GT Exclusive: Myanmar accepts yuan as official settlement currency for border trade with China

Move to help address economic woes: source

Ruili port in Southwest China's Yunnan Province links the country with Myanmar. Photo: IC

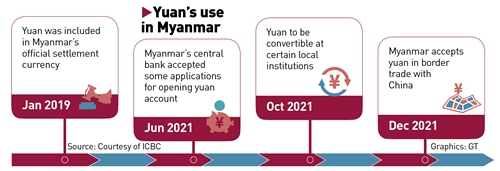

Yuan's use in Myanmar

Myanmar has accepted the Chinese yuan as an official settlement currency for border trade with China, in a move that aims to address its shortage of US dollars and other foreign currencies, as the Southeast Asian country faces economic challenges amid political instability, sources close to the matter told the Global Times on Wednesday.

China, as Myanmar's biggest trading partner and its largest source of foreign investment, will provide a stable source for Myanmar banks to access the yuan, helping alleviate the country's financial difficulties and restore economic growth, according to the sources.

As the US dollar has dominated Myanmar's international settlements, the move also marks an important step in China's joint efforts with neighboring countries to expand the use of the yuan in bilateral trade and counter the US dollar hegemony, which has been increasingly weaponized by Washington to impose unilateral sanctions on other countries, analysts said, adding that the move also paves the way for the yuan's broader use in the Southeast Asian region.

The Global Times learned that an official ceremony, in which Myanmar central bank and Chinese Embassy officials are scheduled to participate, is expected to be held on January 1, 2022.

The estimated settlement scale in the pilot phase will be about 2 billion yuan ($314 million), the sources disclosed. That is equivalent to about 30 percent of the value of bilateral border trade via inland routes, based on the Global Times' calculations.

The yuan's use in trade settlements will be a pilot program involving border trade at the initial stage, focusing on transactions of small commodities and daily necessities, which the locals call "small trade."

In the future, the yuan's settlement could expand to cover what is called "big trade," which refers mainly to containerships carrying big commodities, marine products, machines and equipment, one source noted.

The Myanmar government has approached Chinese banks several times since May, looking for deeper financial cooperation.

"Due to the dual effect of the pandemic and the political situation, the economic development of Myanmar has hit hurdles. Strengthening trade ties with China is the best option for Myanmar to restore economic growth. Against this backdrop, the yuan plays both an evident and a bridging role in cementing bilateral cooperation," a spokesperson for the Myanmar branch of Industrial and Commercial Bank of China (ICBC) told the Global Times on Wednesday.

ICBC is the first Chinese commercial bank to operate in Myanmar, and in June, ICBC's Yangon branch was approved to open yuan accounts for an initial batch of companies.

Zhou Rong, a senior researcher at the Chongyang Institute for Financial Studies at Renmin University of China, said that yuan settlements in border trade will be "an immediate helping hand" for Myanmar people, who have been suffering from rising inflation, job losses and a stalling economy.

"It at least partly ensures their livelihood," Zhou told the Global Times on Wednesday.

The yuan was included in the list of Myanmar's official settlement currencies in January 2019. The move at that time was more symbolic, as all contracts and trade were still not settled in the Chinese currency.

Zhou said that the move, in the long term, will help break the monopoly of the US dollar in Myanmar's foreign currency reserves.

The US has been abusing the dollar's dominant status to impose arbitrary sanctions on other countries, and the yuan's further expansion in Myanmar's trade settlements may provide a shield against such a potential weapon, analysts said.

The ICBC spokesperson noted that the use of the yuan in settlements in Myanmar comes as China has "set up a multi-layer, wide-ranging monetary and financial cooperation framework" with Southeast Asian economies.

China's central bank, the People's Bank of China, has signed currency swap deals with the central banks of Indonesia, Malaysia, Thailand, Singapore and Laos.

"These are all successful examples of how the yuan's internationalization has cemented bilateral trade connections and boosted local economic development," the spokesperson said.

He revealed that under the Myanmar central bank's design, assuming the pilot program is successful, local authorities will consider further expanding it to general trade and allow all Myanmar trade companies to open yuan accounts.

"This is a key step in expanding the yuan's use in settlements in Myanmar, after which local commercial banks will be able to undertake yuan deposit and loan business," the spokesperson said.

Also in the next step, more Chinese companies will consider yuan-denominated investment in Myanmar as the local central bank announces more policies to improve the management of yuan capital accounts, he predicted.

The central banks of China and Myanmar have yet sign agreements on either local currency cooperation or a currency swap.

In October, Myanmar's central bank announced that it will allow the yuan to be convertible at local banks that have licenses for conducting business related to foreign currency settlement and conversion, as well as non-bank currency conversion institutions.