Western sanctions spark anxiety among businesses over dollar hegemony

Businesses grapple with West’s abuse of dollar hegemony via sanctions

A China-Europe freight train departs from Qingdao, East China's Shandong Province to Mannheim, Germany on February 18. Photo: cnsphoto

As sanctions by a number of Western countries against Russia pile up, Zhang Hong, a Chinese grain trader specializing in trade between China and Russia, is watching the situation closely, as many businesses around the world do.

One of the implications of the West's sanctions on Moscow, including removing Russian banks from the SWIFT interbank system, is growing anxiety among global businesses over the West's abuse of their dominant positions in the global financial market to sanction others. There is also growing attention toward alternatives like the China-initiated Cross-border Interbank Payment System (CIPS).

Chinese officials have repeatedly expressed opposition to unilateral sanctions and stated that China will continue normal cooperation with all parties.

Kicking a country out of SWIFT was described as a "nuclear option" of financial sanctions by some media outlets. Iran, after being excluded from the SWIFT, lost nearly half of its oil dollars and 30 percent of foreign trade revenue, according to the Securities Daily newspaper.

As sanctions were announced, Russia's FESCO Transportation Group, which operates ports and fleets, announced that it will accept Chinese yuan from customers.

Some settlements "will have to be done via the CIPS in the future," said Zhang, whose firm was using SWIFT but has also become familiarized with CIPS in recent years.

As US sanctions have been present for several years, countries around the world, including European countries, have developed some alternatives to SWIFT, which is the world's most-used system that handles cross-border payment messages for more than 11,000 financial institutions across 200 countries and regions.

The CIPS serves financial institutions in cross-border and offshore yuan businesses, a significant financial tool to boost economic and trade cooperation, particularly among countries along the Belt and Road Initiative (BRI).

Since its launch in 2015, the nascent CIPS has expanded to cover all the financial markets in all the time zone in the world. According to its official website, the system now is connected to 75 direct participants and 1,205 indirect participants in Asia, Europe, the Americas, Oceania and Africa.

"The direct and indirect participants of CIPS are far fewer than that of SWIFT, but if we are only talking about cross-border yuan settlement here, CIPS serve the same function as SWIFT," Zhang said.

"The only thing I need to make sure is that the bank I use is connected to the CIPS platform," Zhang said.

Growing anxiety

Zhou Yu, director of the Research Center of International Finance at the Shanghai Academy of Social Sciences, said one of the repercussions of the sanctions over global financial infrastructure is raising anxiety among current SWIFT users, meaning that some vendors may start looking for alternatives.

"After decades of development, the SWIFT is mature, safe and fast. The preference of counterparties also contributed to its status. But the world is also seeing a rising tendency by the US to launch unilateral sanctions over financial infrastructure and the current event only serves as an urge of countries to develop alternatives to SWIFT," Zhou said.

"For China, this could mean more efforts to promote cross-border yuan settlement and the further development of CIPS," Zhou said.

The expansion of the CIPS as well as the faster growth of trade between China and its partners, especially along the BRI, could mean CIPS will see more use, analysts predicted, in light of the West's increasing tendency to abuse unilateral sanctions and weaponize financial infrastructure.

