US hijacks European allies on Russian energy ban

Washington’s selfish tactic erodes EU autonomy

People walk past a screen of a currency exchange office displaying the exchange rates of U.S. Dollar and Euro to Russian Rubles in Moscow, Russia, March 1, 2022. Russian President Vladimir Putin signed a decree introducing temporary economic measures to ensure the country's financial stability, the Kremlin announced Tuesday.Photo:Xinhua

Click here to stay tuned with our live updates on Ukraine tensions.Russia and the US showed no signs of stopping biting each other's head off despite progress to a certain extent in Russia-Ukraine talks, with a Russian official announcing Moscow's readiness to respond to sanctions that will be swift and sensitive for targeted countries, just hours after the US announced a ban on Russian oil, natural gas and coal imports and the UK outlined a plan to phase out Russian oil, as Washington took the opportunity of the Russia-Ukraine conflict to press further economic cutoff between Russia and the West, economists said.

The US' move to urge European allies on energy sanctions against Russia has a very "selfish" motive inside, as not only does the US look to weaken Europe's self-independence strategy by binding Europe's economic ties with the US, but also the country is using Russia-targeted sanctions as an excuse to ruthlessly extend its crackdown on third-party countries, including China, they said.

Chinese officials reiterated their stance in opposing unilateral sanctions on Wednesday, while experts said the chances are very small that China's energy supplies will have any severe disruptions as a result of the world energy crisis, although China will also feel the sting of global crude and natural gas price jump.

US President Joe Biden announced on Tuesday that the US is banning Russian oil, natural gas and coal imports, shortly after the UK said it would phase out imports of Russian oil and oil products by the end of 2022.

Dmitry Birichevsky, the director of Russia's foreign ministry's department for economic cooperation, was quoted by the RIA news agency as saying that

Russia was working on a broad response to sanctions that would be swift and felt in the West's most sensitive areas.

As the US moves to launch a campaign of "moral kidnapping" against China, with continued moves that aim for some coercion, China has clarified its stance that the Russia-Ukraine conflict cannot be resolved through sanctions and will require dialogue and negotiations.

China "firmly opposes" unilateral sanctions without basis of international laws, as frequent sanctions will not bring about peace or safety, Chinese Foreign Ministry spokesperson Zhao Lijian stressed on Wednesday during a press conference.

Split sanctions

Economists called the US ban on Russian energy, which it is actively instigating European countries to follow suit, is a long-premeditated tactic that is "not surprising at all," they said.

"The US is looking to replace Russia's role in many European countries as a major energy seller, not only for the good of their own oil and natural gas companies, but more importantly, to bind Europe's economic interests tightly with its own so Europe would be on the side of the US in terms of Asia-Pacific issues," Li Haidong, a professor from the Institute of International Relations at the China Foreign Affairs University in Beijing, told the Global Times on Wednesday.

The US also has much more chips to interfere with EU's independence strategy once Europe becomes a major US energy buyer, Li said.

Dong Yifan, a research fellow with the Institute of European Studies at China Institutes of Contemporary International Relations, also said that efforts to shift the EU toward the US in energy supply actually fit into the US' long-standing tactical intention of "kidnapping" Europe on the energy issue, tracing such tactics to the US accusation that Europe's natural gas ties with the Soviet Union during the Cold War funded the former northern Eurasian state.

Although those objectives are hidden behind the US' outcry against the Russian military operations in Ukraine, some interesting details have exposed the US' double standards about its Russia-targeting sanctions. For example, according to a Reuters report, the US' ban on imports of Russian energy products does not include uranium, which the US relies heavily on to power its nuclear power plants.

However, experts stressed that there remains a significant "discrepancy" between the US and Europe when it comes to banning Russian energy imports, which will largely weaken the influence of the ban on the Russian economy.

The EU showed somewhat of an ambivalent attitude, unveiling a vision to make itself independent from Russian fossil fuels in the coming years but not blindly following Washington's steps of sanction against Moscow. In particular, Germany reportedly pushed back against calls from the US and Ukraine for a ban on imports of Russian gas and oil.

"There's still a big question mark over to what extent the EU vision could eventually materialize," Dong said, saying the EU's heavy reliance on Russia energy will not lessen in the near future.

