China’s yuan jumps to 3-year high against US dollar despite central bank monetary easing

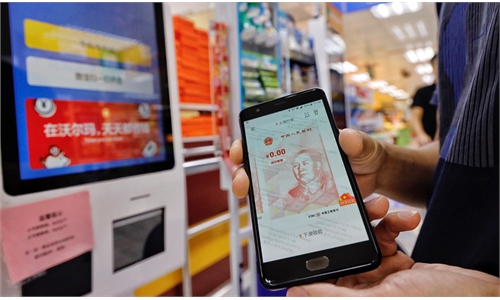

Renminbi Photo: VCG

The Chinese currency yuan's daily official exchange rate was set at 6.3498 per US dollar on Thursday, an advance of 179 basis points from the prior day, indicating sustained yuan strength despite recent central bank moves to funnel liquidity into the economy.

The daily fixing's move beyond 6.35 echoed a similar trend over the previous day when the yuan's onshore and offshore exchange rates against the dollar both strengthened beyond the 6.35 level, hitting the highest since May 2018.

The yuan's strength against the dollar contrasted with the apparent weakness of a basket of currencies including the euro, the Australian dollar and the yen this year.

More strikingly, the yuan's rise against the US dollar wasn't interrupted by the central bank's announcement on Monday that a 50 basis-point universal cut in the reserve requirements for financial institutions will be effective from December 15. That decision will release 1.2 trillion yuan ($189 billion) in long-term liquidity into the economy, according to the central bank.

The move followed a similar broad-based cut in July, when a reduction of 0.5 percentage points in the reserve requirement ratio was applied to financial institutions, a move that was envisioned to release long-term capital of about 1 trillion yuan.

Additionally, the central bank cut the relending rate to support rural and small enterprises by 25 basis points, effective on Tuesday, according to the Securities Times, another adjustment of relending facility rates after the central bank cut the interest rates by 25 basis points in July 2020.

Overseas funds' risk-on buying of yuan-denominated assets was considered to have partly underpinned the strong yuan.

Net capital inflows into the Chinese mainland stock market through the northbound link between the Hong Kong and mainland bourses tallied 21.66 billion yuan, the third time that the daily net purchase reading topped 20 billion yuan, according to Chinese financial news site cls.cn.

Also, it's traditional that between December and early in the new year, when the Chinese Spring Festival falls, exporters tend to sell the dollar in exchange for the yuan, and that might be propping up the Chinese currency, media reports said.

A stronger yuan, arguably a drag on Chinese exports, was seen as being offset by the country's unrivalled export strength as the coronavirus and its mutations - the Delta and Omicron variants - remain a big concern for the global economy at large, analysts said.

Still, there are expectations that the yuan's upward spiral is unlikely to continue.

"China's central bank has signaled a limit to its tolerance for the [yuan's] recent advance by setting its reference rate at a weaker-than-expected level," Bloomberg reported Thursday.

The gap between the daily reference rate and the forecast in a Bloomberg poll of analysts and traders was the biggest since mid-October, when the yuan gained steam on strong trade numbers and hopes of easing tensions between the world's top two economies, the report said.

Global Times