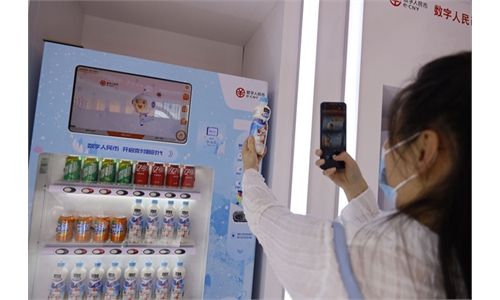

Residents who received "red packets" of digital yuan use the money in stores in Shenzhen, Guangdong Province. Photo: Li Hao/GT

The download of e-CNY app, which hit application markets for mobile phones for less than one month, witnessed soaring download figures, as the opening ceremony of the Beijing Winter Olympics approaches.

The cumulative downloads via Huawei stood at 13.29 million as of 2:30 pm on Saturday, 10.8 million via Vivo, 5.33 million via Xiaomi, and 1.85 million via OPPO, according to calculations done by the Global Times.

The iPhone could also download the e-CNY app, but the exact number of downloads is not open to public.

The total downloads of e-CNY, which was developed by the People's Bank of China, the central bank in four phone brands are more than 30 million as of Friday, up from 23 million on January 17.

The pilot version of the app was rolled out on January 4.

The data reflects the heightened interest in digital currency or e-CNY across consumption channels, and research reports even predict that the entire e-CNY transformation is expected to drive a total investment scale of 116.5 billion yuan ($18.31 billion).

Market watchers said that the rising demand is due to the promotion campaign across different cities and different payment channels.

Budget carrier Spring Airlines told the Global Times on Saturday that the carrier now allowed in-cabin payments via digital currency. The carrier said the digital yuan payment covers ticket purchase and on-site check-in services.

Chinese digital services platform Meituan said on Wednesday that the digital yuan payment channel will be open for all offline consumption scenarios on the platform, and users can pay via digital yuan and receive exclusive consumption subsidies when purchasing fresh food, taking a taxi or watching movies.

Since January this year, nearly 90 percent of the digital yuan payment in Meituan has flowed to daily consumption settings such as take-out, grocery shopping, and catering. Among them, small transaction orders below 30 yuan accounted for the highest proportion, Meituan told the Global Times on Saturday.

Similarly, Tencent-owned WeChat, one of the leading payment services providers, also began supporting the digital yuan on January 6 via its WeChat Pay mobile wallet.

Data from Beijing Local Financial Supervision and Administration on Friday showed that by the end of 2021, Beijing has opened more than 12 million digital yuan wallets for individuals, covering more than 400,000 Winter Olympic scenarios such as food, housing, transportation, travel, shopping, entertainment, and medical care, and the transaction amount reached 9.6 billion yuan.

Market insiders have claimed that the Winter Olympics will be an opportunity for the full on promotion of the digital yuan. A research report released by Guotai Juan Securities said that the pilot of different digital yuan settings will focus on the areas within the security red line of the Winter Olympics, with the main goal of ensuring and facilitating the payment choices for domestic and foreign consumers.

Essence Securities predicted that calculated from the infrastructure and system transformation of commercial banks, the entire digital yuan transformation is expected to drive a total investment scale of 116.5 billion yuan.