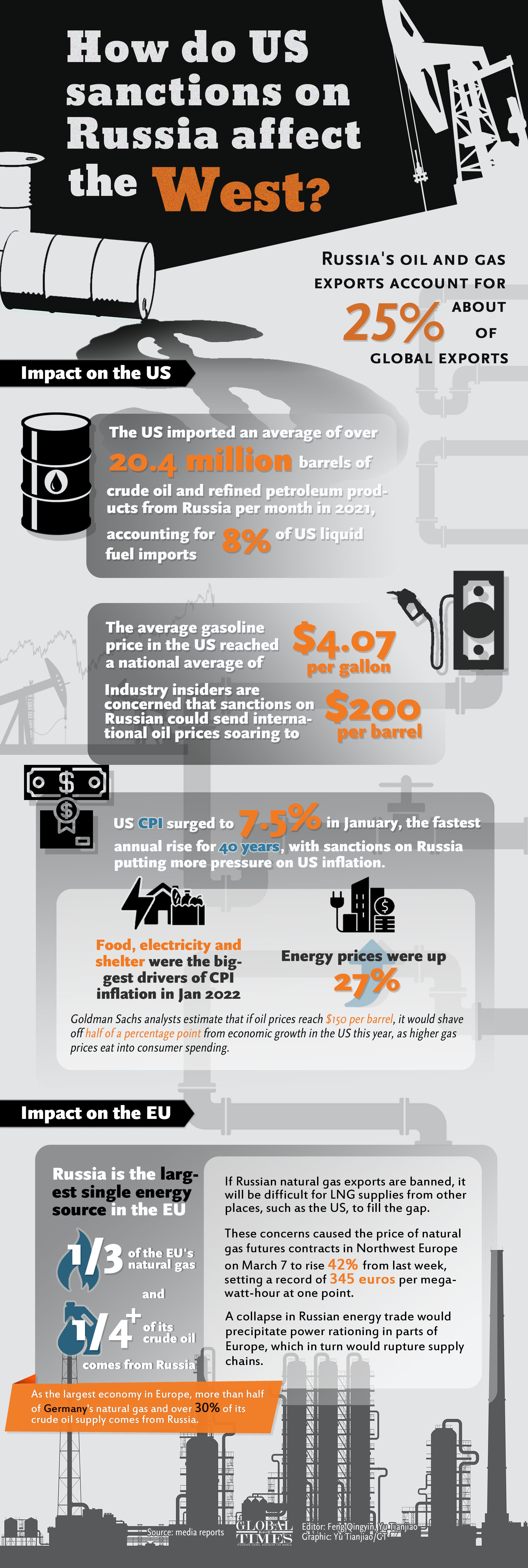

The EU sources about 40 percent of its gas from Russia and 27 percent of its oil, while the US gets no gas from Russia and around 7 percent of its oil, media reports showed.

How do US sanctions on Russia affect the West?

China's response

The extent to which Russia will suffer from the energy trade ban from the US and certain European countries is hard to predict, but most economists the Global Times talked to predict that Russia will take action to offset such influence, and one effective method is to shift energy exports from the West to countries in the East, like China and India, which will make China's trade structure more balanced.

"It goes without saying that Russia will increase energy intermediary trade with China or energy exports to China in the future to form an important channel to get foreign reserves," Yang Haiping, a research fellow at the futures research institute under the Central University of Finance and Economics, told the Global Times.

On the other hand, China might also face some pressure due to the changing global energy trade pattern, and one major risk is that the US might extend sanctions on China on the excuse of the Russia-Ukraine conflict.

Signs of such extended punishment have already emerged. According to a New York Times report, US Commerce Secretary Gina Raimondo noticed that the US government could cut off SMIC and other Chinese chip makers' access to US-produced tools and software if China violates the ban on exporting chips to Russia.

Experts cautioned that Chinese companies need to prepare for entangled restrictions on matters including energy from the US, and take active measures to safeguard their interests, such as by using the Chinese trade payment settlement system and arranging forward foreign exchange contracts to offset risks of exchange rate fluctuation.

"Chinese businesses, for their part, have been well-placed for responses to the US long-arm jurisdiction enforcement, especially since a flurry of tough actions targeting Chinese firms and entities since the Donald Trump era," Dong said.

Another side effect is that the ongoing energy sanctions would send global energy prices sky high, which would inevitably extend to China's commodity markets and add difficulties to the country's economic growth.

Chinese officials have taken the impact into consideration and expressed confidence that China's economy will not experience widespread harm caused by external geo-political volatility.

Lian Weiliang, an official from the National Development and Reform Commission, said during a recent press conference that China's costs of importing crude and natural gas would increase to some extent, but in general the impact is under control.