China’s tech sector eyes advances in 2022 with more policy support, amid US sanctions

More efforts to bolster innovation capabilities amid US crackdown

Aerial photo taken on Aug. 18, 2020 shows a self-driving bus of autopilot bus line 1 running on a road in Zhengzhou, central China's Henan Province. (Xinhua/Li An)

As the US continues to crack down on a growing list of Chinese technology companies in areas such as semiconductors, artificial intelligence (AI) and quantum computing, Chinese companies are also growing more resilient in coping with US sanctions and move forward with their own technological advances.

Analysts noted on Sunday that 2022 will be a critical year for China's technological capabilities with major advances are expected, given robust measures in recent years to boost innovation capabilities and resolve what officials call "bottleneck" problems.

At the tone-setting Central Economic Work Conference concluded on Friday, Chinese top policymakers also stressed enhancing China's technological innovation capabilities in 2022 with major actions plans, policy supports, systemic reforms as well as international cooperation.

In the latest crackdown on Chinese firms, the US government put SenseTime, a Chinese AI company, on an investment blacklist on Friday, the very day on which SenseTime was supposed to set the final price of its IPO in Hong Kong, claiming without evidence that the firm enables "human rights abuses" in Northwest China's Xinjiang Uygur Autonomous Region.

The sanction was part of a package of US sanctions against a number of countries to mark Human Rights Day. It also adds to a growing list of Chinese companies that have been hit with a US crackdown, including Huawei and its multiple subsidiaries, as well as Chinese drone giant DJI.

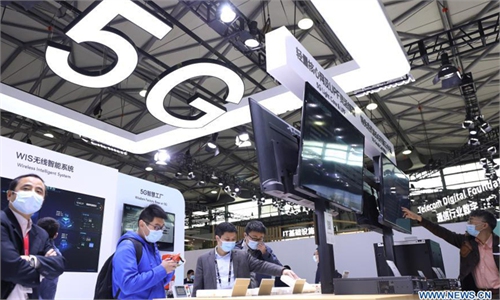

Market watchers said that the US is implementing a business "Cold War" against China, and AI has obviously become the next target of US tech suppression against China after 5G.

"The US is keeping a close eye on China's advanced technology, and any areas showing signs of growth might be targeted with crackdown measures. However, China's AI industry is unlikely to be beaten down by the US, because it does not involve too many bottleneck technologies, and it's relatively easy to find substitute suppliers compared with chips," Fu Liang, an independent tech analyst, told the Global Times on Sunday.

Zhang Yi, CEO of the iiMedia Research Institute, told the Global Times that China's technological weakness mostly lies in the size, instead of the performance, of chips, and SenseTime, as a business-to-business company, does not rely on importing small chips like those used in mobile phones.

Even for Chinese high-tech firms that used to depend on US supplies, like Huawei, most are also doing better than expected after the implementation of US sanctions, as they have taken active measures to cope with external challenges, instead of accepting the strikes passively, analysts noted.

According to a report by the Financial Times in July, the US' move to sanction Chinese tech companies failed to derail the ambitions of Chinese tech start-ups, with domestic start-ups like Megvii and SenseTime continuing to raise money and sign overseas contracts. It noted that SenseTime had turned to private investors to raise up to $1 billion in capital this year.

Data revealed by leading industry bodies also showed the rapid development of China's high-tech industries. For example, a report by consulting firm International Data Corp (IDC) showed China's AI-related expenses are expected to surpass $16 billion in 2025, with a compound average growth rate of about 22 percent from 2021 to 2025. About 70 percent of China's AI expenditure comes from the hardware sector.

IDC also noted in another report that China's AI software market reached a scale of 23.09 billion yuan ($3.62 billion) in 2020, about 60 percent of the US' AI software market.

"There are companies and products that face production disruptions because of US sanctions, but there are not many. In general, China's high-tech industries can still maintain rapid development, and the pandemic and US sanctions are even stimulating technological advances to emerge at a faster pace," Fu said, adding that chips and software are two areas that face the biggest impact from US crackdowns.

Zhang predicted that with China's input in high-tech areas since 2016, the country could see further technological advances in the coming years.

"Usually there are certain breakthroughs for every three years of research, considering the industry record. Next year, China is very likely to announce scientific achievements," he said.

Analysts noted that 2022 will be an especially important one for China, when the country will hold both the Beijing Winter Olympics and the 20th Communist Party of China (CPC) National Congress.