Aviation industry eager for more government support to survive another bleak winter

Industry eager for more government support during winter

A sanitation worker cleans the ticketing area at Nanjing Lukou International Airport, where a COVID-19 outbreak was reported in August. Photo: VCG

The aviation industry, a major victim of the global pandemic, has been forced to slog through another tough year, dragged down by volatile passenger demand, and a pandemic which continues to rage around the world.

As China is one of the top global aviation markets, Chinese players are finding different ways to make up for lost revenue, with many stating that government support remains critical to maintaining their current operations.

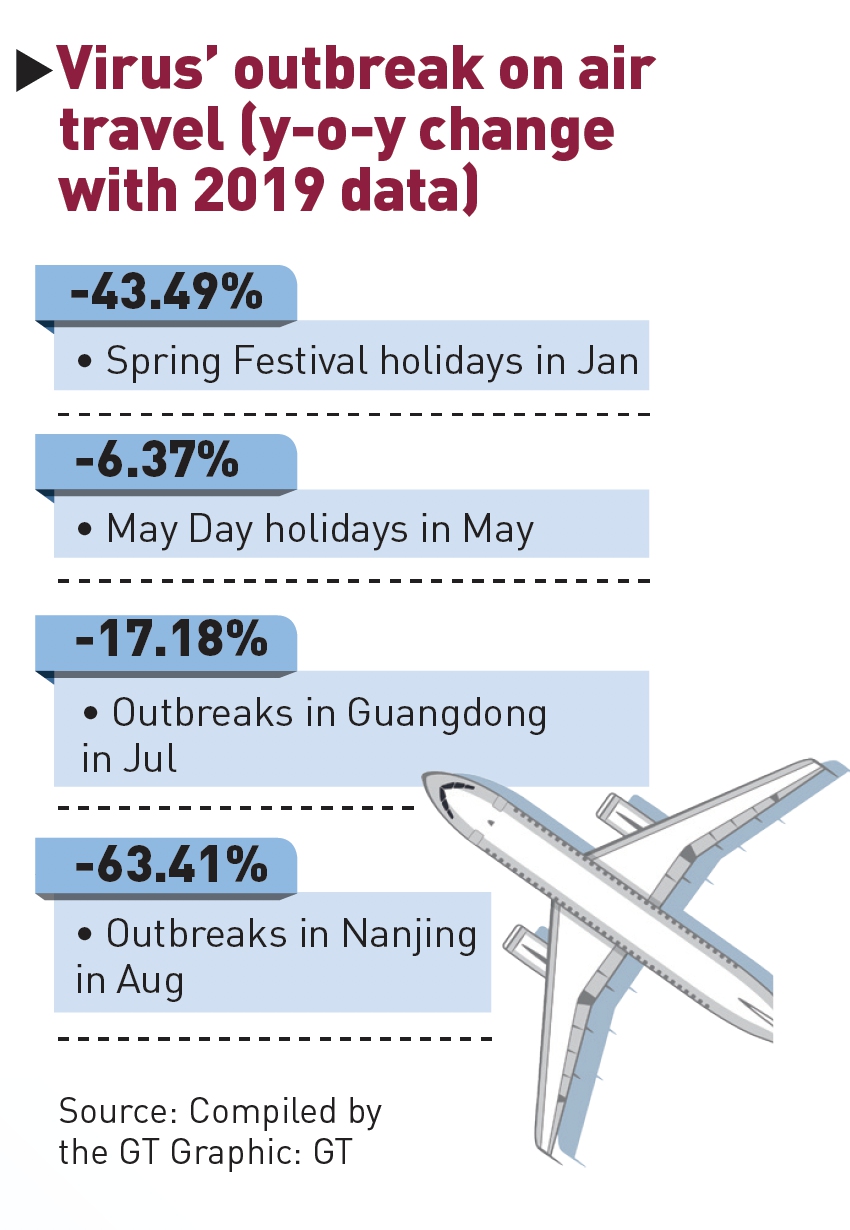

Looking back at each month's performance this year, the whole industry has gone through ups and downs, initially speeding up, then suffering a dramatically decline during the middle of the year, only to see a small uptick during 2021's remaining days.

From January to February, travel demand declined due to the pandemic and the remain in place policies in some cities, civil aviation passengers only recovered to half level compared with the same period in 2019.

Entering March, civil aviation traffic quickly recovered to about 89.4 percent of the same period in 2019, while the passenger traffic of domestic routes has exceeded the level of the same period in 2019, showing a strong resilience.

However, entering July and August, due to the spread of COVID-19 in Guangzhou and Shenzhen in Southern China, the recovery began to slow, travel demand fell precipitously following a cluster of imported cases through Nanjing Lukou International Airport in August, with the number of passengers in August was only 36.6 percent in the same period in 2019.

The recovery picked up later, but the emergence of Omicron has again hindered the pace of growth.

In the week ending December 24, domestic air capacity dropped by 31 percent from 2019 levels, and down by 41 percent compared with 2020. Unlike almost all other major aviation markets, market watchers even said that China's domestic aviation industry performed better in 2020 than in 2021.

China is not alone. Many countries in the Asia-Pacific region have adopted stricter measures on international travel, which have affected airlines. In contrast, benefiting from the relatively relaxed travel restrictions in European and the US, the aviation market there have recovered strongly.

Countries hope to solve the travel restrictions through high rates of vaccination, such as Singapore in part has resumed passenger flight operations due to an overwhelming majority of that country's population being immunized. However, the threat of imported cases means the market recovery remains fragile. For example, the Omicron variant has caused the exchange of people between Europe and the US to fall back to 2020 levels overnight.

Graphic: GT

What will be happen next year? Will Chinese commercial airlines continue to struggle?There is some good news on the horizon. A total of 1.274 billion Chinese have completed a full course of vaccination against COVID-19, that means 85.64 percent of the population in China is fully vaccinated, according to National Health Commission on Wednesday, which shows China is gradually building a wall of immunity.

With the advancement of vaccination, it is expected that aviation market demand will rebound strongly during the May Day holidays, the summer peak, and even National Day holidays in 2022.

But, it is clear that airline performance relies mainly on long haul routes, where much uncertainty remains.

There is hope that in 2022 that some of the international passenger transport market will be gradually restored and the restrictions on international travel will be lifted step by step, most experts also believe that the air freight sector will continue to boom.

Meanwhile, the domestic market may have a number of supporting policies introduced next year, such as reforming the fuel surcharge adjustment mechanism to adapt to changes in international oil prices.