COMMENTS / COLUMNISTS

With inflation running amok at 7%, US has no easy way out

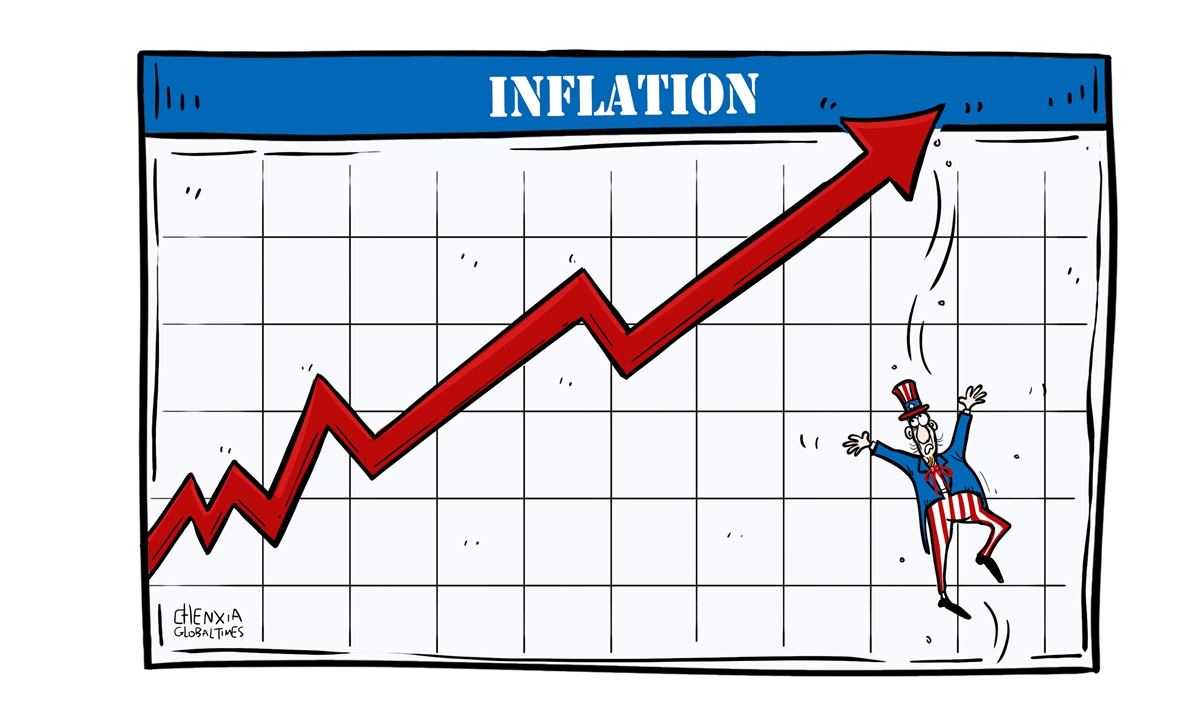

Illustration: Chen Xia/Global Times

Throughout 2021, US President Joe Biden and Federal Reserve chair Jerome Powell insisted that consumer price rises were only "transitory", and inflation would fade away in the face of more federal spending, key of which was Biden's slated $1.8 trillion 'Build Back Better' initiative. It turned out they were very wrong. Now, the vast American middle class and working poor are paying dearly for persistently uncontrolled price rises.

On Wednesday, the US Labor Department reported that inflation finished 2021 at its highest level since 1982 with the consumer price index up 7 percent in December versus a year ago, which rose from 6.8 percent in November. Yes, the world's largest economy now faces an inflation crisis that the country hasn't seen in the past 40 years. If the Federal Reserve doesn't move immediately to tighten policy, the CPI is likely to elevate to 9-10 percent by the summer of 2022.

