Russia can withstand Western sanctions after years of preparation: Chinese analysts

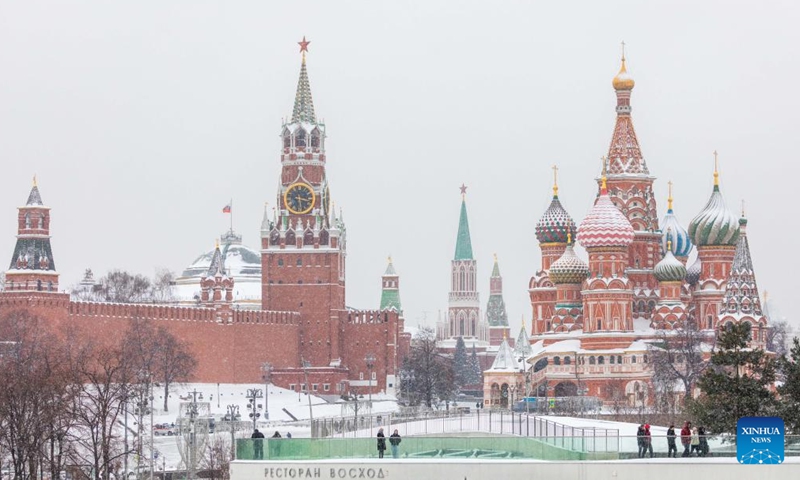

Photo taken on Jan. 26, 2022 shows the snow-covered Kremlin and Saint Basil's Cathedral in Moscow, Russia.Photo:Xinhua

Russia has strong capacity and resilience to withstand US and EU sanctions, as its economy - which has been buffering the impact of sanctions for years - is not outward-looking, and it has been diversifying its energy exports from Europe, a process that won't encounter difficulties amid global energy shortages, Chinese analysts said on Tuesday, as tensions are running high between Russia and Ukraine and the West.

But they also suggested that Russia needs to prepare for being cut off from SWIFT, which has been described as a "nuclear option" in sanctions packages that could deprive it of 40 percent of its revenue from energy exports and have long-term repercussions on its economy, even though the likelihood of such a move is extremely slim.

After Russian President Vladimir Putin on Monday signed two decrees recognizing "the Lugansk People's Republic (LPR)" and "the Donetsk People's Republic (DPR)" as independent and sovereign states, the US and Europe announced immediate sanctions against Russia.

US President Joe Biden issued an executive order on Monday to "prohibit new investment, trade, and financing by US persons to, from, or in the so-called DNR and LNR regions of Ukraine." The EU's top officials said the bloc will impose more sanctions against those involved in the recognition of LPR and DPR.

This marks the first wave of sanctions against Russia from the West after tensions between Russia and Ukraine flared for months. Biden has pledged that Russia will face "swift, severe and unified" consequences from the US and its allies.

Germany, Britain, Canada, and Japan soon followed the sanctions. Japan will ban the issuance of Russian bonds in the country and will freeze the assets of selected Russian individuals, Japanese Prime Minister Fumio Kishida said on Wednesday.

Britain announced plans to target Russian elites and banks, while Germany put the brakes on a major gas pipeline project from Russia, the new Nord Stream 2 pipeline.

Canada will prohibit Canadians from buying Russian sovereign bonds, Canadian Prime Minister Justin Trudeau announced on Tuesday.

The sanctions sent global stocks and the ruble tumbling. The Russian RTS index, which tracks the 50 top Russian stocks in US dollar terms on the Moscow Stock Exchange, was up 1.59 percent on Tuesday after Russia's central bank said "it was ready to take all necessary measures to support financial stability," recovering from a precipitous 17 percent fall on Monday.

Chinese observers said that the sanctions so far are more symbolic than anything likely to inflict substantial harm on the local economy, and capital market moves reflect transitory investor nervousness.

"The first batch of sanctions is not targeted at either specific industries or the core of the Russian economy, so the impact is minimal," Cui Hongjian, director of the Department of European Studies at the China Institute of International Studies, told the Global Times on Tuesday.

Cui said that the follow-up measures, if they will be taken as threatened, could be more concrete and wide-ranging, involving energy, finance and military dimensions.

The Biden administration has proposed expanding a new technology export ban and cutting off Russian companies' access to dollars, Reuters reported.

On Sunday, European Commission President Ursula von der Leyen warned that Russia would "in principle be cut off from the international financial markets" and denied access to major exporting goods if it "attacks Ukraine."

In several interviews, von der Leyen also hinted at the possibility of imposing sanctions on Russia gas giant Gazprom and targeted the Nord Stream 2 gas pipeline connecting Russia to Germany.

Europe imports around 40 percent of its gas supply from Gazprom and Russia is one of the world's largest oil and natural gas producers.

Global oil prices rose on fears that the Ukraine situation would disrupt global supplies. The price of benchmark Brent crude reached a seven-year high of $97.76 a barrel on Tuesday.

Observers said it would be a mission impossible for Europe to shed its overreliance on Russia's natural gas, considering the persisting global shortage. Such ability also depends on the extent to which the US is able to replace Russia's natural gas exports, Cui said.

Russia has been making diversification efforts to explore alternative markets. For example, Russia used to mainly export products to Europe, but now its exports to China, like oil and natural gas, are also rising in scale.

In February, China National Petroleum Corp (CNPC) and Russia's Gazprom signed an agreement on the purchase and sale of gas from the Russian Far East, and under the agreement, Russia will increase gas exports to China to 48 billion cubic meters (bcm) per year.

Cui said that the US' potential new tech export ban may restrict the supply of raw materials and equipment to Russia's military, aerospace and energy sectors.

"But the West has blacklisted Russian military and high-tech enterprises since 2014. So it remains unclear that the US could leverage its embargo to heap pressure on Russia," Li Jianmin, a research fellow at the Chinese Academy of Social Sciences, told the Global Times.

As to whether the US will play the ace card of removing Russia from the SWIFT system, which has serious implications for its foreign trade, Cui said that "the West is deeply divided" on this issue due to Europe's immense trade volume with Russia, partly driven by energy.

Li said that Russia has long been taking steps against such a possible move, including avoiding the US dollar in some trade settlements, and clearing US debts and its foreign reserves. Russia has developed an alternative messaging system called SPFS since 2014, which now reportedly handles about one-fifth of its domestic payments.

"Russia has been running pressure tests of how its economy would run in extreme cases, which must have included being cut off from links to the outside. But even in such a case, Russia is able to secure its own supplies as it has a large territory and ample resources," Li explained.

Cui agreed, noting that Russia's reliance on the external market is "limited" except for the energy and military sectors, which speaks volume to its ability to offset the fallout of Western sanctions.

Chinese State Councilor and Foreign Minister Wang Yi on Tuesday called on all parties on the Ukraine issue to remain restrained and resolve disputes through peaceful means.

In 2021, Russia's GDP grew 4.7 percent, the fastest in more than a decade, due to a surge in oil prices and consumption expenditures.