COMMENTS / EXPERT ASSESSMENT

Doomsayers set themselves up for humiliation again on China’s economy

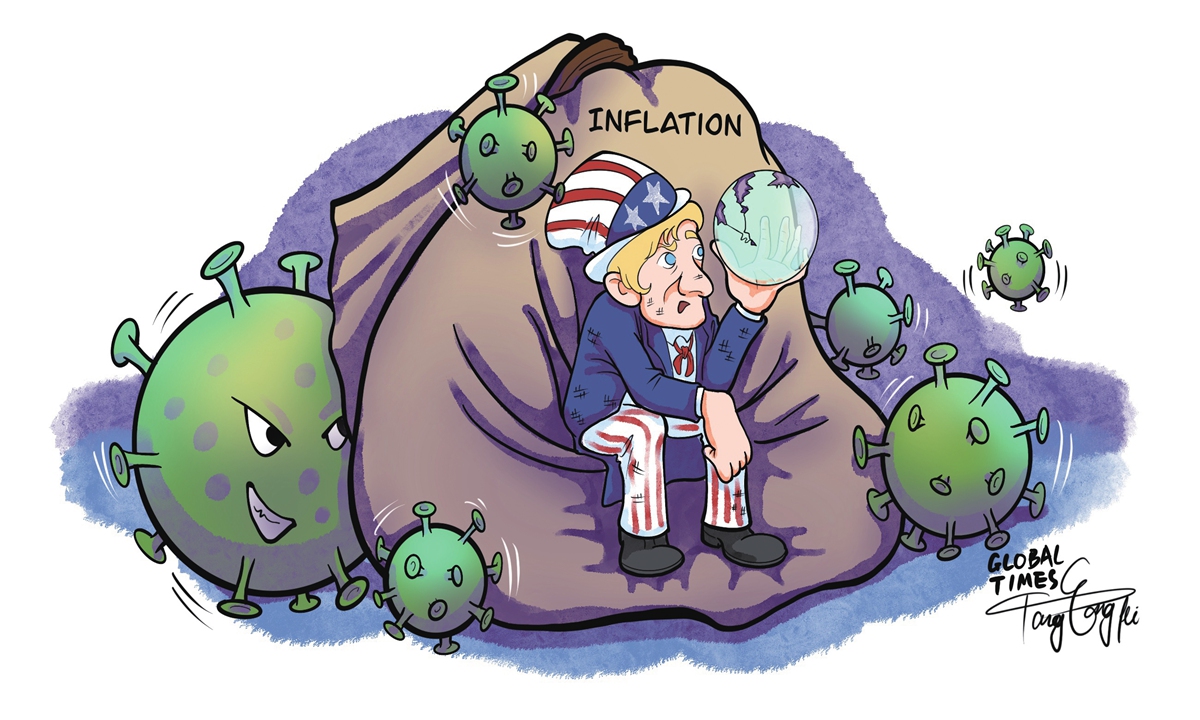

Illustration: Tang Tengfei/Global Times

One thing that is as stubborn and mutable as the novel coronavirus is doomsayers of the Chinese economy. Their "China collapse theory" has been repeatedly struck down by the rapid rise of the Chinese economy through ups and downs over the years, but it keeps coming back in various forms - just like how the virus keeps coming back with new variants.As the Omicron variant rages around the world, Western media outlets and institutions have also launched a new wave of doomsaying about the Chinese economy. The new premise of their latest dire predictions for the Chinese economy in 2022 is China's dynamic zero-case strategy against the COVID-19 epidemic.

In a report on its Chinese-language website, the Voice of America, the international propaganda arm of the US government, on Thursday asserted in a headline that "the evil consequence of zero-case policy reappears, as Goldman Sachs lowers its forecast for China's economic growth this year." Bloomberg also claimed on Thursday that "China faces mounting economic damage from its Covid-zero policy."

Both articles pointed to Goldman Sachs' lowering of its forecast for China's GDP growth in 2022. The US investment bank cut its previous forecast of 4.8 percent to 4.3 percent, citing "the likely higher average level of restriction (and thus economic cost) to contain the more infectious Omicron variant." In the same report, the bank even predicted that in an extreme scenario of a national lockdown, China's GDP growth rate could drop to 1.5 percent.

Indeed, such figures are concerning. If Goldman Sachs turns to be correct, China's GDP growth in 2022, at 4.3 percent, would be the slowest in decades, and at the extreme end, could be the lowest on record. Furthermore, a 4.3-percent rate means China's economic growth would be surpassed by that of the US for the first in many years, as Goldman Sachs forecast a 3.8 percent growth for the US economy, down from 4.2 percent previously. That would certainly slow the progress of the Chinese economy's catching up with the US economy.

However, keep in mind, Goldman Sachs is just one of countless institutions around the world that make predictions about China's GDP growth, and in comparison, it appears to be among the most pessimistic ones. For some perspective, the World Bank expects China's GDP will grow 5.1 percent in 2022. The IMF forecast a 5.6-percent GDP growth. The Chinese Academy of Social Sciences, an official think-thank in Beijing, expects a 5.5-percent growth.

There are also growing expectations that Chinese policymakers will set the official growth target at above 5 percent at the upcoming Two Sessions. Chinese policymakers are also aware of the downward pressure on the economy this year. The tone-setting Central Economic Work Conference in December pointed out pressure from three areas - shrinking demand, supply shocks and weakening expectations.

Clearly, there is no denying the mounting pressure on China's economic growth this year. But the Chinese economy is hardly alone in facing such downward pressure. The World Bank expects global economic growth will slow to 4.1 percent in 2022 and warned of risks of a "hard landing." The US economy is also facing a litany of challenges, including the decades-high inflation that has already hit US consumers at grocery stores and gas pumps, not to mention the out-of-control epidemic in the country, persistent supply disruptions, labor shortages, and other generational challenges.

Admittedly, there are also growing concerns within China about the economic impact of the strict anti-epidemic efforts, as major cities move to contain new COVID-19 flare-ups and tighten measures to stop the spread of the virus ahead of the Chinese New Year. Certain industries and businesses, especially small firms, will face difficulties. But such impact are limited to those specific cities and regions, they are not affecting the whole country and the entire economy.

It is too far-fetched to conclude China's dynamic zero-case strategy will drag down the world's second-largest economy. If anything, the strategy will only minimize the economic cost in the long run, despite short-term pain, whereas the US' surrender to the virus will cause long-term economic damage, as many observers have already warned.

Also, what's grossly underestimated by China doomsayers per usual is the ability of the Chinese system in identifying problems and addressing them effectively. After two years of experience with and knowledge of the negative effect of the dynamic zero-case strategy, Chinese officials have been continuously improving the implementation of the strategy to minimize the costs. If history is any indication, these doomsayers will once again be humiliated when China's economy defies expectations as it has done for decades.

The author is an editor at the Global Times. bizopinion@globaltimes.com.cn