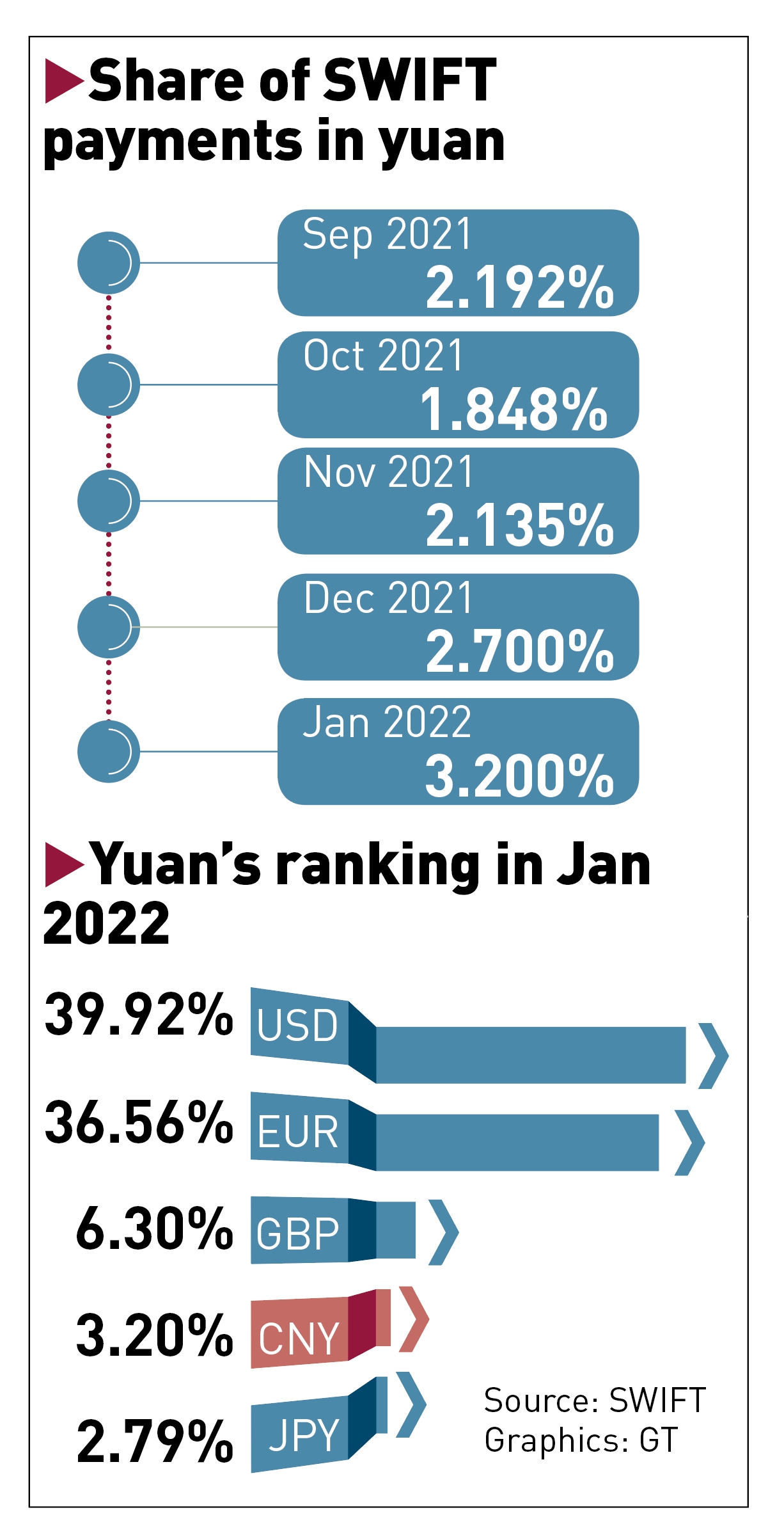

The yuan has seen its popularity as an international currency steadily climb over the last decade.

The yuan's share in global cross-border payment reached 3.2 percent, ranking the fourth trailing behind the US dollar, the euro, the pound, per SWIFT data in January. In 2010, the yuan only ranked 35th when SWIFT started tracking usage across currencies.

BRI boost

In 2021, cross-border yuan settlement volume increased steadily. During the January-November period, cross-border yuan settlement in BRI markets reached 5.1 trillion yuan, a year-on-year increase of 25 percent, according to a China National Radio report in January.

More cross-border settlement in yuan has steadily improved the efficiency of fund settlement and saved transaction costs shouldered by enterprises, reducing the adverse impact of exchange rate fluctuations, the report said.

A manager of the financial department of China Resources, a Chinese state-owned conglomerate, was quoted as saying the company's pharmaceutical business was able to avoid potential currency fluctuations worth over 200 million yuan ($31.65 million). The company currently settles about 10 billion yuan across its pharmaceutical import business in yuan.

Some users of CIPS are also saying the system has made doing business more convenient.

A staff member from a finance company located in Qingdao, East China's Shandong Province told the Global Times on Thursday that the CIPS standard transceiver had addressed shortcomings during the previous cross-border clearing process.

"It helped us overcome clearing delays and inability to confirm the status of fund nodes in a timely manner, which has not only reduced cost and commission rate, but also improved the efficiency of cross-border payment," he said.

The company is connected to the CIPS standard transceiver and an indirect participant, which needs to rely on peer banks for clearing business.

Myanmar Chinese Chamber of Commerce told the Global Times on Thursday that some enterprises in Myanmar use the CIPS for trade with China.

"The convenience brought by settlement on the CIPS is that there is no need for China-Myanmar trade to be settled with the US dollar," the chamber said.

Analysts noted that many of the BRI partners are not Western countries and this fact could mean that the insistence of settling trades in US dollars or using SWIFT won't be as strong as counterparties traditionally dealing with Chinese companies.

Given the faster growth of trade between China and countries and regions along the BRI, the internationalization of the yuan and payment via CIPS could grow, analysts have claimed.

In 2021, China's trade with BRI economies grew by 23.6 percent, 2.2 percentage points higher than the overall growth rate, per customs statistics in January.