Many ordinary Americans are annoyed and angry, claiming the Biden administration has "re-engineered incompetency by re-igniting inflation". Why people are so sensitive to price rises? Inflation is a regressive tax which disproportionately harms low income groups and the retirees. A deposit of $10,000 last year is now worth about $9,300, and next year it could be worth less than $9,000, a vivid example of the erosive effect of inflation.

Undoubtedly, inflation has become a political liability for Biden and his fellow Democrats, who face the crucial mid-term election later this year. Recent poll numbers reveal Biden's job approval has plunged to 34 percent, even lower than his predecessor Donald Trump at their second-year mark in the White House.

Sobering 7-percent inflation represents an utter policy failure of the US government.

Throughout 2021, Biden administration officials and the Federal Reserve largely played down the breath and persistence of steadily rising prices. Biden himself was the cheerleader for the $1.9 trillion pandemic rescue spending bill which he signed into law in March, on top of more than $3.9 trillion in coronavirus relief that Trump signed off on in 2020. If not for the maverick Democrat Senator Joe Manchin, another colossal fiscal stimulus, the $1.85 trillion investment in social and environmental programs, would have been heaped upon the inflation bonfire.

The US central bank has played a significant role in fueling inflation. The minutes of the Federal Open Market Committee revealed that Powell and his lieutenants had incessantly spoken against tightening money policy to rein in price rises, and stubbornly maintained the US' benchmark interest rate close to zero. They have even refused to wind down the monthly bonds-buying policy - also called quantitative easing, despite clear signs of excess monetary growth and rising inflation.

Biden administration officials have consistently refused to withdraw the extraordinary fiscal and monetary support to buoy up the US economy since the 2008-09 Great Recession is an indication that they are detached or disconnected from reality. Also, the Federal Reserve, under Powell, has increasingly succumbed to politicization. No wonder that there are a growing number of Americans now taking issue with the flawed policy of the US government, saying that Biden, by printing and spending money, has burdened the country with the highest inflation in four decades.

But Biden remains in denial. In July he said: "there is nobody suggesting there's unchecked inflation on the way - no serious economist." And, Biden's speech on Wednesday took solace in the 0.5 percent monthly inflation growth from November. The Labor Department report, Biden said, "shows a meaningful reduction in headline inflation" from November, and "we are making progress in slowing the rate of price increases".

But the fact is, even the monthly 0.5 percent rise in prices is nothing worth celebrating, meaning the US inflation keeps going up, with no sign of flattening out. To make things worse, employers are paying their employees more given the tight labor market. To offset across-the-board price hikes in food, energy, rent and furniture, workers are demanding higher salaries, which facilitates the set-in of a wage-price spiral, and as a result, the elevated inflation seems unlikely to level off in the foreseeable future.

President Biden recently blamed American businesses for price-gouging and profiteering, but he should reflect on how much the prices of oil, coal, metals and other raw materials have risen in the past 12 months on the international market, because of his government's loose monetary policy, and, how much his inheritance of Trump's punitive trade tariffs imposed on China has led to price rises across the US economy.

The tariffs, designed to undercut China's economic growth, have punished ordinary households in the US.

Entering 2022, the Biden administration remains clueless on how to tame inflation. In addition to removing Trump's tariffs, Biden needs to consider a few other issues impacting price rises, including the trajectory of the coronavirus and new variants, addressing global supply chain bottlenecks, and the opening of America's doors to immigrants to alleviate the tighter labor market in the US.

In an economy as large as that of the US or China, it is always hard to predict what comes next, and the current unique circumstances - including the COVID-19 pandemic, reckless economic sanctioning measures imposed by the Biden administration on China, Russia and others, partisan politics on Capitol Hill, and exacerbating the wealth gap in the US - make it ever harder.

A recent poll among US business CEOs reveals up to 60 percent of business leaders expect US inflation to keep rising until at least mid-2023. And, it's insane for Biden officials to watch inflation spiral while doing little to mitigate it. The myth that the US government is able to keep pumping money into the system to perpetuate a prosperous America is falling apart.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn