leave China, the manufacturing center and the world's largest market.

Despite Trump's tech war against China, US firms and their Chinese affiliates are ramping up investment in Chinese semiconductor companies. US venture capital firms, chip-industry giants and other private investors participated in 58 investment deals in China's semiconductor industry from 2017 through 2020, more than double the number from the prior four years, according to an analysis of deals data by US research firm Rhodium Group.

In comparison, global chip manufacturing companies are moving away from the US. Raimondo said on Monday that US chip assembly represents only 12 percent of global production, down from 40 percent in the 1990s.

The Biden administration's chip hegemony will not help the US attract chipmakers to build factories in the US any time soon; instead, it will further worsen the current global chip supply shortage. For instance, SK Hynix's Wuxi factory is critical to the global electronics industry because it makes about half of SK Hynix's DRAM chips, which amounts to 15 percent of the global total. The US' political interference could create another supply gap on global memory markets.

From hurriedly urging the passage of the CHIPS Act to barring chip companies from investing in China, the US is aggressively coercing chipmakers into producing chips within its border. However, such an attempt violates market laws and industrial development trends and will inevitably fail.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn